How does the V3 liquidity pools work on OKX DeFi?

How does market making work?

Market making in DeFi involves providing liquidity to decentralized exchanges (DEXs), such as adding assets like ETH or SOL to pools. In return, you earn a share of the trading fees, contributing directly to the efficiency of the crypto ecosystem. By ensuring there are sufficient assets for trading, market makers help stabilize price fluctuations. Additionally, impermanent loss is a key concept to consider. When liquidity providers add assets to a pool, they receive LP tokens representing their share. Upon exiting, they exchange these tokens for a portion of the pool's value. For example, if an LP adds $5,000 worth of ETH and $5,000 worth of USDC and the pool's value increases to $11,000 due to asset price changes, the LP can exchange their tokens for $11,000, yielding a profit of $1,000. However, considering their initial investment, they could've earned $1,500 more without adding liquidity, highlighting the concept of impermanent loss. In this case, the pool value increased by $1000 due to the increase in ETH price. However, at this moment, when ETH prices increase, you'll have lesser ETH tokens and more USDC tokens.

So by holding $5000 ETH, users might be better off with the increase of ETH price.

What's OKX DeFi?

Our DeFi lets you manage all your DeFi investments right from the OKX Wallet and serves as a powerful gateway to 22 chains and 3000 investments with 100 protocols like Aave, Curve, Compound, and Yearn, and Arbitrum. With DeFi, earn yield on your assets by either staking tokens or providing liquidity to DeFi protocols. Our DeFi interface includes features that make it easier than ever to earn from DeFi, such as one-click staking and CertiK scores that help you assess which protocols best suit your risk tolerance. It'll automatically identify opportunities for you to earn yield based on the assets you hold in your OKX Wallet. Recently, we've also added V3 pools to DeFi, which help you improve capital efficiency when market making.

What's V3 liquidity pools?

V3 liquidity pools allow you to specify price ranges you want exposure to when providing liquidity, which results in better capital efficiency. Stablecoins like USDT and USDC are pegged to the US dollar, aiming to maintain a stable value of approximately $1. Due to this stability, providing liquidity for these assets across a wide price range doesn't offer substantial returns. By contrast, narrowing down the price range for liquidity provision, such as 0.995 to 1.005, can lead to higher yields. This narrower range ensures that your liquidity is more efficiently utilized, as it closely aligns with the stable value of these assets. Consequently, you can maximize your earnings by focusing on a specific price band where trading activity is more likely to occur, optimizing your liquidity provision strategy for enhanced profitability.

Implementing custom price ranges in liquidity provision offers several benefits beyond managing fluctuations in price. In addition to providing greater control over price exposure, custom ranges also play a crucial role in mitigating the impact of sudden drops in liquidity. With the introduction of V3 pools, liquidity providers can leverage automated asset swaps as the price approaches the upper or lower bounds of their specified range. This automated feature ensures that liquidity remains balanced and responsive to market dynamics, optimizing the efficiency of liquidity provision strategies. By dynamically adjusting asset allocations within the defined price range, providers can better adapt to changing market conditions and minimize the risk of impermanent loss. Overall, the integration of custom price ranges in liquidity provision mechanisms enhances liquidity pool stability and resilience, contributing to a more robust and efficient decentralized finance (DeFi) ecosystem.

When adding liquidity to a Uniswap v3 pool, liquidity providers specify the price range they'd like to add liquidity. In return, they're no longer given an ERC-20 LP token, but rather an NFT that contains far more information specific to LP’s unique position. An LP can still exit the pool at any time; however, the rewards work slightly differently. There are pool fee tiers, which range from 0.05% to 1%, and determine the rewards paid to the LPs for adding liquidity. However, if the price moves outside the range at which the LP specified, they'll stop earning rewards. This means that the v3 model requires more of an actively managed approach from LPs who are dealing with volatile tokens.

This is done to maintain the liquidity of the pool and to help manage impermanent loss. Here are some examples:

If you provide liquidity to an ETH/USDC pool with a range of 1,000 to 2,000 USDC per ETH, your ETH will be swapped to USDC as ETH approaches 2,000.

The opposite happens if the price of ETH approaches $1,000. In this case, your USDC will be gradually swapped to ETH.

What's suggested price ranges?

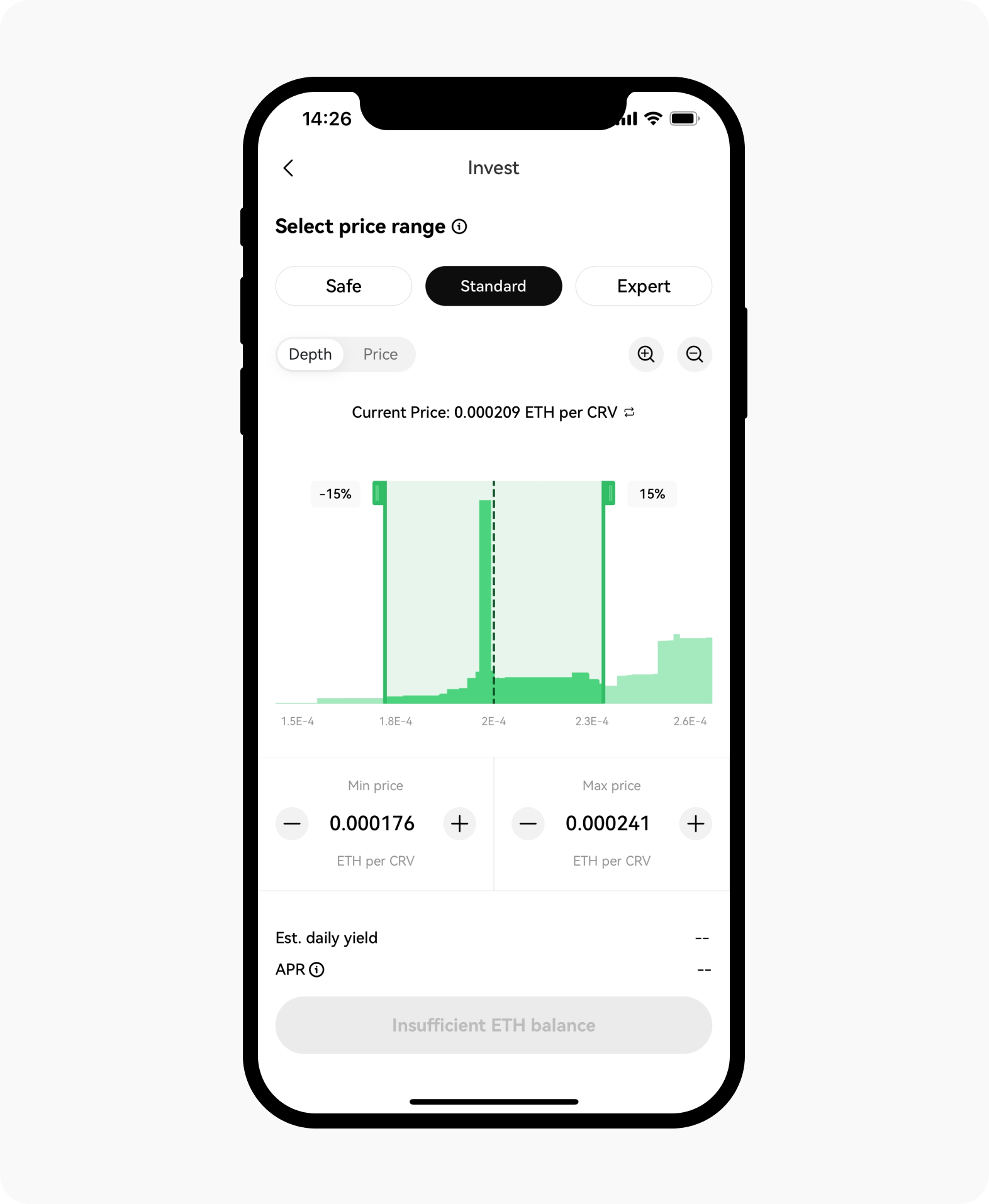

On our platform, V3 pools dynamically suggest price ranges based on risk and token volatility. These price ranges are updated in real-time according to market conditions, and users can choose between Safe, Standard, and Expert price ranges. Additionally, users have the option to provide liquidity to V3 pools, and in return, they'll receive an NFT representing their provided liquidity. This NFT can then be staked in LP pools to earn additional fees.

An example of price ranges for liquidity pools with us

Get started

On the app

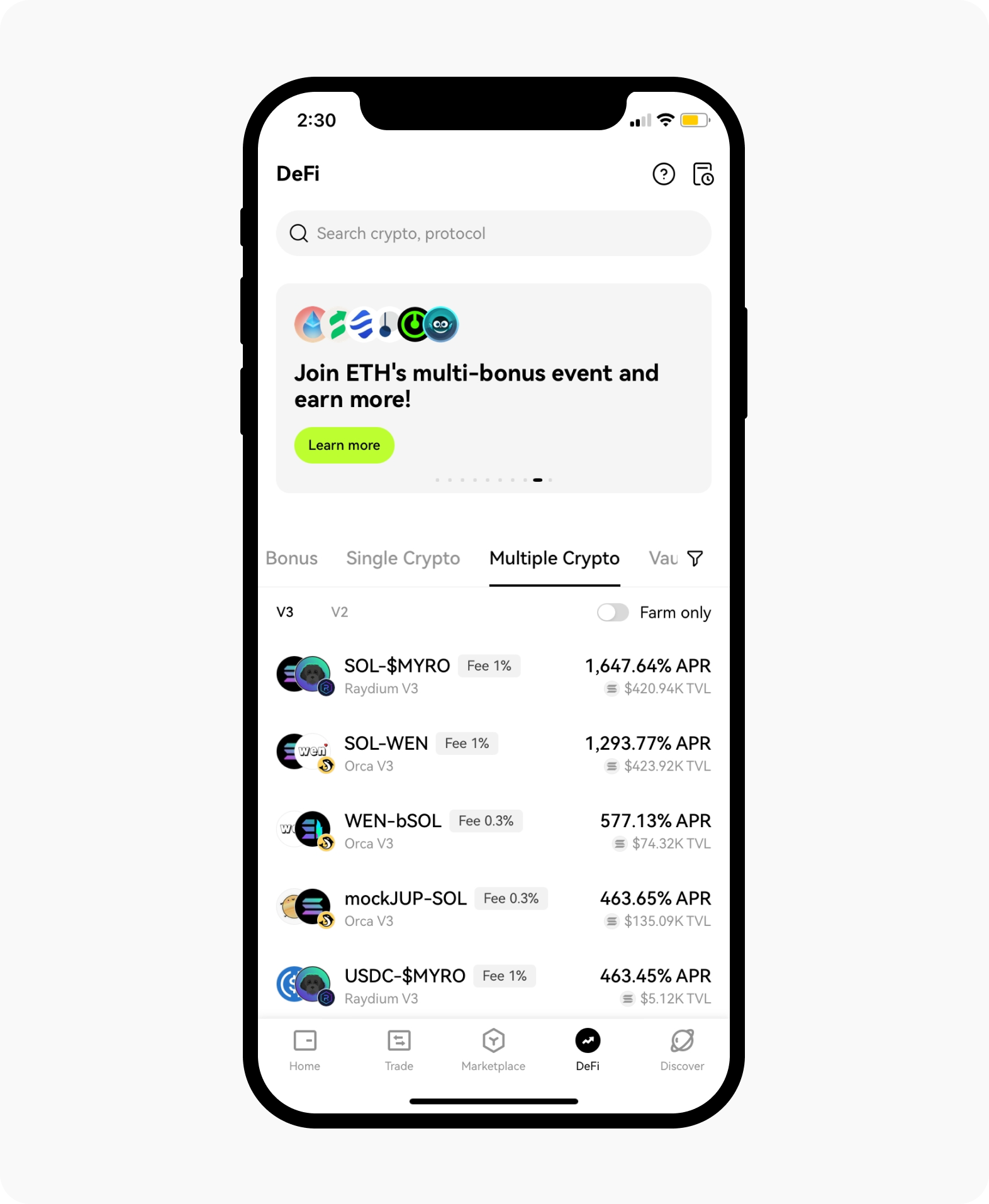

Download the OKX app, switch to wallet, and head over to the DeFi tab

Select Multiple crypto > V3 on the main page to access V3 liquidity pools

Easily access V3 liquidity pools on the app

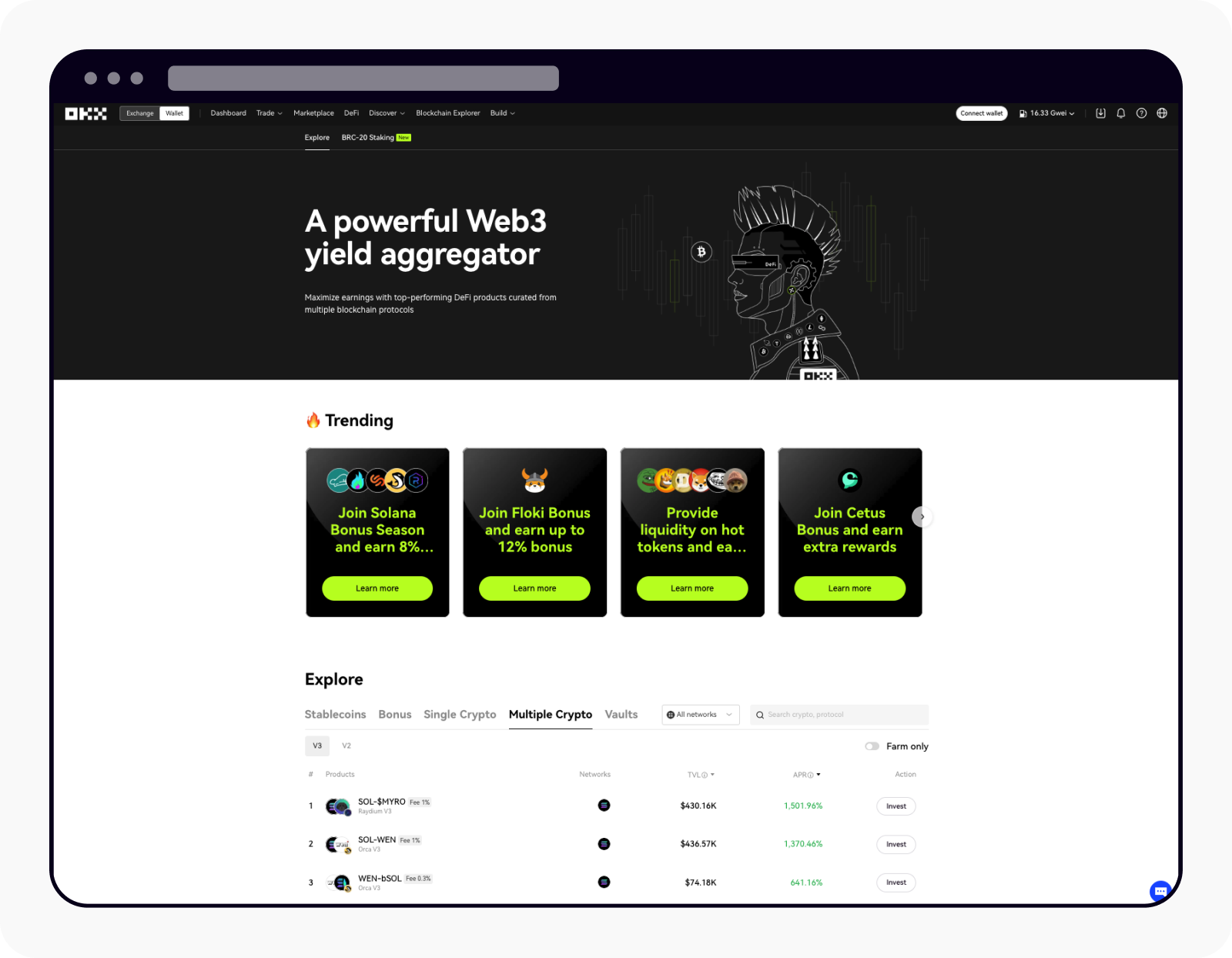

On the web

Create an OKX wallet on this page here or you can refer here

Head over to the Defi page here

Select Explore > Multiple crypto > V3 to access V3 liquidity pools

Access V3 liquidity pools effortlessly at the Defi page