How do I place a TP/SL with Limit Order?

What's Take Profit (TP) and Stop Loss (SL)?

Take Profit (TP) and Stop Loss (SL) are parts of One-Cancels-the-Other (OCO) order. OCO order is a pair of orders that are set simultaneously. If one order is triggered and executed, the other order is automatically canceled. This strategy allows traders to manage their trades more effectively by combining both a TP and an SL order.

Take Profit (TP): a TP order is designed to automatically buy or sell a position when the market price reaches a specific target, locking in profits.

Stop Loss (SL): an SL order is designed to automatically buy or sell a position when the market price falls to a certain level, limiting potential losses.

Why should I use TP/SL with Limit Order?

Using TP/SL with Limit Orders offers several benefits:

Setup your trades for success: you can automate your trading strategy by setting predefined exit points, allowing you to manage trades without constant monitoring.

Risk management: TP/SL orders help you manage risk by setting clear profit targets and loss limits.

Enhanced Control: setting trigger prices gives you precise control over when your orders are executed, improving your ability to react to market movements.

What's a Trigger price?

The trigger price is the price at which your buy or sell order becomes active on the exchange servers. In other words, once the market price reaches the trigger price you have set, your order is sent to the exchange servers for execution.

What's an example of setting a TP/SL with a Limit Order?

Placing the order:

Order price: $50,000 (the price at which you want to buy Bitcoin)

Order size: 1 BTC (the amount you wish to buy)

Setting TP/SL:

TP trigger price: $55,000 (the price at which you want to take profit)

SL trigger price: $45,000 (the price at which you want to stop loss)

In this example, when the market price of Bitcoin reaches $55,000, the TP order will be triggered, and you'll sell your 1 BTC to lock in profits. Conversely, if the market price drops to $45,000, the SL order will be triggered to sell your 1 BTC and limit your losses.

What should I consider when setting TP/SL prices?

Market volatility: consider the volatility of the cryptocurrency you are trading. More volatile markets may require wider TP/SL ranges to avoid premature triggering.

Risk tolerance: set TP/SL levels according to your risk tolerance and trading strategy.

Market conditions: stay informed about market trends and conditions, as these can impact the effectiveness of your TP/SL settings.

How do I place a TP/SL with a Limit Order on OKX?

When placing a Limit Order on our platform, you can simultaneously set Take Profit (TP) and Stop Loss (SL) orders to manage your trades effectively. Follow these steps to set up TP/SL with a Limit Order:

Enter Order Details

Order price: specify the price at which you want to execute the trade.

Order size: enter the amount of cryptocurrency you wish to buy or sell.

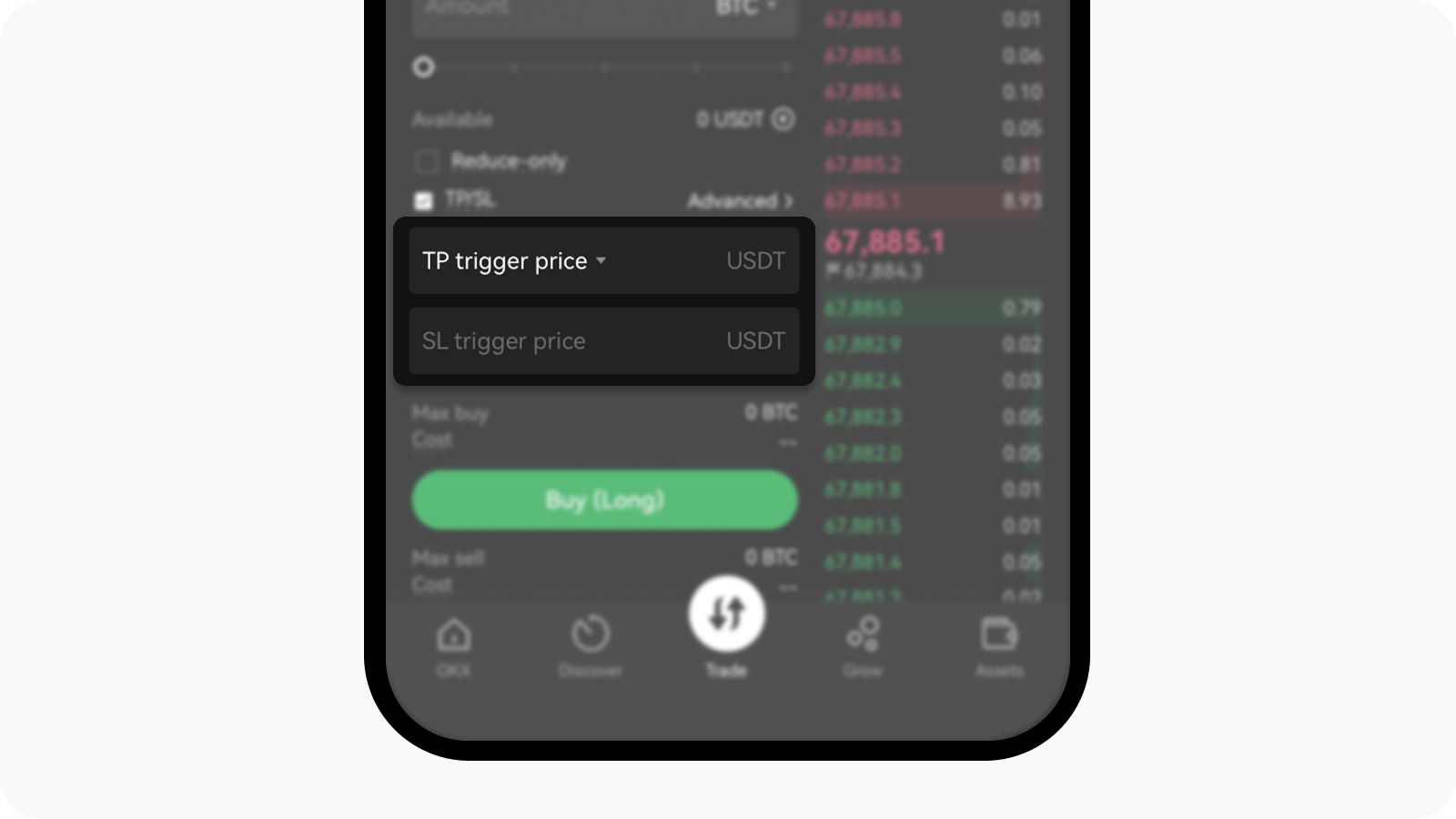

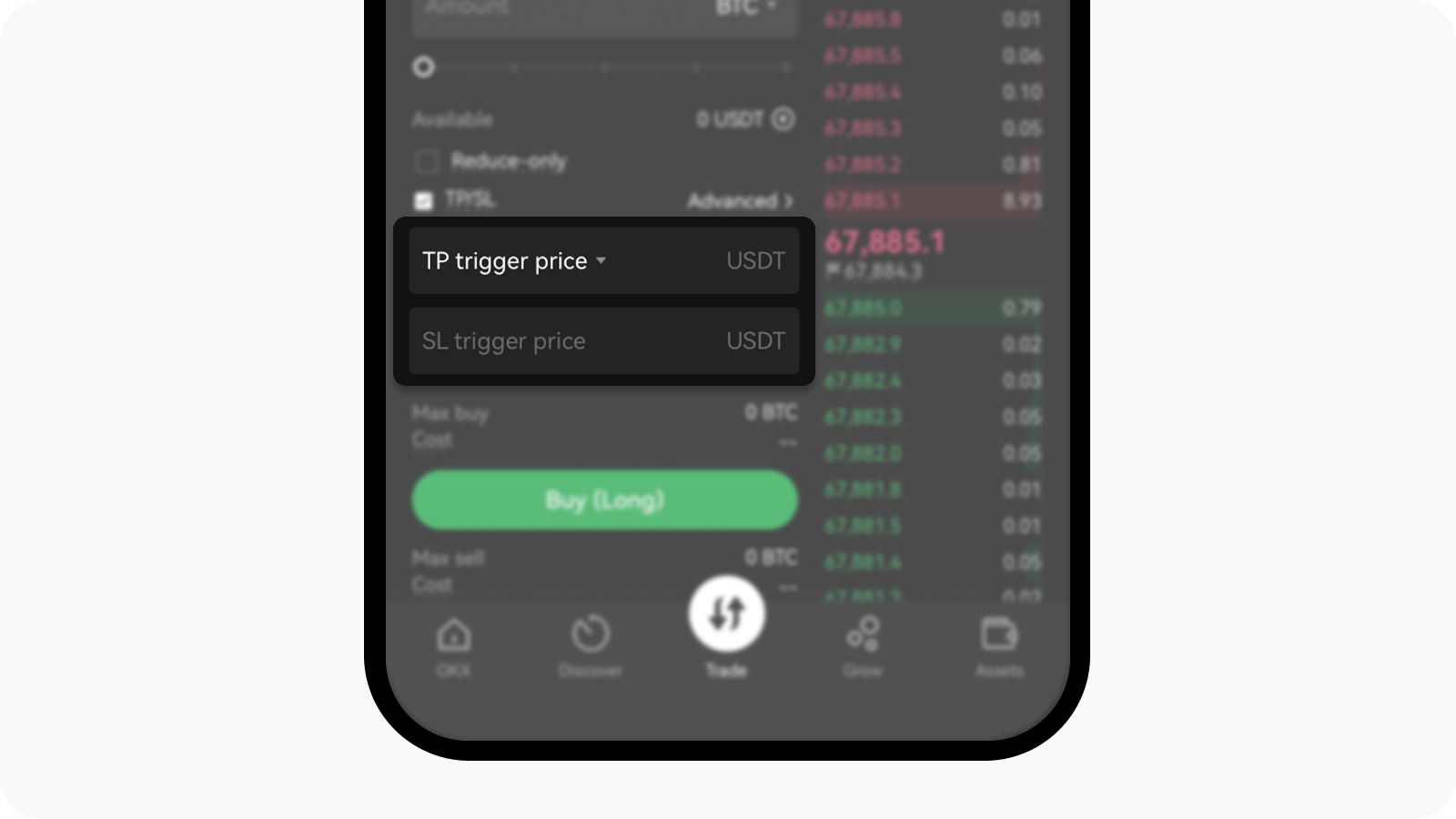

Insert and select your preferred details for the order

Enable TP/SL

Check the TP/SL box: after entering the order price and size, check the box next to [TP/SL] to activate the settings for Take Profit and Stop Loss.Set Trigger prices

TP trigger price: this is the price at which your Take Profit order will be triggered. When the market price reaches this level, the TP order will be executed to lock in profits.

SL trigger price: this is the price at which your Stop Loss order will be triggered. When the market price hits this level, the SL order will be executed to limit your losses.

Fill in your TP/SL trigger prices to proceed with your trading