Preguntas frecuentes sobre las reglas de la comisión de trading

1. ¿Cuándo se aplican la comisión del tomador y del creador? ¿Cuál es la diferencia entre la comisión del tomador y del creador?

Una orden de tomador se produce cuando colocas un trade que se ejecuta inmediatamente contra una orden que ya está en el libro de órdenes. Las órdenes de los tomadores conllevan una comisión basada en la tasa de comisión del tomador.

Una orden de creador se produce cuando se coloca una orden en el libro de órdenes con un precio y una cantidad determinados, como una orden límite que permanece en el libro hasta que se iguala.

Las órdenes de los creadores tienen una comisión basada en la tasa de comisión del creador. Las órdenes de los creadores aumentan la liquidez del libro de órdenes, proporcionando más profundidad al mercado. Por el contrario, las órdenes de los tomadores eliminan liquidez al ejecutar las órdenes en el libro de órdenes, reduciendo la profundidad del mercado. Para incentivar la provisión de liquidez por parte de los creadores, las comisiones de los creadores suelen ser más bajas que las de los tomadores. Si deseas conocer las normas detalladas, puedes consultar nuestro programa de comisiones de trading.

2. ¿Cómo puedo consultar mis comisiones actuales y cuáles son las comisione de los distintos niveles?

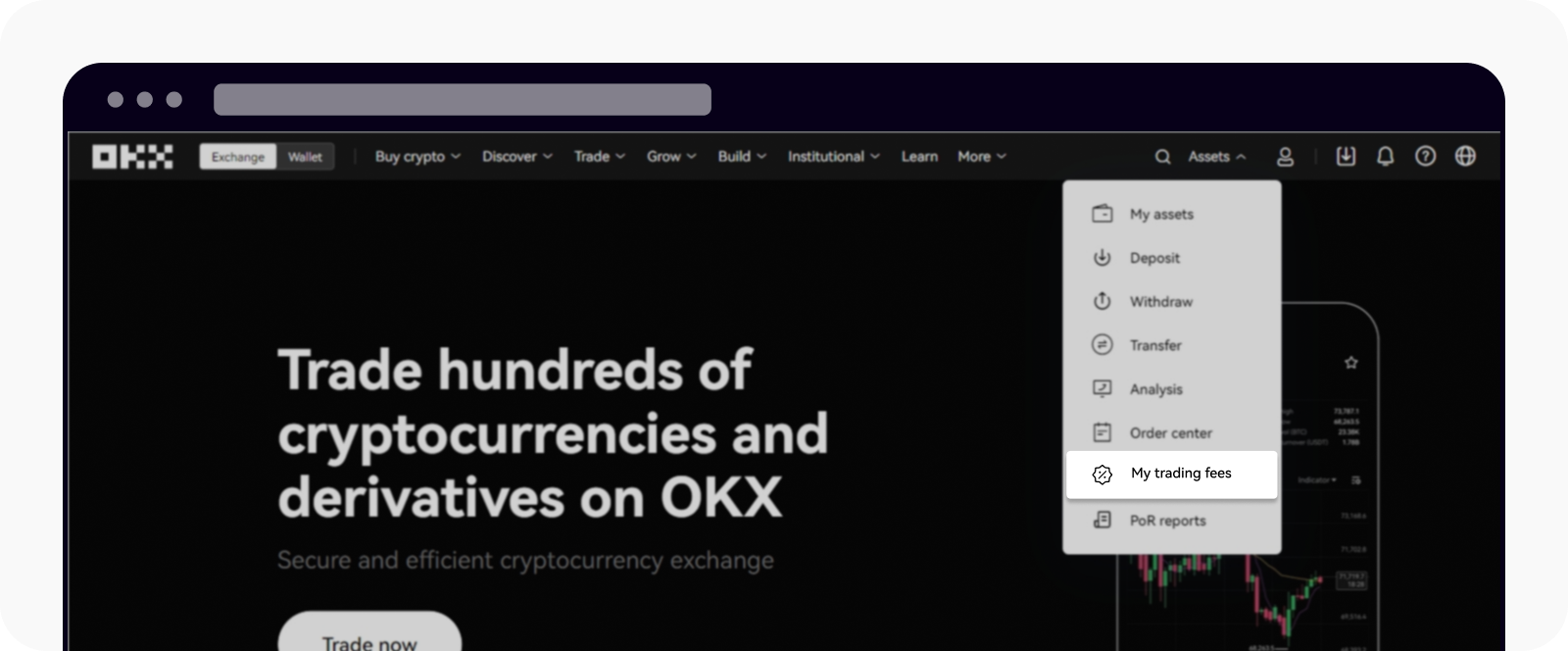

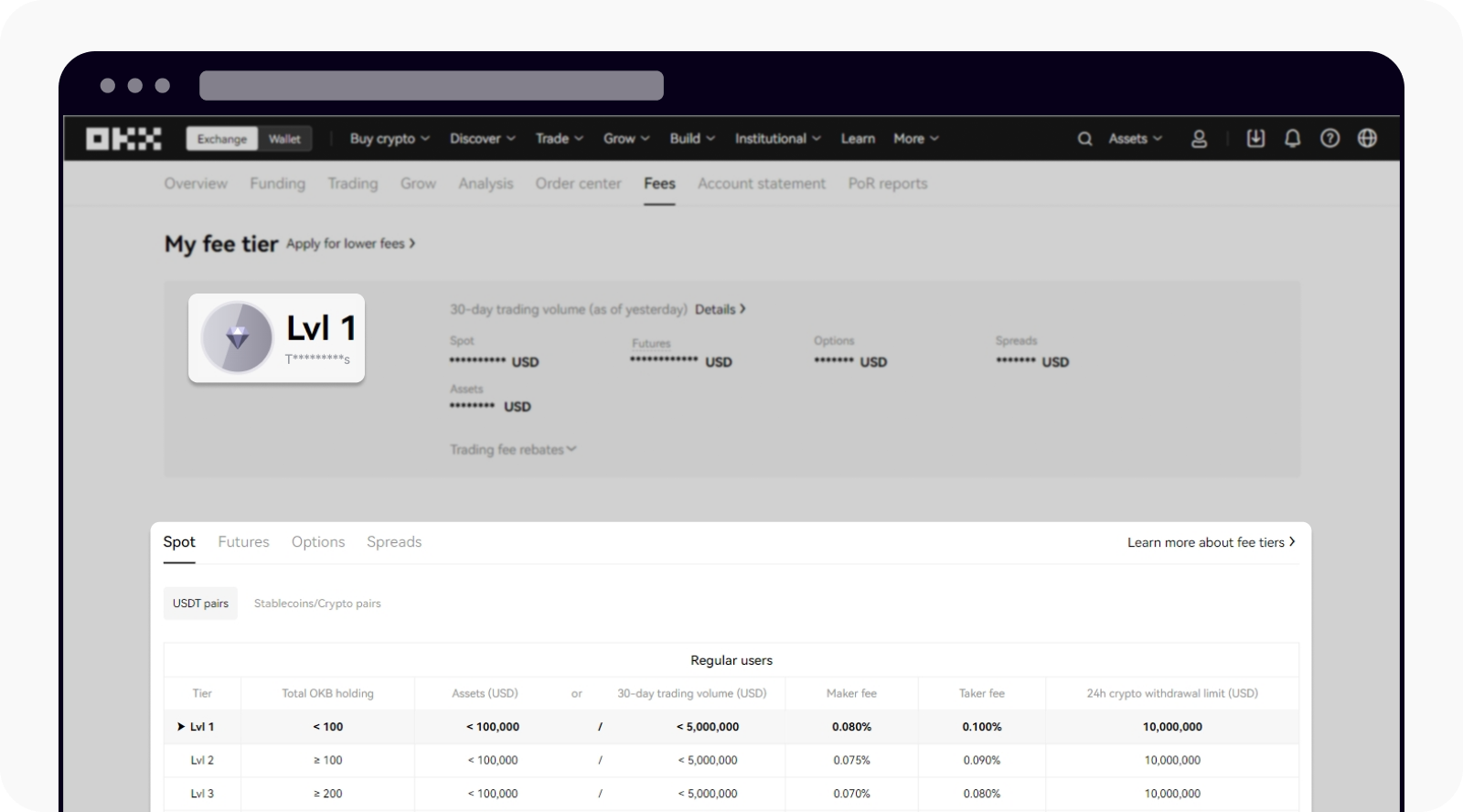

Puedes acceder a tu cuenta en nuestro sitio web e ir a Activos > Mis comisiones de trading. Puedes consultar Mi nivel de comisiones para conocer tu nivel de comisiones actual y la tabla de comisiones de trading, que incluye las tasas de comisiones para cada instrumento y par de trading.

Abrir mi página de comisiones

Encuentra tu nivel actual de comisiones y la tasa correspondiente a los distintos niveles en Mis comisiones de trading

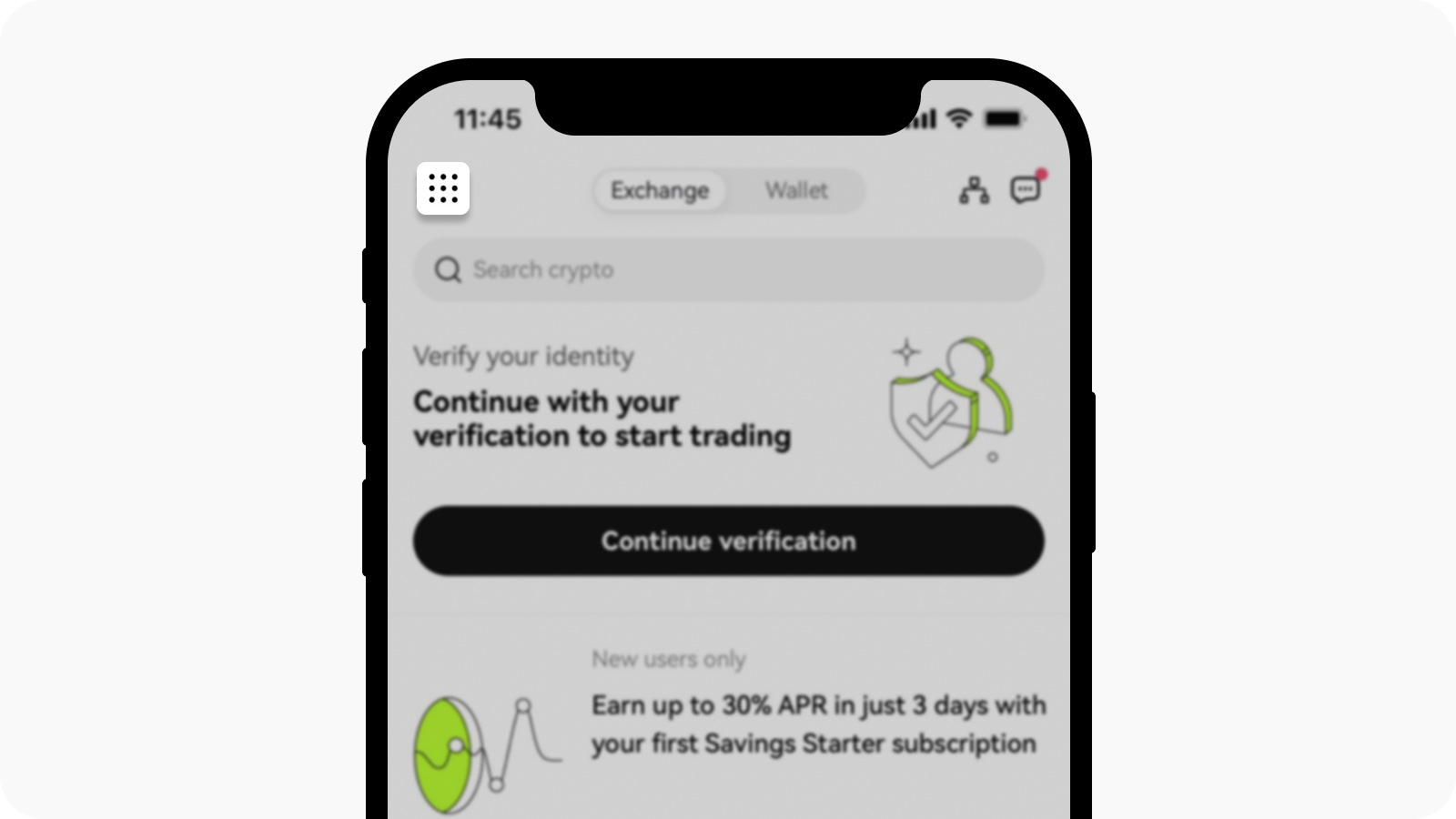

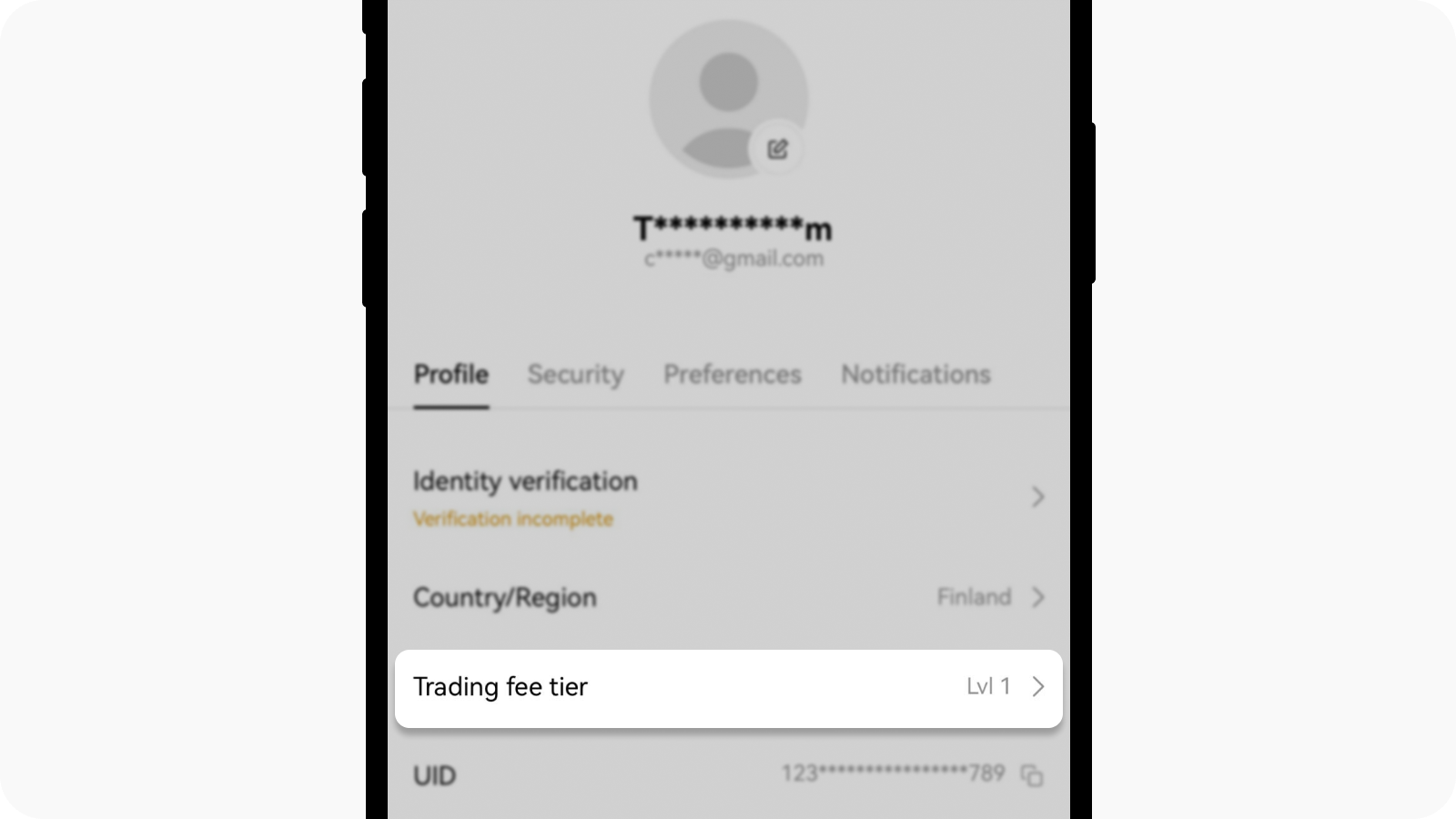

También puedes iniciar sesión en tu cuenta en nuestra app e ir a Centro de usuarios > Perfil y configuración > Perfil > Nivel de comisión de trading. Puedes consultar Mi nivel de comisiones para conocer tu nivel de comisiones actual y la tabla de comisiones de trading, que incluye las tasas de comisiones para cada instrumento y par de trading.

Abrir el menú de usuario desde la página de inicio

Abrir la página de niveles de comisiones de trading para ver los detalles de las comisiones de trading

3. ¿Cómo puedo comprobar la comisión actual de un par concreto en la página de trading?

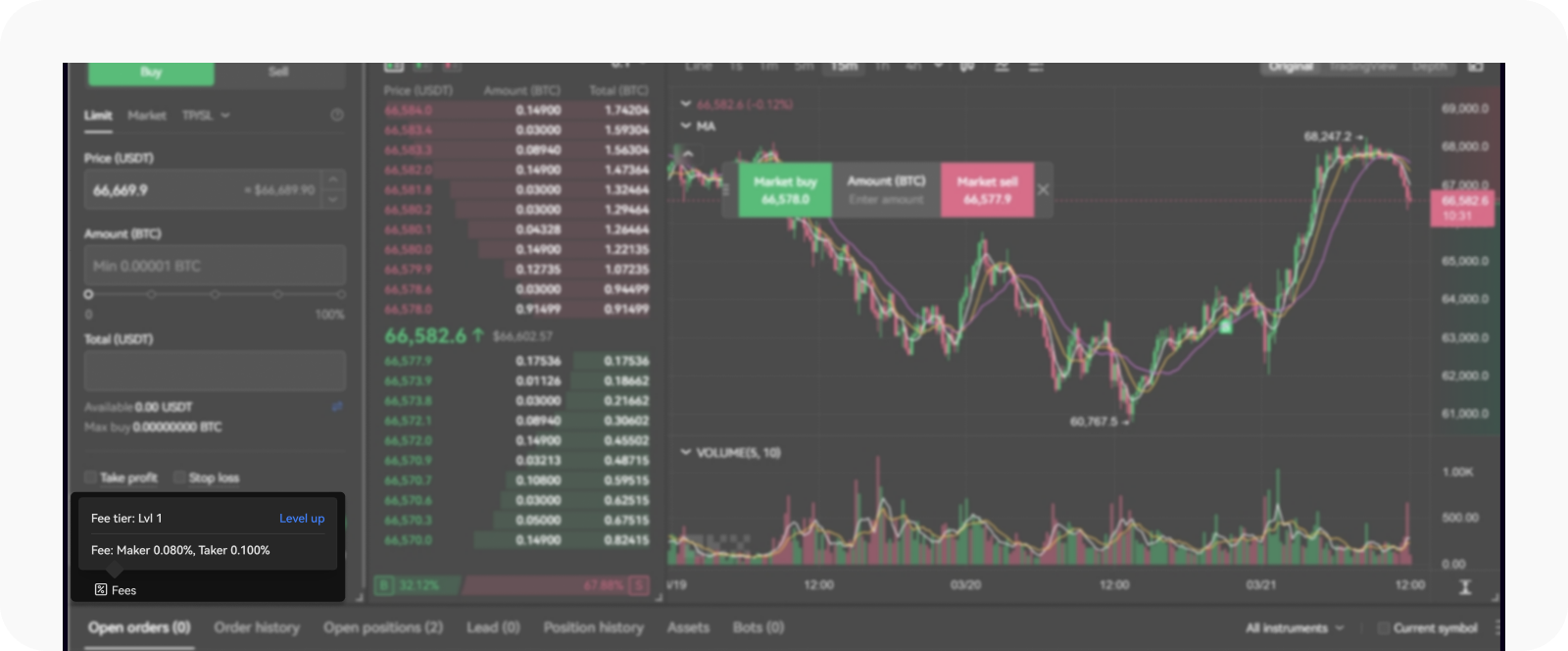

Puedes ir a nuestra página de trading y buscar los pares de trading que desees. Puedes consultar las tasas de comisión del par de trading actual en Comisiones en el panel de colocación de órdenes.

En nuestra página de trading encontrarás las comisiones actuales de comprador y tomador

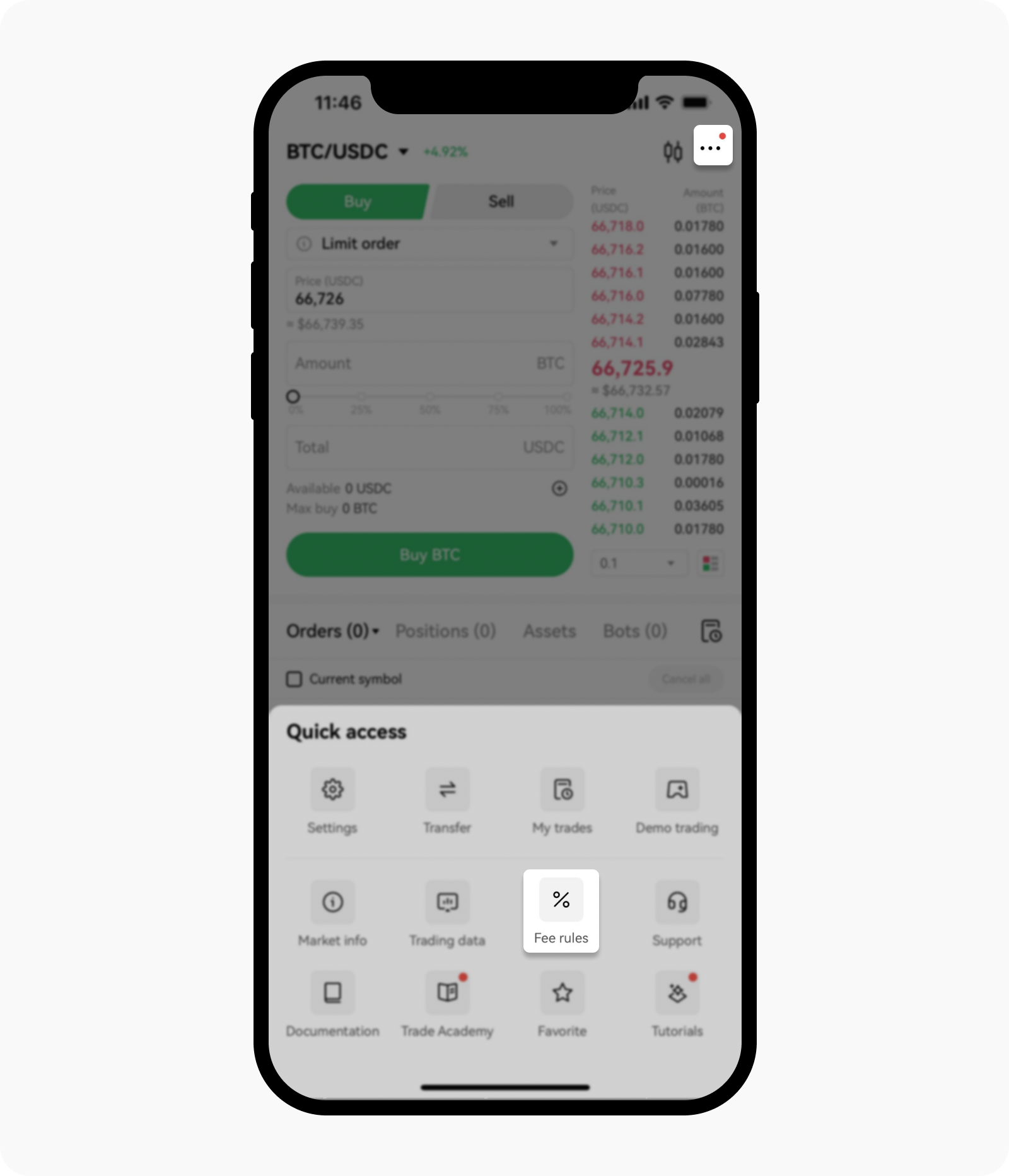

También puedes iniciar sesión en tu cuenta en nuestra app, luego ir a Trade y seleccionar Mas y Reglas de comisiones para conocer el nivel de comisión y la tasa de comisión del par actual.

Selecciona Reglas de comisiones para ver más información sobre tu nivel de comisión y las reglas actuales

4. ¿Cómo puedo consultar las comisiones de mis órdenes anteriores?

Puedes encontrar las comisiones de tus órdenes anteriores en la web en las siguientes secciones:

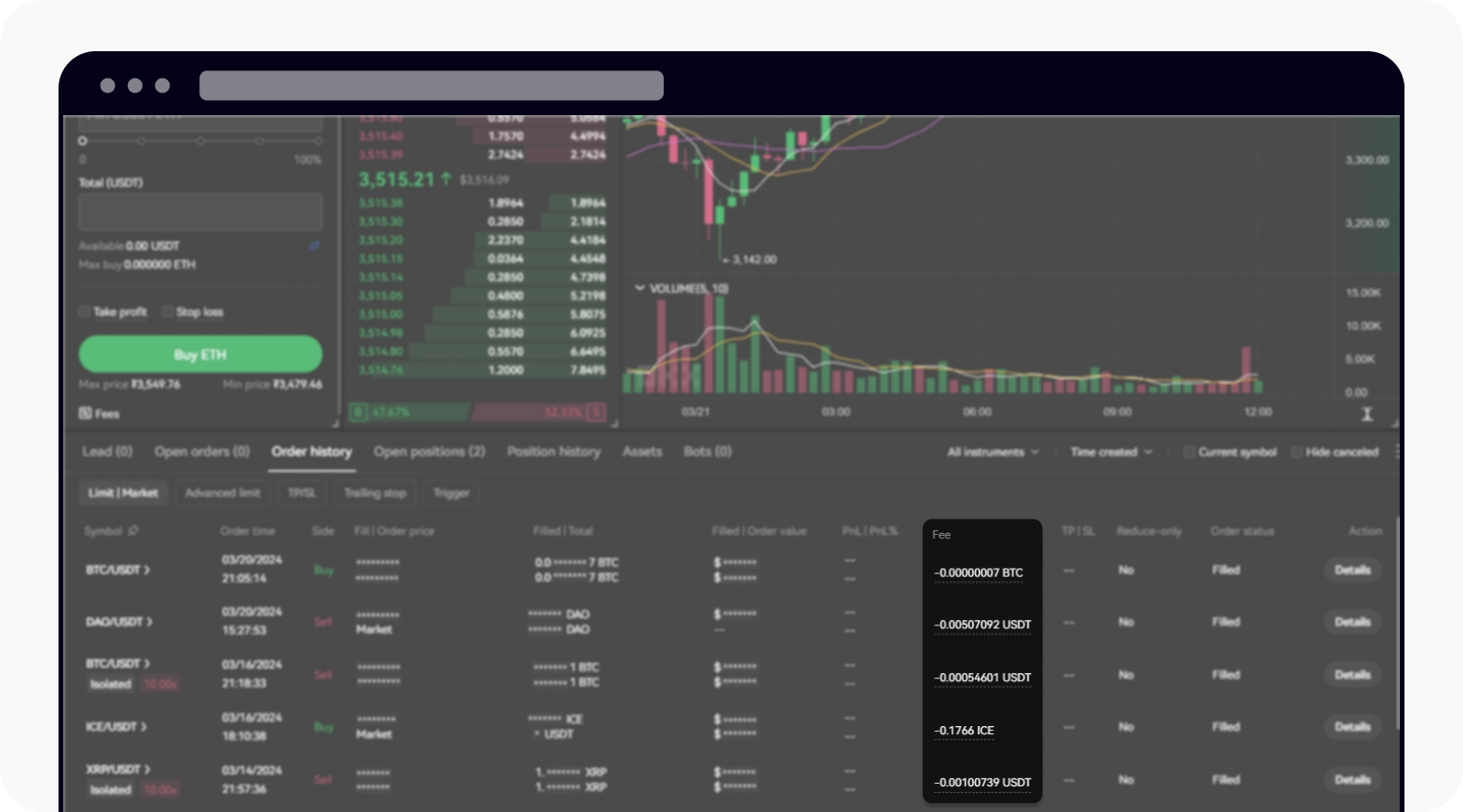

En la página de trading > Historial de órdenes

Ingresa a la página de trading y selecciona Historial de órdenes. Verás la cantidad de la comisión aplicada.

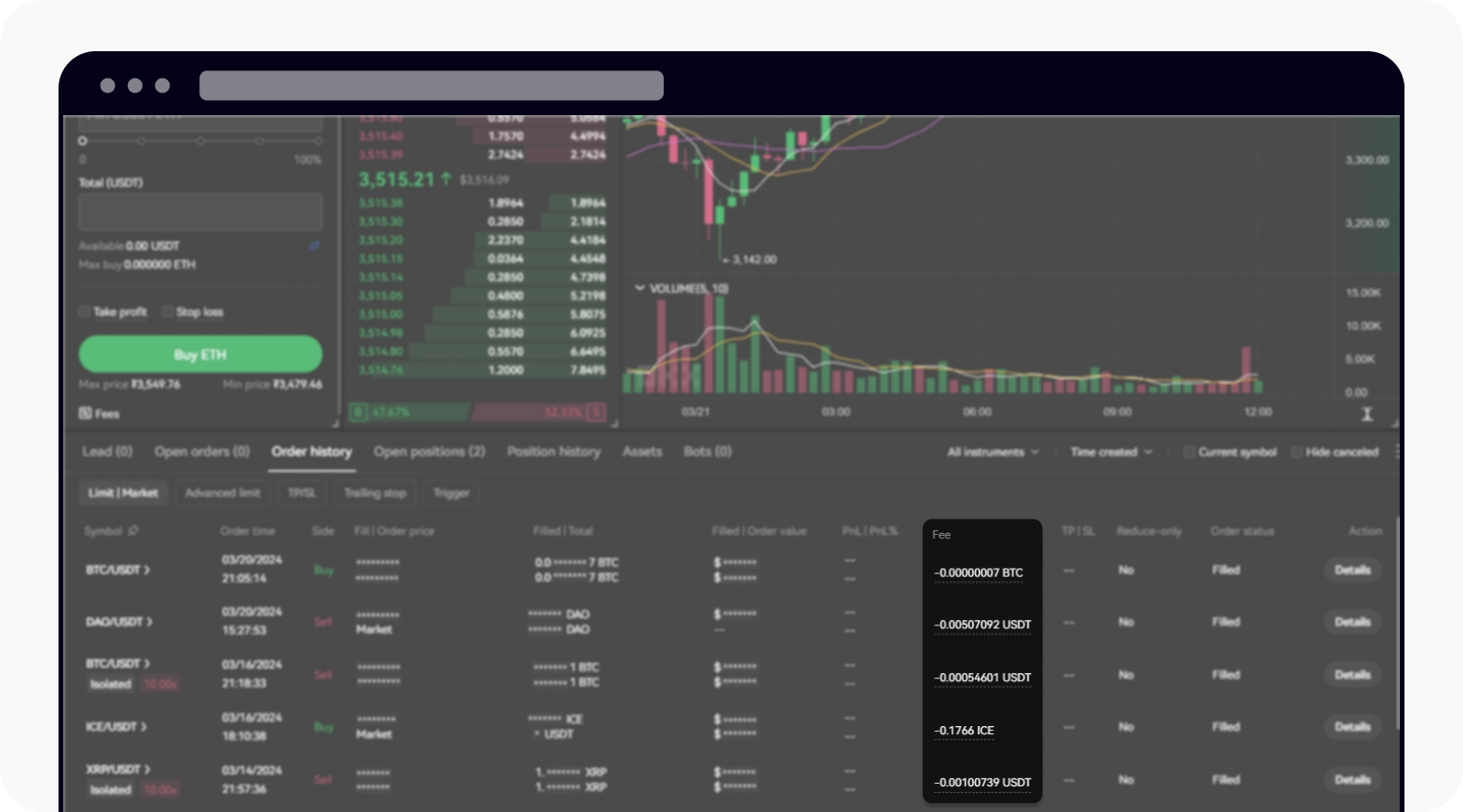

Busca la cantidad de la comisión en tu historial de órdenes

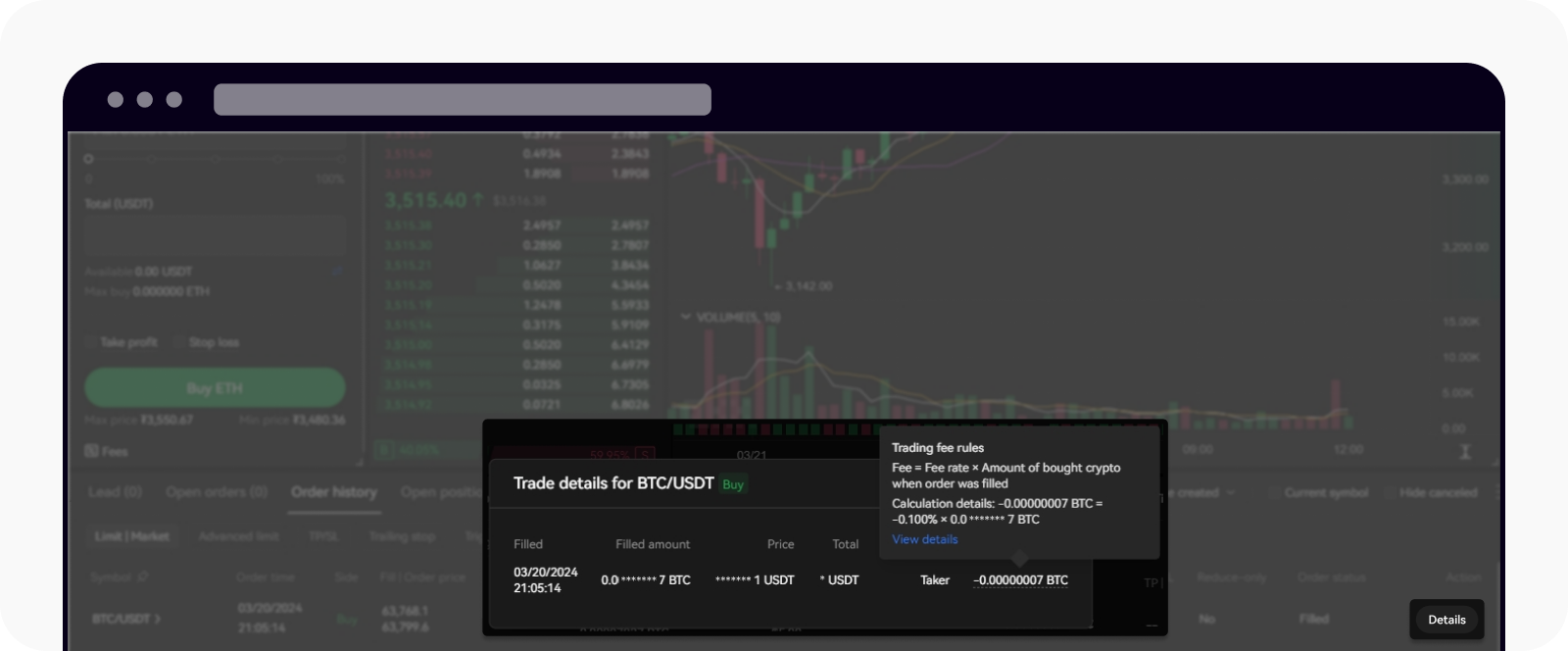

Si quieres saber cómo se calcula la tasa, puedes seleccionar Detalles y colocar el mouse encima de Comisión.

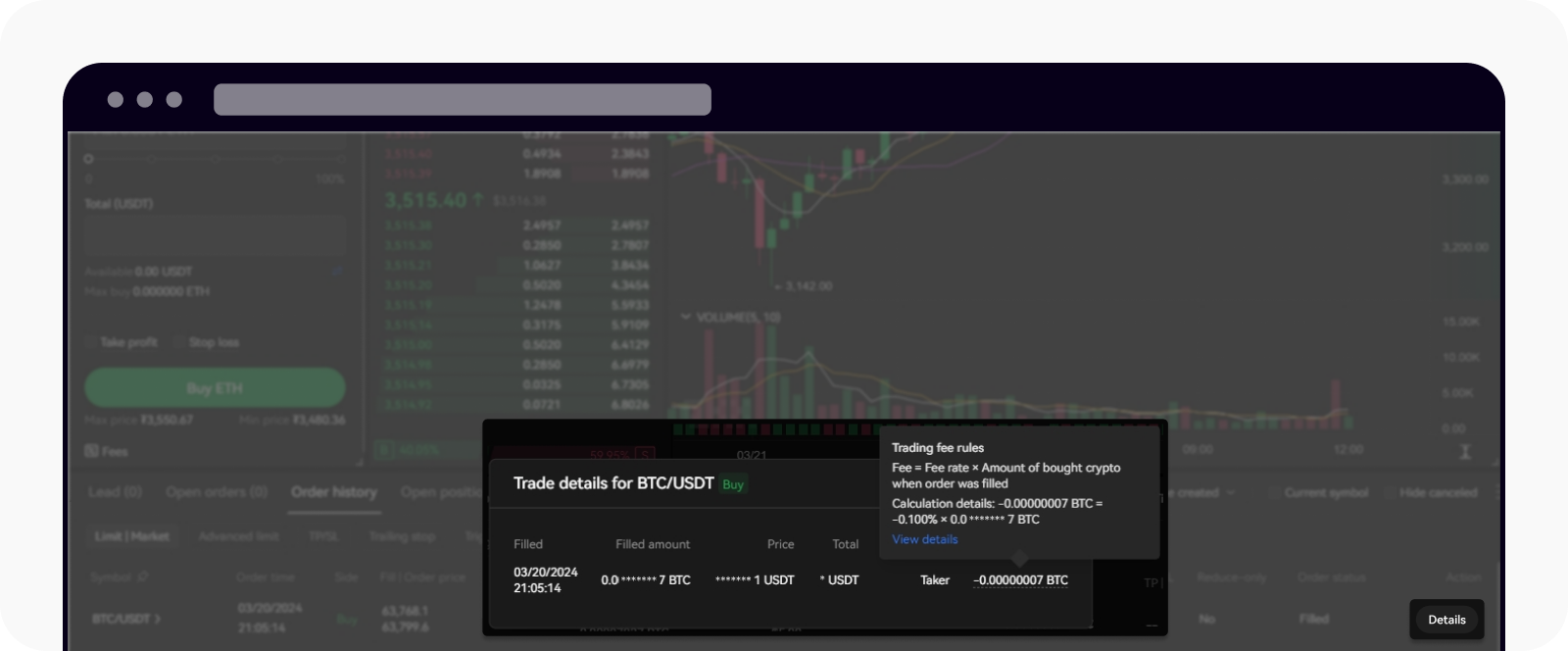

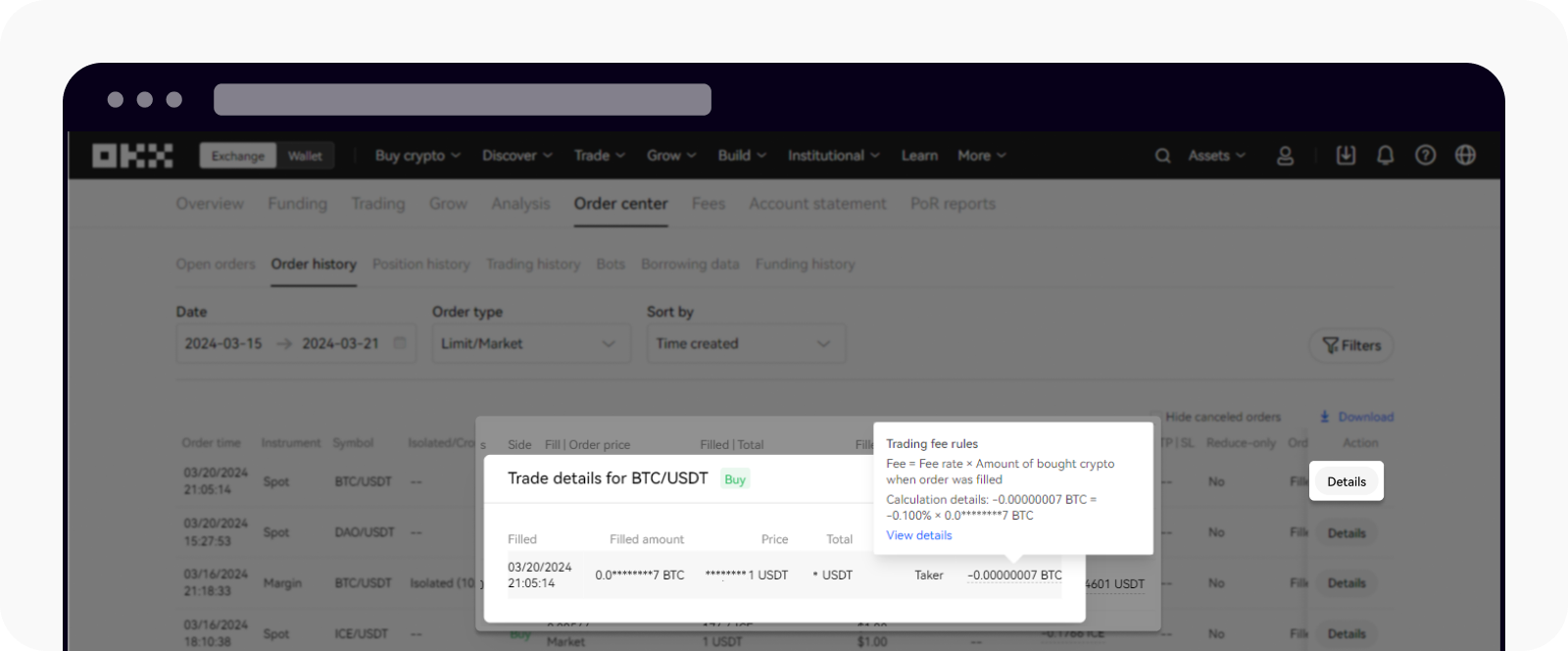

Selecciona detalles para saber cómo se calcula la comisión

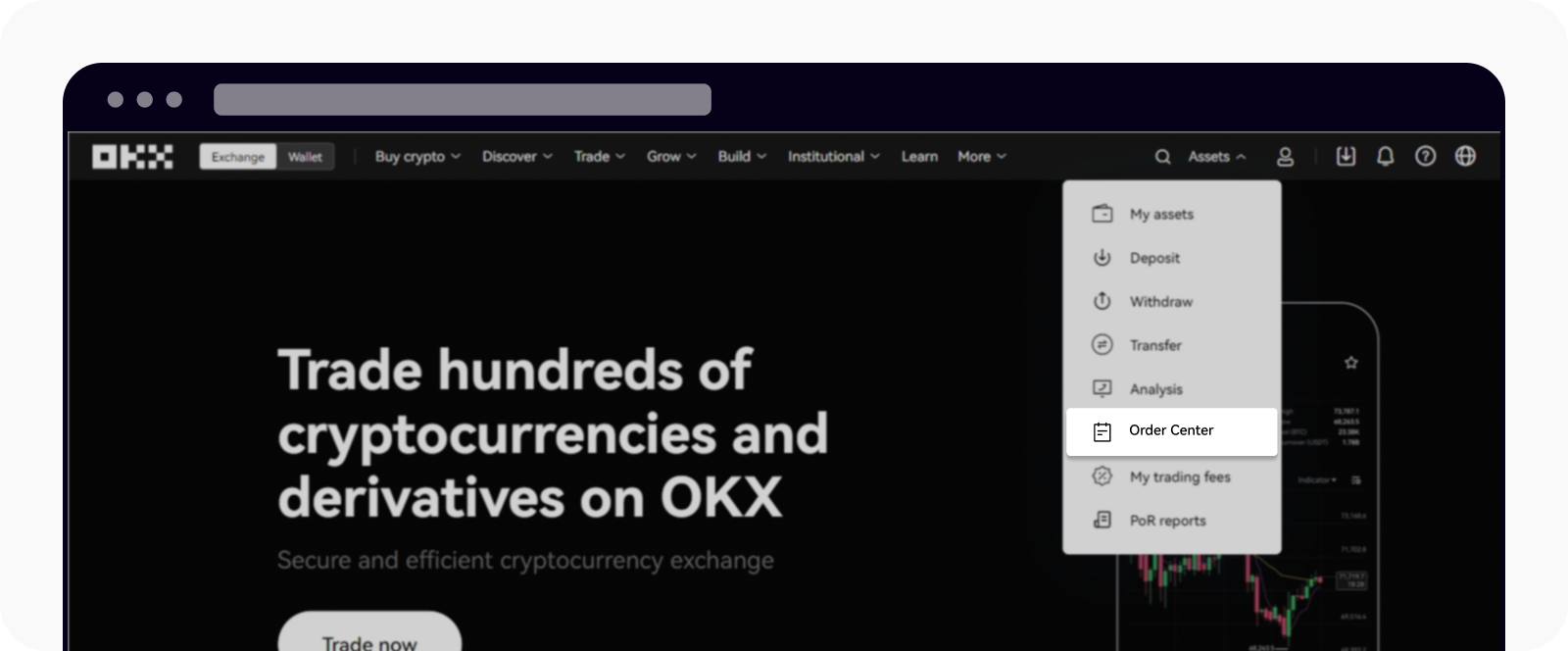

En Centro de órdenes > Historial de órdenes

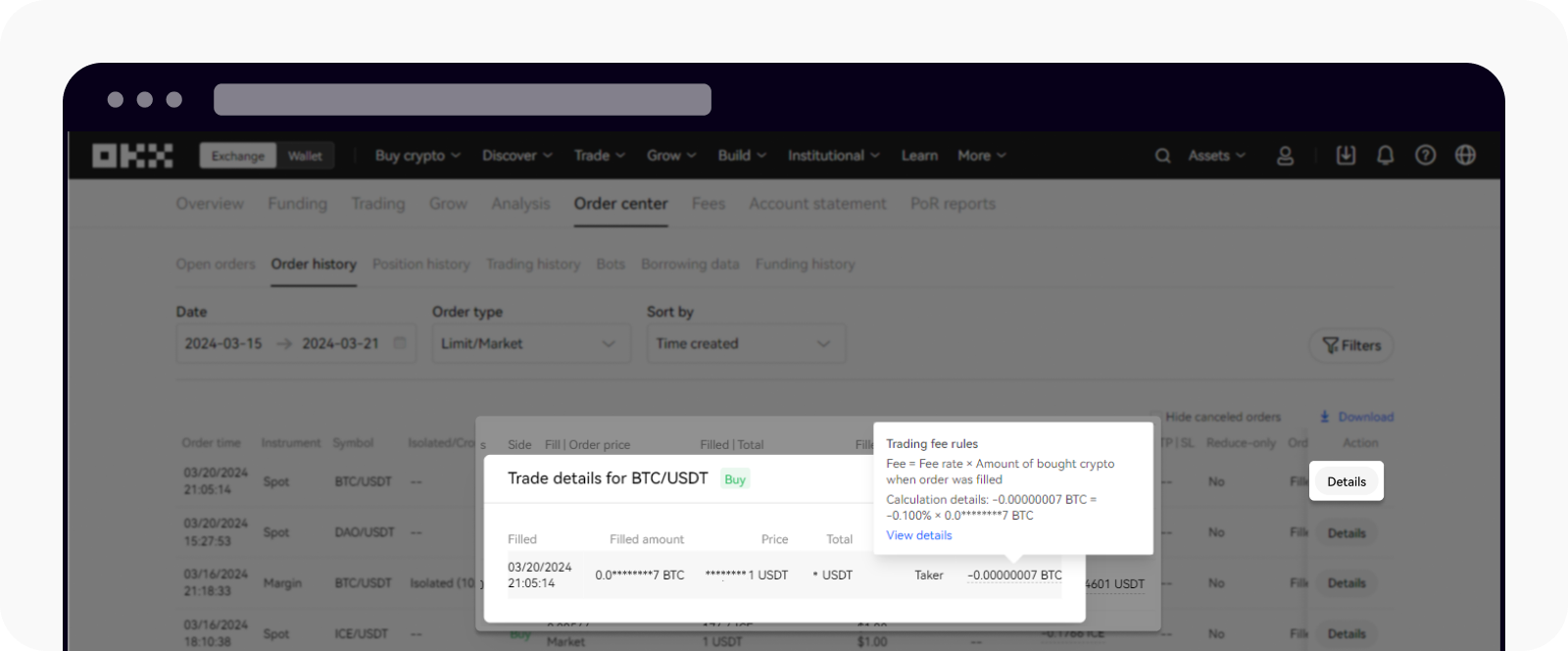

Ingresa al Centro de órdenes y selecciona Historial de órdenes. Verás la cantidad de la comisión aplicada.

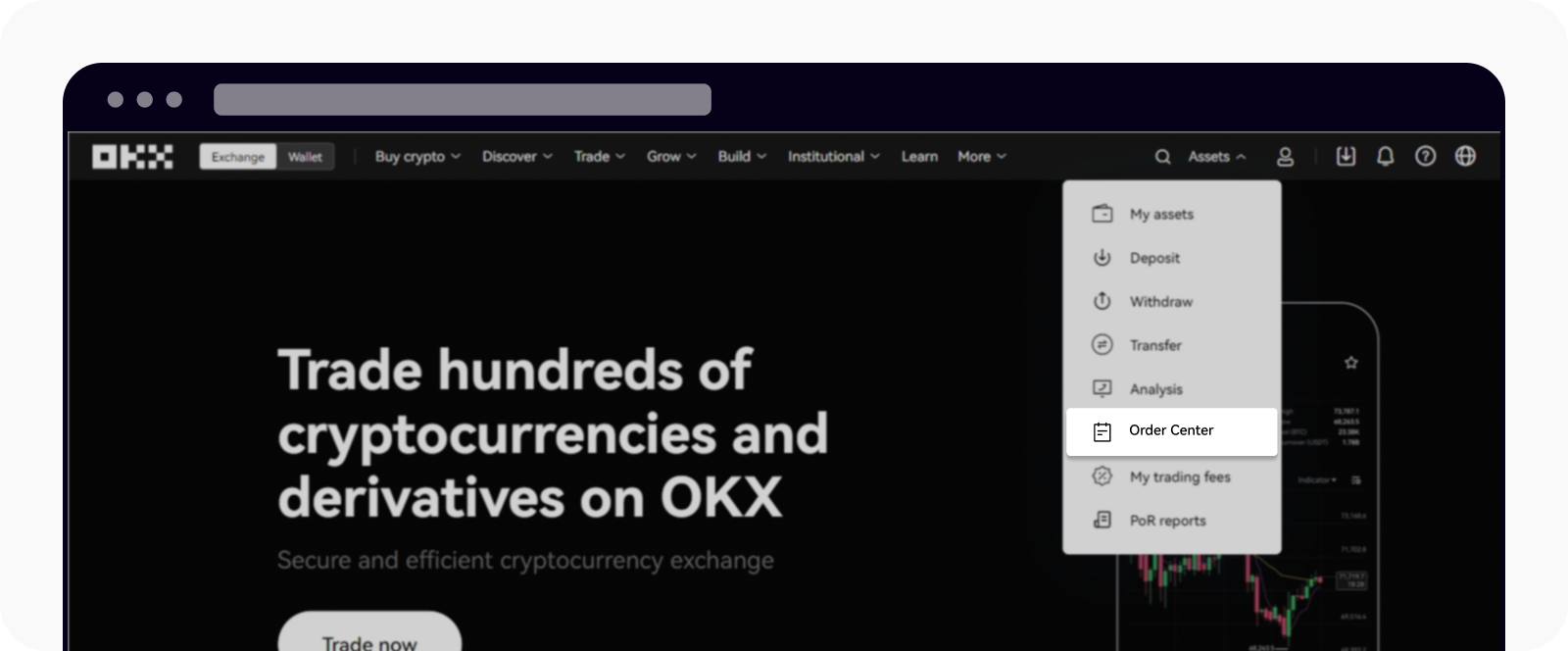

Abrir la página del Centro de órdenes

Si quieres saber cómo se calcula la tasa, puedes seleccionar Detalles y colocar el mouse encima de Comisión.

Selecciona detalles para saber cómo se calcula la comisión

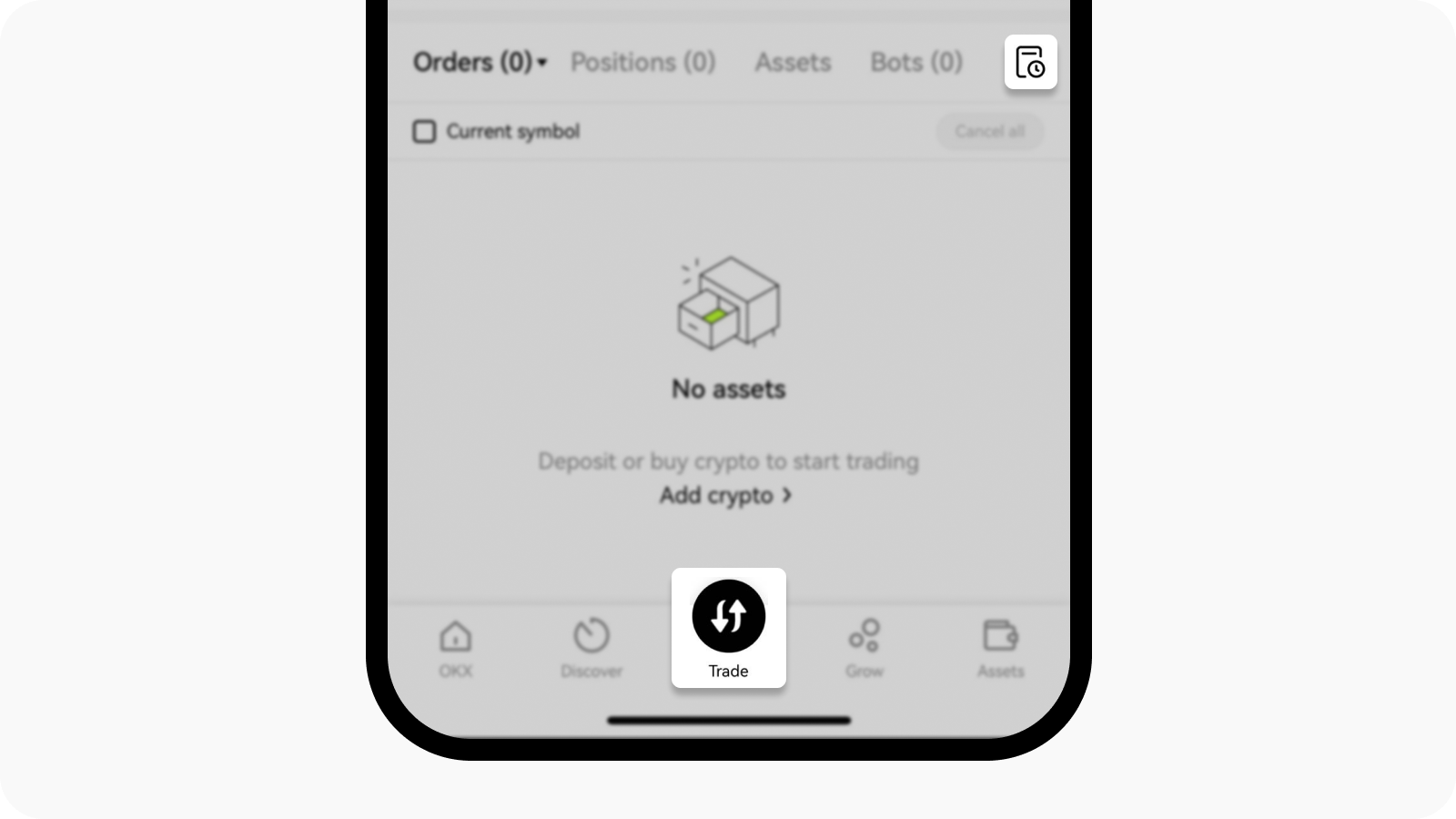

También puedes consultar las comisiones de tus órdenes anteriores en nuestra app en la sección Trade, seleccionando Mis trades, en Historial de órdenes.

Abrir la página del historial de transacciones

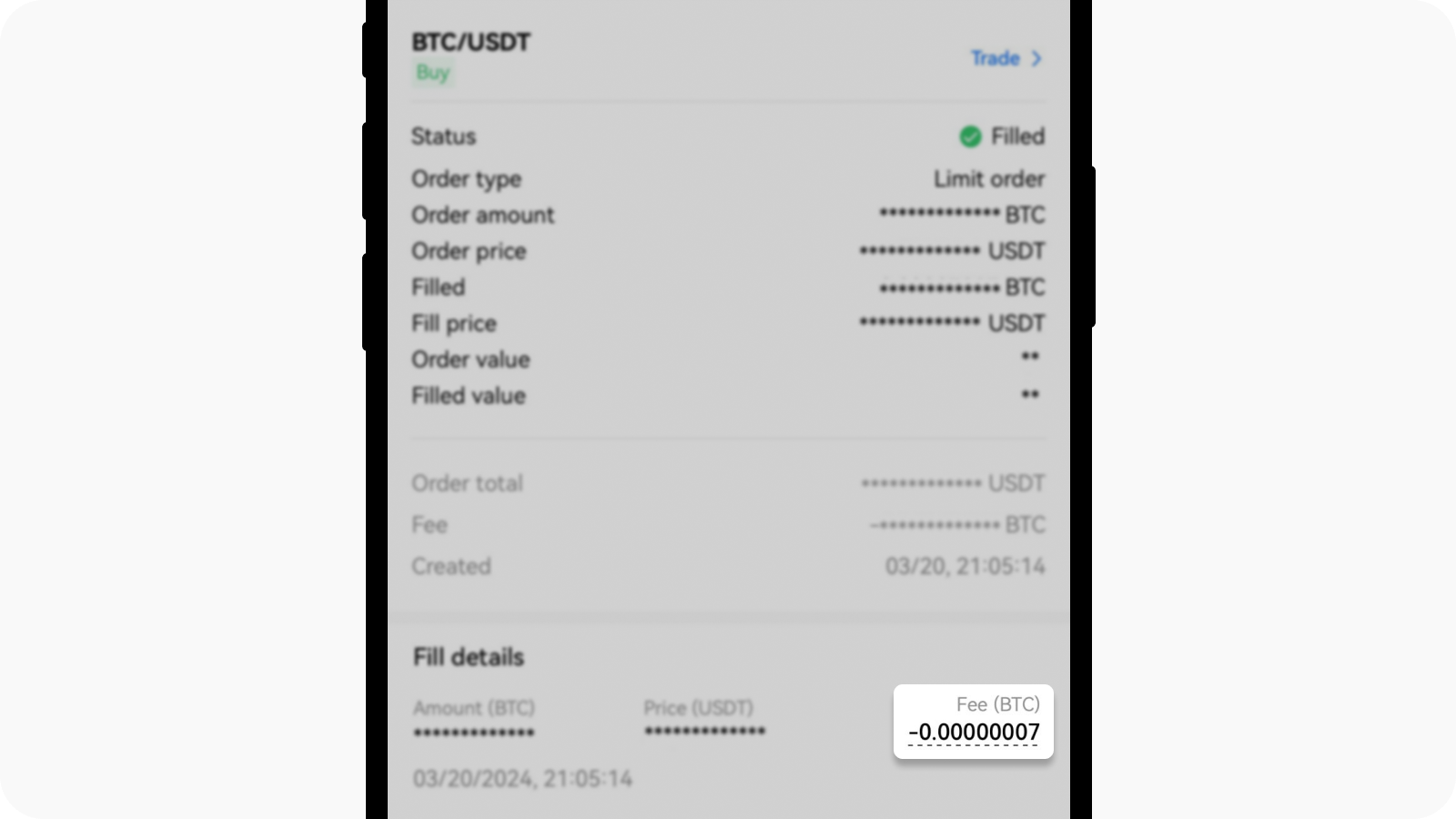

Selecciona el historial de transacciones que deseas consultar y encontrarás la cantidad de la comisión aplicada en Detalles de la ejecución.

Buscar la comisión que se aplicó en la transacción anterior

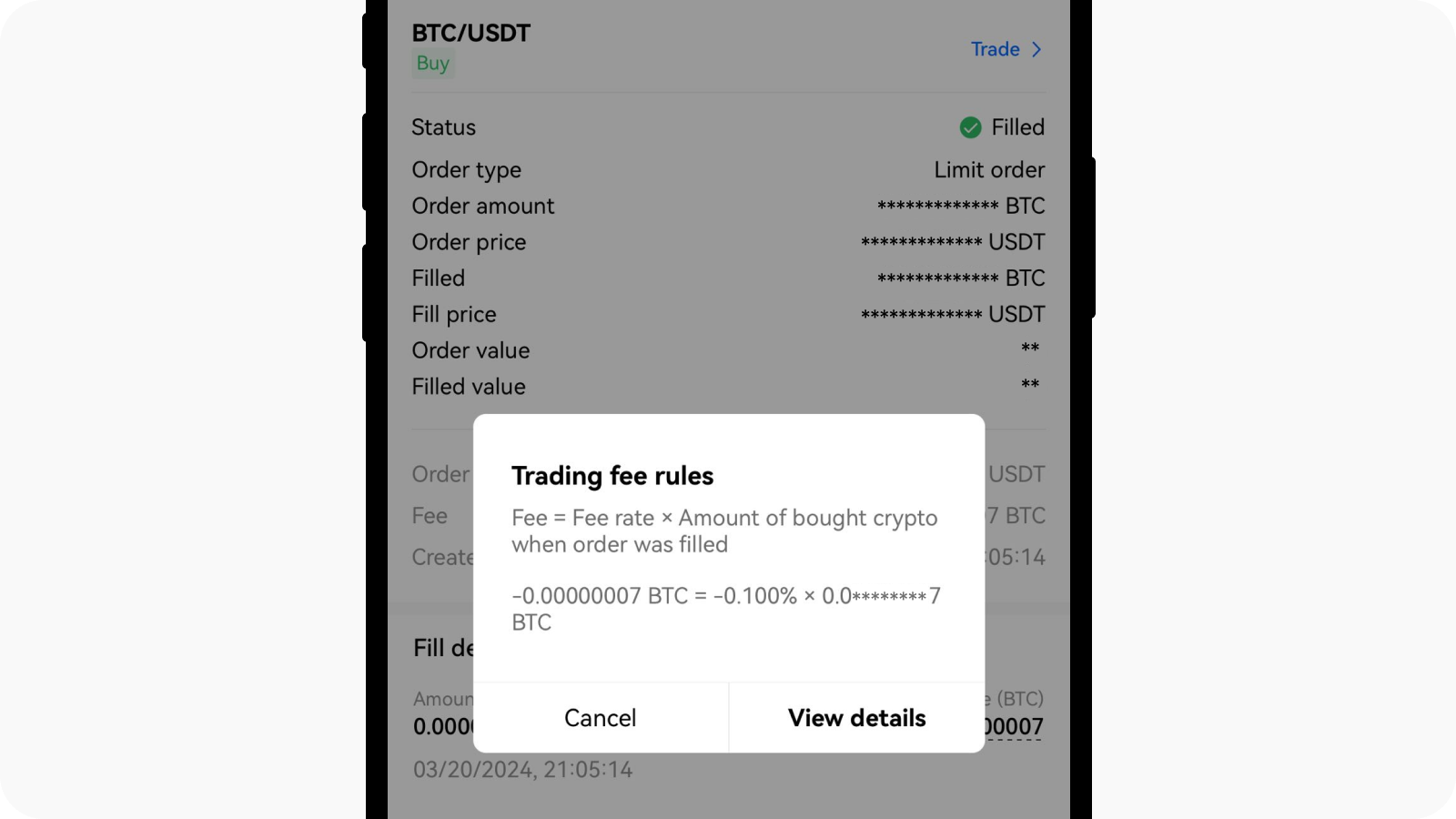

Si quieres saber cómo se calcula la comisión, puede seleccionar la cantidad de la comisión y podrás ver los detalles de la misma.

Ver cómo se calcula tu comisión de trading

5. ¿Cómo se determina el nivel de mi comisión de trading?

Puedes mejorar tus niveles de comisión aumentando la cantidad de los activos, el volumen de trading o el holding de OKB.

En función del volumen de trading, los usuarios se clasifican en habituales y VIP. Los usuarios habituales se clasifican según su holding de OKB, mientras que los usuarios VIP se clasifican en función de la cantidad de activos y el volumen de trading de los últimos 30 días. Los distintos niveles determinan las comisiones de trading para el siguiente día de trading.

Al calcular el nivel de comisión, si el volumen de trading spot, el volumen total de futuros perpetuos y a vencimiento (futuros perpetuos de USDT, futuros a vencimiento de USDT, futuros perpetuos de USDC, futuros a vencimiento de USDC, futuros perpetuos con margen con cripto y futuros a vencimiento con margen con cripto), el volumen de trading de opciones, el volumen de trading de spreads y la cantidad de activos, cumplen las condiciones para los diferentes niveles de comisión, disfrutarás del nivel más alto de comisiones, es decir, la tasa de comisión más favorable.

Por ejemplo, si el volumen de trading spot de los últimos 30 días de un usuario es de 10,000,000 USD (lo que corresponde al nivel VIP 2), el volumen total de trading de futuros perpetuos y a vencimiento en los últimos 30 días es de 200,000,000 USD (lo que corresponde al nivel VIP 3), el volumen de trading de opciones de los últimos 30 días es de 5,000,000 USD (lo que corresponde al nivel VIP 1), el volumen de trading de spreads de los últimos 30 días es de 150,000,000 USD (lo que corresponde al nivel VIP 2), y la cantidad de activos curso es de 5,000,000 USD (lo que corresponde al nivel VIP 4), entonces el usuario disfrutará del nivel de comisión VIP 4, y todos los trades con distintos instrumentos pueden disfrutar de las ventajas de la comisión VIP 4.

6. ¿Cómo se calcula la comisión de trading?

Instrumentos | Fórmulas de cálculo de la comisión de trading |

Spot/Margen | Comisión de trading de spot/margen = Tasa de comisión × Cantidad de criptos compradas al ejecutar la orden. Regla de cobro de cripto: Comisión = Tasa de comisión × Cantidad de criptos compradas al ejecutar la orden; Tomemos spot de BTC/USDT como ejemplo, suponiendo que el precio actual de BTC es de 20,000 USDT; Trader A (comisión del creador: 0.08 %; comisión del tomador: 0.1 %) compró 1 BTC a precio de mercado, y se convirtió en tomador de este trade, por lo que la comisión de trading = 0.1 % × 1 = 0.001 BTC, y A recibirá 0.999 BTC una vez deducida la comisión; El trader A vendió 1 BTC al precio límite y recibió 20,000 USDT. El trader A se convirtió en creador de este trade, por lo que la comisión de trading = 0.08 % × 20,000 = 16 USDT, y A recibirá 19,984 USDT una vez deducida la comisión. Regla de reembolso de la comisión de trading: Comisión = Tasa de comisión × Cantidad de criptos vendidas al ejecutar la orden; Tomemos spot de BTC/USDT como ejemplo, suponiendo que el precio actual de BTC es de 20,000 USDT; Trader A (comisión del creador: -0.002 %; comisión del tomador: 0.025 %) vendió 1 BTC al precio límite, y se convirtió en creador de este trade, por lo que la comisión de trading reembolsada a A = 0.002 % × 1 = 0.00002 BTC; El trader A compró 1 BTC con una orden límite y recibió 20,000 USDT. El trader A se convirtió en creador de este trade, por lo que la comisión de trading reembolsada a A = 0.002 % × 1 × 20,000 = 0.4 USDT; |

Futuros | Comisión de trading de futuros perpetuos y a vencimiento con margen con USDT y con margen con USDC = Tasa de comisión × (Número de contratos × Multiplicador × Tamaño del contrato × Precio fill). Regla de cobro: La comisión de trading de los futuros perpetuos con margen con USDT se liquida en USDT y se cobra cuando se ejecuta la orden; Tomemos como ejemplo los futuros perpetuos de BTCUSDT (el tamaño del contrato es de 0.01 BTC, el multiplicador es 1), suponiendo que el precio actual del BTC es de 20,000 USDT; Trader A (comisión del creador: 0.02 %; comisión del tomador: 0.05 %) compró/vendió 100 contratos (1 BTC) a precio de mercado con un apalancamiento de 10x, y utilizó 2,000 USDT (0.1 BTC) como margen. El trader A se convirtió en tomador de este trade, por lo que la comisión de trading = 0.05 % × (100 × 1 × 0.01 × 20,000) = 10 USDT; El trader A compró/vendió 100 contratos (1 BTC) al precio límite con un apalancamiento de 10x, y utilizó 2,000 USDT (0.1 BTC) como margen. El trader A se convirtió en creador de este trade, por lo que la comisión de trading = 0.02 % × (100 × 1 × 0.01 × 20,000) = 4 USDT. Comisión de trading de futuros perpetuos y a vencimiento con margen con cripto = Tasa de comisión × (Número de contratos × Multiplicador × Valor nominal por contrato / Precio fill). Regla de cobro: La comisión de trading de los futuros perpetuos y a vencimiento con margen con cripto se liquida en la cripto de trading y se cobra cuando se ejecuta la orden; Tomemos como ejemplo los futuros perpetuos de BTCUSD (el tamaño del contrato es de 100 USD, el multiplicador es 1), suponiendo que el precio de mercado de BTC es de 20,000 USD. Trader A (comisión del creador: 0.02 %; comisión del tomador: 0.05 %) compró/vendió 100 contratos (10,000 USD) a precio de mercado con un apalancamiento de 10x, y utilizó 0.05 BTC (1,000 USD) como margen. Si el Trader A es el tomador de este trade, la comisión de trading = 0.05 % × (100 × 1 × 100 / 20,000) = 0.00025 BTC; El trader A compró/vendió 100 contratos (10,000 USD) al precio límite con un apalancamiento de 10x, y utiliza 0.05 BTC (1,000 USD) como margen. Si el Trader A es el creador de este trade, la comisión de trading = 0.02 % × (100 × 1 × 100 / 20,000) = 0.0001 BTC. Comisión de liquidación forzada: Se calcula de acuerdo con la comisión del tomador en el nivel actual del usuario. Comisión de liquidación al vencimiento: Es del 0,01 % para todos los usuarios, independientemente del nivel. |

Opciones | Comisión de trading de opciones = Mínimo (Tasa de comisión × Multiplicador × Tamaño del contrato × Número de contratos, 12.5 % × Prima de opciones × Multiplicador × Tamaño del contrato × Número de contratos) Tomemos como ejemplo las opciones de BTCUSD (el multiplicador es 0.01, el tamaño del contrato es 1 BTC, la prima de opciones es 0.05 BTC). Trader A (comisión del creador: 0.02 %; comisión del tomador: 0.03 %) compró 100 contratos de opciones call (el nocional es 1 BTC): Si el trader A es el tomador cuando la orden se ejecuta, entonces la comisión de trading = Mín. (0.03 % × 0.01 × 1 × 100, 12.5 % × 0.05 × 0.01 × 1 × 100) = 0.0003 BTC; Si el trader A es el creador cuando la orden se ejecuta, entonces la comisión de trading = Mín. (0,02 % × 0.01 × 1 × 100, 12.5 % × 0.05 × 0.01 × 1 × 100) = 0.0002 BTC. Comisión de ejercicio = Mín. (0.02 % × Multiplicador × Tamaño del contrato × Número de contratos, Tasa de comisión del tomador del usuario × Multiplicador × Tamaño del contrato × Número de contratos, 12.5 % × Valor de liquidación × Multiplicador × Tamaño del contrato × Número de contratos) Las opciones diarias no tienen comisión de ejercicio. Las opciones diarias son opciones que no vencen los viernes. Solo aplicable a las opciones ejercidas. No se aplica a las opciones no ejercidas. Comisión de liquidación forzosa = Mín (Tasa de comisión del tomador del usuario × Multiplicador × Tamaño del contrato × Número de contratos, 12.5 % × Precio de mercado × Multiplicador × Tamaño del contrato × Número de contratos) Los trades combinados de opciones en RFQ pueden disfrutar de hasta un 50 % de descuento en las comisiones Para cada activo subyacente, las comisiones de trading se cobran en los instrumentos del lado (compra o venta) con el nocional más alto. Solo los instrumentos que incurren en una comisión de trading se contabilizan en el volumen de trading a 30 días del instrumento correspondiente. |

Spreads | La tasa de comisión de cada instrumento es un 50 % inferior a la tasa de su libro de órdenes clásico, como se muestra en los niveles de comisión. |

Para obtener más información, visita: https://www.okx.com/fees

7. ¿Cuál es la diferencia entre las comisiones de apertura y cierre de futuros?

Las comisiones se cobran cuando se ejecuta una orden. No hay diferencia entre las comisiones de apertura o cierre de posiciones. Las comisiones se cobran en función del tamaño ejecutado de la orden, y corresponden a la comisión del tomador o del creador.

8. ¿Se cobran comisiones por liquidación?

Las comisiones de liquidación forzosa se cobran de acuerdo con la tasa de comisión del tomador de tu nivel actual.

9. ¿Por qué hay una discrepancia entre el beneficio cuando se mantiene una posición y después de cerrarla?

En la trading de futuros y opciones, el beneficio realizado tras cerrar una posición es el beneficio neto después de deducir las comisiones de trading y financiación. La diferencia entre el beneficio obtenido al mantener y al cerrar una posición se debe a estas comisiones de trading y financiación.

Por ejemplo, en un contrato de perpetuos de BTCUSDT, si el valor actual de la posición es de 20,000 USDT con un beneficio flotante de 15 USDT, la comisión de apertura es de -4 USDT, la de cierre es de -5 USDT y la de financiación es de -1 USDT. Tras cerrar la posición, las ganancias realizadas serán de 5 USDT (= 15 USDT - 4 USDT - 5 USDT - 1 USDT).

En el trading con margen, solo se registran las ganancias cerradas, sin las ganancias realizadas, por lo que las ganancias al mantener o cerrar la posición siguen siendo consistentes.

10. ¿Por qué son incoherentes las ganancias de las órdenes y posiciones anteriores?

Para el trading de futuros y opciones, las ganancias realizadas en posiciones anteriores incluyen las ganancias cerradas, las comisiones de financiación y las comisiones de trading, mientras que las ganancias de órdenes anteriores solo incluyen las ganancias cerradas. Por ejemplo, después de cerrar la siguiente posición:

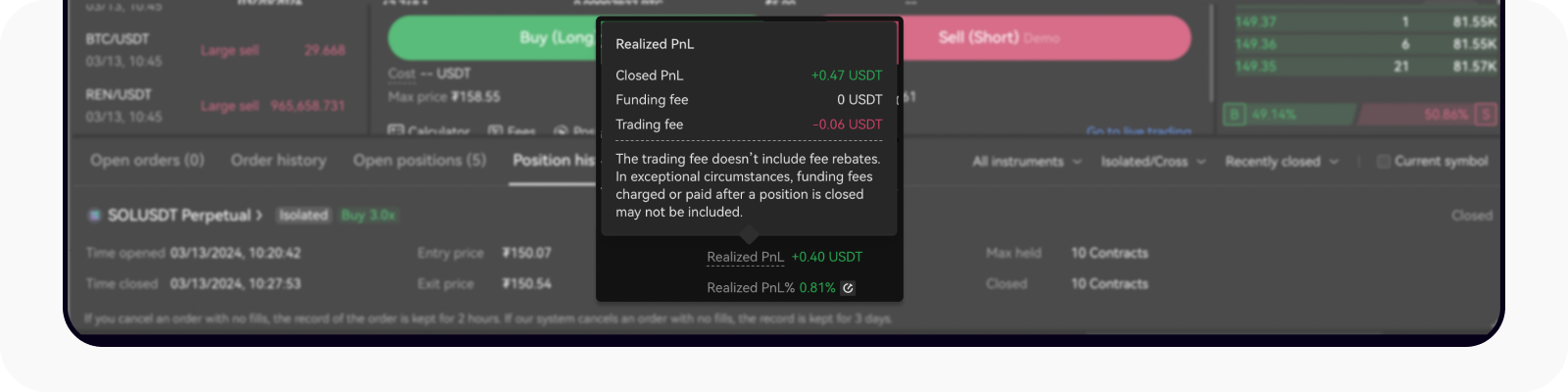

De la lista de órdenes anteriores, las comisiones de apertura y cierre son ambas de -0.03 USDT, y las ganancias cerradas es de +0.46 USDT.

Buscar las comisiones de trading de tu historial de órdenes

De la lista de posiciones anteriores, las ganancias realizadas para esta posición incluyen unas ganancias cerradas de +0.46 USDT. La comisión de financiación es 0, y la comisión de trading es -0.06 USDT (= comisión de trading abierta + comisión de trading cerrada), por lo que las ganancias totales realizadas son de +0.40 USDT (= ganancias cerradas + comisión de financiación + comisión de trading).

Buscar los detalles de G&P realizadas colocando el mouse sobre el % de G&P

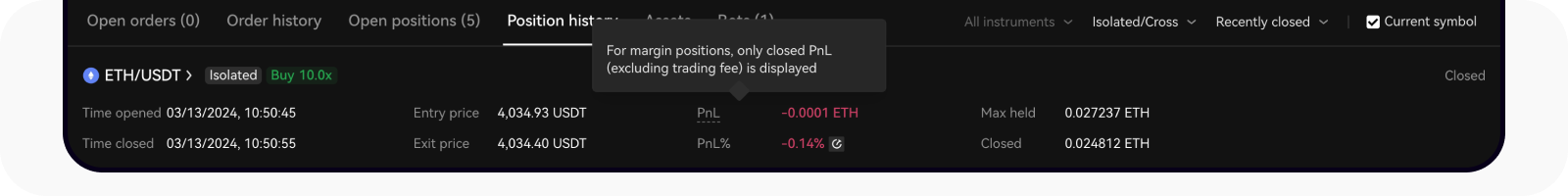

En el trading con margen, solo se registra las G&P cerradas, sin ganancias realizadas, por lo que las ganancias en órdenes y posiciones anteriores son coherentes.

Encontrar la explicación de G&P para el trading con margen pasando el ratón por encima del campo G&P en el historial de posiciones