欧易策略交易概况

什么是策略交易?

策略交易是以先进的数学模型替代人为的主观判断,基于计算机与网络技术从庞大的历史数据中海选能带来超额收益的多种“大概率”事件以制定策略,极大地减少投资者情绪波动的影响,避免在市场极度狂热或悲观的情况下作出非理性的投资决策。

策略交易可以帮助您利用程序化交易智能完成下单,为您节省了盯盘时间,并实时把握住市场机会,不错过建仓、涨跌点以及卖出与买入的机会。适合大部分追求稳健收益的投资者。

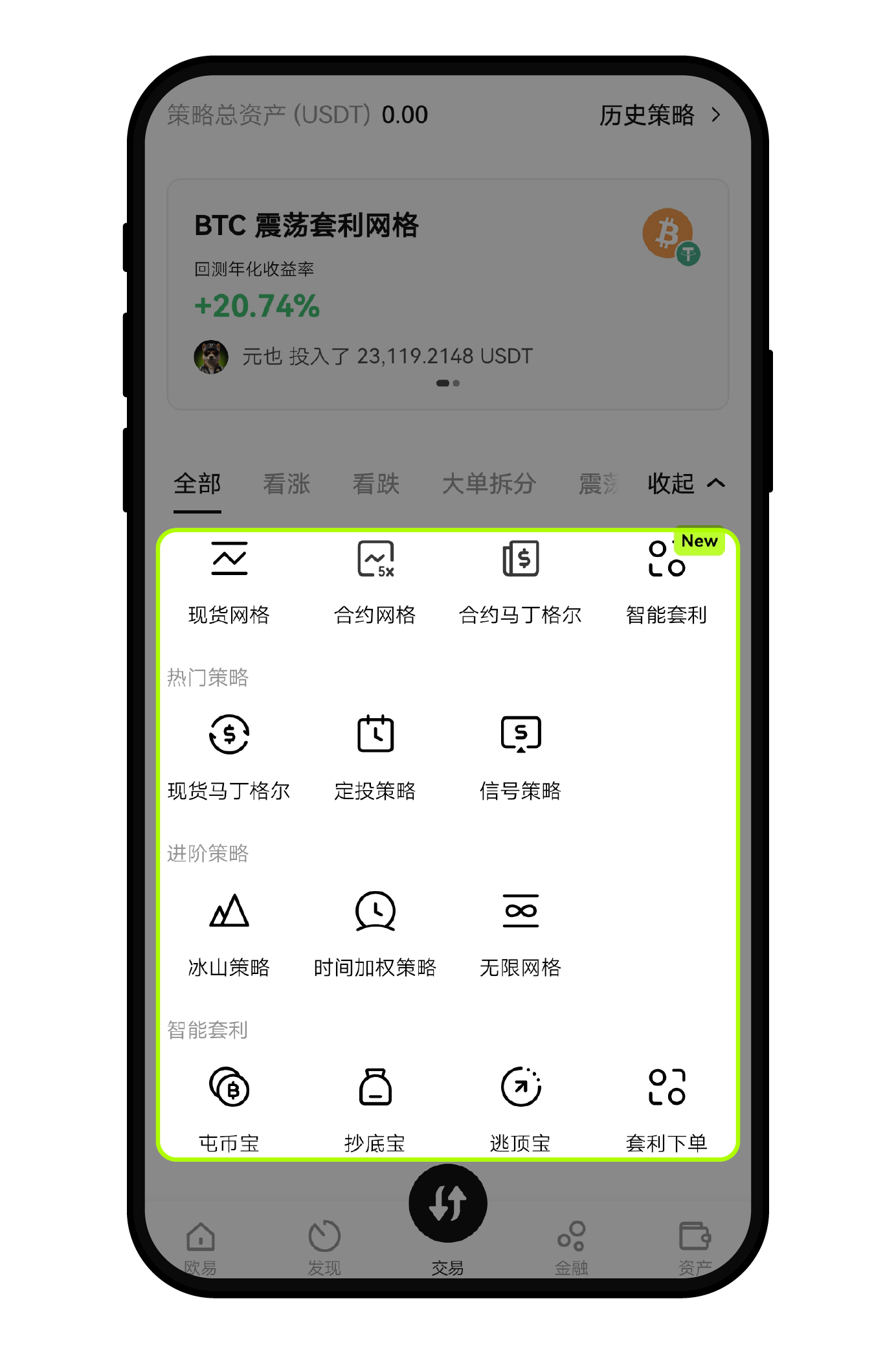

欧易有哪些策略交易?

1、现货网格

2、合约网格

3、合约马丁格尔

4、智能套利

5、现货马丁格尔

6、定投策略

7、信号策略

8、冰山策略

9、时间加权策略

10、无限网格

11、屯币宝

12、套利下单

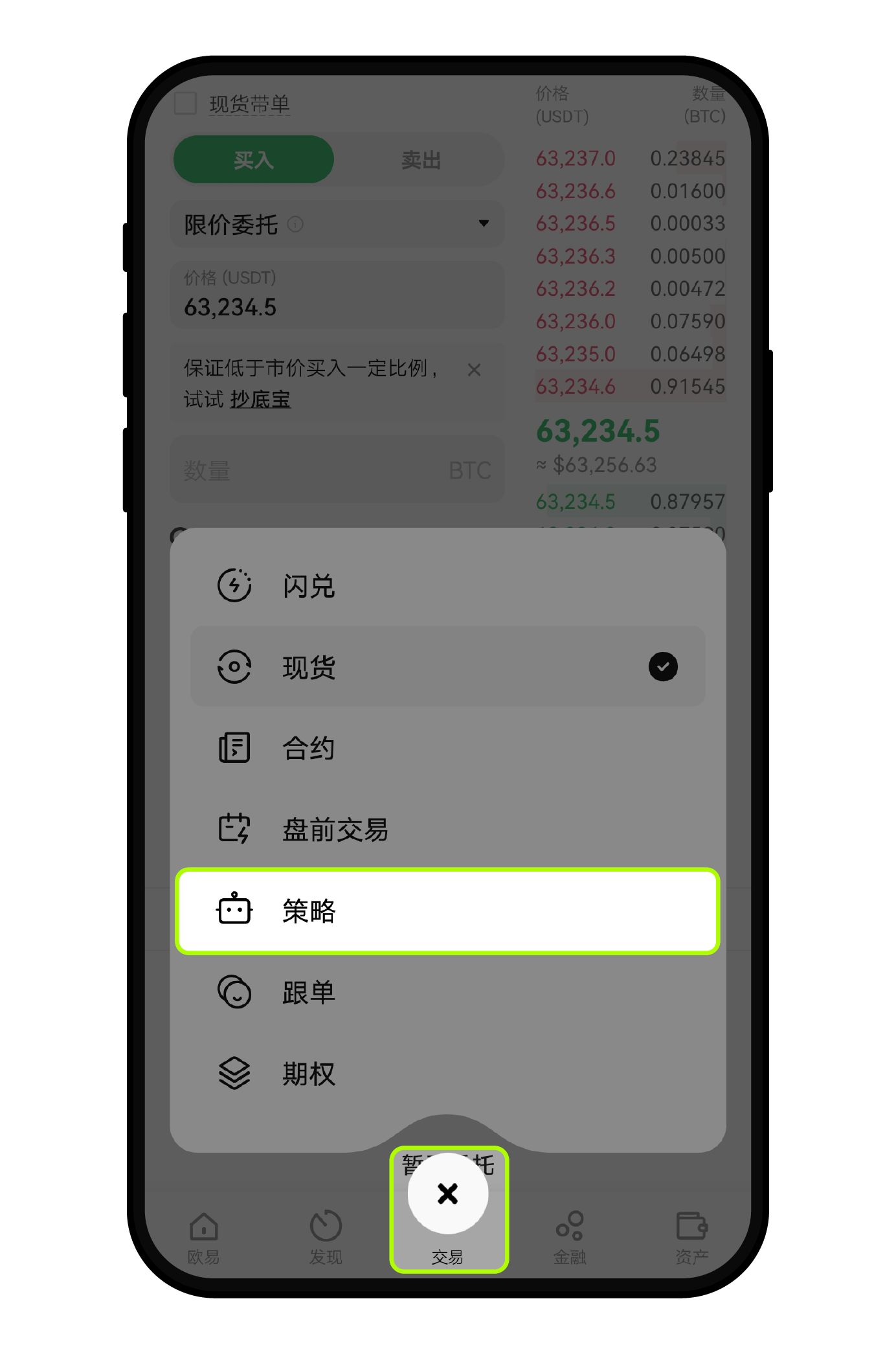

如何使用策略交易?

打开欧易 App,点击交易,选择【策略】,在策略交易页面,展开全部的策略,选择您想要交易的策略即可。

您可可以根据 看涨、看跌、大单拆分、震荡等主题,快速选择您需要使用的策略。

什么是现货网格?

现货网格策略是一种在特定的价格区间中执行低买高卖的自动化策略,用户只需要设定区间最高价和最低价,确定好要细分的网格数,即可开始运行策略。策略会计算每个小网格低买高卖的价格,自动挂单,随着市场波动,不断地低吸高抛赚取波动带来的收益。

现货网格的核心是"高抛低吸震荡套利",所以这种策略非常适合震荡行情以及震荡上涨行情,若市场出现下跌行情则会给您带来相应的亏损风险。

什么是合约网格?

合约网格策略是一种在特定的价格区间中低买高卖来交易合约的自动化策略,用户只需要设定区间最高价和最低价,确定好要细分的网格数,即可开始运行策略。策略会计算每个小网格低买高卖的价格,自动挂单,随着市场波动,不断地低买高卖或者高卖低买来赚取波动带来的收益。

合约网格目前支持所有币种的USDT合约。

合约网格的核心是"震荡套利",所以在判断接下来将会有较长时间的震荡行情时,适合使用合约网格。同时,合约网格还可以带有一定的多空倾向,即:做多网格只会开多和平多,适合于震荡向上的行情,做空网格只会开空和平空,适合于震荡向下的行情。中性网格是在策略开启时的市场价格的上方开空/平空,下方开多/平多。用户可以根据对具体行情的判断选择使用合适属性的网格。

什么是合约马丁格尔?

马丁格尔策略常用于外汇和合约交易等场景。合约 DCA 是一种使用马丁格尔策略的合约交易策略,允许交易者根据这些原则自动化交易。

马丁格尔是一种基于每次亏损后加倍交易规模的策略。每次亏损后加倍的仓位规模可以让下一次盈利交易的收益超过所有前期交易的亏损总额,并获得额外盈利。

简单来说,如果您亏损了一笔交易,您就加倍下一笔交易以弥补亏损,并希望获得盈利。马丁格尔策略通过从反弹周期 (做多方向) 或回调周期 (做空方向) 中获取波动利润,旨在减少整体买入的损失,从而实现潜在的长期增长。

合约马丁格尔交易策略适合波动(显著但短暂的走势)市场,也可在存在短期反弹或回调的横盘(无趋势)市场中使用。基于交易周期的概念,合约马丁格尔可以在多个交易周期中获得收益。

什么是智能套利?

智能套利策略是一种旨在通过对冲市场价格波动来获取稳定收益的方法。它的核心原理是利用Delta中性策略,通过在现货市场和合约市场持有方向相反且大小相同的仓位,对冲价格变化的风险。具体来说,智能套利策略会在现货市场买入(做多)某种资产,同时在合约市场卖出(做空)同样数量的该资产。这样,无论市场价格如何波动,这两个仓位的损益可以相互抵消,从而减少价格波动带来的风险。用户主要通过持仓期间收取的资金费用(例如正资金费率下的收益)来实现利润。

智能套利策略特别适用于那些在长期内具有正资金费率的主流币种。这是因为在资金费率的设计机制下,许多主流币种通常会保持正资金费率,这意味着投资者可以通过持有这些币种的仓位,长期获得资金费用收益。

什么是现货马丁格尔?

DCA,全称Dollar Cost Averaging(美元平均成本),它在国内更常用的一种叫法,是马丁格尔策略,比较常用于传统金融中的外汇市场。

马丁格尔策略的基本原理是,在一个可以买涨买跌的双边市场,总体上只押注一边,如果做反了,就不断反向加码。直到市场回调,即可赚取从低位买入到高位卖出的利润。目前,马丁格尔策略凭借一系列优势,已逐渐被各类投资者广泛运用,但鉴于市场的风险性,该策略无法承诺保本,投资者需控制风险。

什么是定投策略?

定投策略是以固定的时间周期,投入固定的金额买入选定币种组合的策略。在市场波动较为剧烈时,运用适当的定投策略,以同样的投资额度可以在低点购入更多的筹码,帮助用户获得更加可观的收益。

定投策略比较适用于一定金额,在一段周期内,进行抄底的策略。可以自由选择要组合的币种一起定投买入,定投实际触发时,按照比例买入对应的币种(最多可选20个币种同时定投)。

什么是信号策略?

信号策略,可以让TradingView用户和信号供应商使用自己的TradingView信号发布并设置一个信号策略,是一种基于市场数据和技术指标的交易策略,通过利用预先确定的信号或指示,指导交易者在金融市场中做出交易决策。这些信号可以是技术指标的特定组合、价格走势的转折点或其他市场分析工具生成的信号。

信号策略的核心理念是基于市场的历史数据和模式来预测未来的价格动向。交易者通过观察和分析市场信号,寻找可能的买入或卖出机会,以进行交易。这种交易策略旨在帮助交易者规避情绪驱动的决策和随机性交易,提供更为客观和系统化的方法。

什么是冰山策略?

冰山是一种大额订单拆分后分批挂单的策略。 用户在进行大额交易时,为避免对市场造成过大冲击,冰山策略会将大单委托自动拆为多笔限价单委托。这个策略会根据当前的最新买一/卖一价和用户设置的挂单偏好来决定挂单位置,然后自动进行小单委托来挂单交易,在有订单全部成交或档位变动时,自动重新进行委托。

什么是时间加权策略?

时间加权是一种大额订单拆分后分时吃单的策略。

用户在进行大额交易时,为避免对市场造成过大冲击,需要将大单委托自动拆为多笔委托。这个策略会按照用户设置的间隔时间来触发委托,委托时根据当前的最新买一/卖一价和用户设置的价格距离来计算委托价格,然后委托小单来吃单交易。(如果吃单没有完全成交则直接撤单,即IOC订单逻辑)

什么是无限网格?

无限网格的基本设计思路是,通过持续高抛低吸来帮助用户获利,并且在上涨行情中确保用户握有与初始值等值的计价货币资产。简单来说就是,使用无限网格策略,用户无论卖多少次,还是拥有与上一个仓位等值的资产,而随着行情上涨卖出部分的资产是用户的浮动收益。

由于无限网格策略的上限为一个现价很多倍的值,很难被突破。因此无限网格适用于震荡慢牛,整体不断向上的行情。

什么是屯币宝?

屯币宝策略是一种在用户选定的币种组合中做智能动态调仓的自动化策略。动态调仓会帮助用户的屯币组合中各币种的比例保持恒定,用户可以选择两种调仓模式来触发调仓,分别是按照固定的时间周期和按照币种市值的变化比例。

该策略的优势在于可以利用不同币种之间的汇率波动来赚币和屯币。

什么是套利下单?

套利一般是指利用对冲或互换的方式,以极低的风险来赚取不同市场之间的利差。常见的套利交易手段有资金费率套利、期现套利、期期套利等方式。

资金费率套利:在现货和永续合约中同时进行两笔方向相反、数量相等、盈亏相抵的交易,目标是赚取永续合约交易中的资金费率收益。

期现套利:当同币种的交割合约和现货存在较大价差时,通过买入低价方、卖出高价方,当两者的价差缩小时进行平仓,即可收获价差缩小部分利润。

期期套利:买卖同币种不同交割日期的合约,利用其价差变动进行的套利。但是期期的价差不一定回归0,所以风险比期现套利稍大。

套利用户在套利交易中需要实时观察两个市场,并同时下单,并且需要两个订单尽可能同时成交,避免滑点。所以欧易提供该策略工具辅助用户在套利时提高效率和成交准确度。