Portfolio margin mode: cross-margin trading (Risk Unit Merge)

Notice:

To provide better trading services, OKX will update margin calculation rules for portfolio margin mode. This rule change will gradually affect users using portfolio margin mode starting from December 30, 2024, 08:00 (UTC). The new rules will be fully applied to all users by January 21, 2025, 08:00 (UTC).

To provide you with a preview and better understanding, these new product changes will be available to all users by December 17, 2024, 08:00 (UTC) .

Risk notice: These changes will result in your margin being adjusted. Please take precautionary measures against potential liquidation risk in your account. You can find out more about our improved PM mode below:

Portfolio margin mode allows you to trade spot, margin, perpetual futures, expiry futures, and options within one account and uses a risk-based model that determines margin requirements.

Portfolio margin mode considers positions in spot, margin, perpetual futures, expiry futures, and options combined. This model helps reduce the margin requirements of a portfolio and allows for effective margin coverage and efficient use of capital.

Similar to multi-currency margin mode, your equity in different cryptocurrencies is calculated into a USD-equivalent amount and used as the margin for order placement and holding positions.

How can I be qualified for portfolio margin mode?

To be qualified for portfolio margin mode, you must:

Maintain a minimum net equity of 10,000 USD.

Declare you understand the concept of portfolio margin mode.

How does risk-offsetting work in portfolio margin mode?

Risk unit merge: In the upgraded portfolio margin mode, risk units are consolidated. Perpetual futures, expiry futures, and options with the same underlying asset are merged into a single risk unit, as shown in the table below.

Before

Mode | ETH-USDT risk unit | ETH-USDC risk unit | ETH-USD risk unit |

|---|---|---|---|

Derivatives only | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options orders |

Spot-derivatives risk offset (USDT) | ETHUSDT perpetual and expiry futures, ETH spot, ETH/USDT and ETH/USDC spot orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options orders |

Spot-derivatives risk offset (USDC) | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures, ETH spot, ETH/USDT and ETH/USDC spot orders | ETHUSD perpetual and expiry futures orders |

Spot-derivatives risk offset (crypto) | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options, ETH spot, ETH/USDT and ETH/USDC spot orders |

After

Mode | ETH risk unit |

|---|---|

Derivatives | ETHUSDT perpetual and expiry futures orders ETHUSDC perpetual and expiry futures orders ETHUSD perpetual and expiry futures orders ETHUSD options orders ETH spot orders ETH/USDT spot orders ETH/USDC spot orders |

Automatic inclusion of spot assets: In the upgraded portfolio margin mode, spot assets are automatically included in your selected risk unit for margin calculation. If spot assets and derivatives within the selected risk unit are in a hedged position, the required margin will be reduced accordingly.

How is portfolio margin calculated?

The maintenance margin requirement (MMR) is determined by the risk unit. All instruments (perpetual futures, expiry futures, options, and spot) are grouped by the assets they’re based on to show the possible maximum loss in a portfolio under certain market conditions. The USD value of each MMR will then be summed up into a portfolio MMR, also in USD value.

The initial margin requirement (IMR) is then derived from MMR.

Spot in use

Spot in use, or how much spot is used under the risk unit, is determined by the delta of derivatives that belong to the same risk unit. Spot is only added when derivatives of the corresponding risk unit can be hedged with the spot.

For each risk unit:

If spot equity > 0 and derivatives delta < 0, Spot in use = Min (|Equity|, |Spot and derivatives delta|, |User-defined threshold|)

If spot equity < 0 and derivatives delta > 0, Spot in use (borrowing) = -Min (|Equity|, |Spot and derivatives delta|, |User-defined threshold|)

Otherwise, spot in use = 0

Portfolio margin components

Portfolio margin consists of derivatives margin and borrowing margin. Portfolio margin considers the sum of derivatives margin under each risk unit, then adds borrowing margin to obtain the margin at the portfolio level.

Derivatives MMR1 = Max (MMR of derivatives positions, focusing on positive-delta orders,

MMR of derivatives positions, focusing on negative-delta orders,

MMR of derivatives positions)

Derivatives MMR2 = Max (MMR of derivatives and spot positions, focusing on positive-delta orders,

MMR of derivatives and spot positions, focusing on negative-delta orders,

MMR of derivatives and spot positions)

Derivatives MMR = Min (Derivatives MMR1, Derivatives MMR2)

MMR = Derivatives MMR + Borrowing MMR

IMR = 1.3 × Derivatives MMR + Borrowed IMR

Where,

A = MMR of derivatives with the holding positions and positive delta orders = MMR required for all derivative positions + Spot hedged + All derivative orders with positive delta + All derivative orders in the Liquid Marketplace

B = MMR of derivatives with the holding positions and negative delta orders = MMR required for all derivatives positions + Spot hedged + All derivative orders with negative delta + All derivative orders in the Liquid Marketplace

C = MMR of derivatives with the holding positions = MMR required for all derivatives positions + Spot hedged + All derivative orders in the Liquid Marketplace

MMR of derivatives and spot with the holding positions and positive delta open orders = A + All spot order with positive delta + All spot orders in the Liquid Marketplace

Considering the negative delta derivatives MMR of spot orders = B + All open spot order with negative delta + All spot orders in the Liquid Marketplace

Considering the total derivatives MMR of crypto-to-crypto orders = C + All spot orders in the Liquid Marketplace

A. Derivatives MMR

The derivative margin calculations consider 6 types of risks (MR1-6) by stress-testing the portfolio under a specific set of market conditions for each risk unit, then applying the minimum charge (MR7). The minimum charge is designed to cover any liquidation fee, transaction cost, and slippage. Details of the corresponding market conditions are available in the Appendix.

MR1: spot shock (Applies to all derivatives, spot, and spot orders under spot-derivatives in risk offset mode)

MR2: theta decay risk (Applies to options only)

MR3: vega risk (Applies to options only)

MR4: basis risk (Applies to all derivatives, spot, and spot orders under spot-derivatives in risk offset mode)

MR5: interest rate risk (Applies to options only)

MR6: extreme move (Applies to all derivatives, spot, and spot orders under spot-derivatives in risk offset mode)

MR7: adjusted minimum charge (Applies to all derivatives)

MR9: stablecoin depegging risk (Applies to all derivatives, spot, and spot orders)

Derivatives MMR = Max {[Max (Spot shock, Theta decay risk, Extreme move) + Basis risk + Vega risk + Interest rate risk], Adjusted minimum charge + Stablecoin depegging risk}

B. MR8: Borrowing MMR/IMR

Borrowing margin means the margin is calculated based on the borrowing amount of each underlying asset per corresponding tier. Refer to margin tiers here.

Both auto-borrow mode and non-borrow mode are available. In auto-borrow mode, you can sell crypto that you don't hold or crypto that's currently in use through spot or derivatives when the total USD-equivalent equity at portfolio level is sufficient. Borrowings could include margin borrowing, options buyer borrowing, and floating loss caused by opening derivatives positions.

Maintenance margin requirement refers to position tier.

Note that MR8 also includes borrowings that might be required to cover derivatives MMR.

C. Margin level calculation

*The USD value of margin required:

The MMR/IMR of different cryptocurrencies under each risk unit are converted into an equivalent USD value by spot indices.

**The USD value of portfolio equity

Due to the differences in market liquidity of each crypto, the platform calculates the equivalent USD value of each crypto in the portfolio equity based on certain discount rates. For the latest rates, refer to the discount rates table.

***The margin ratio of the portfolio is then determined by the USD value of the portfolio equity divided by the USD value of the margin required.

How can I test the portfolio margin on an existing or simulated portfolio?

Position builder and the corresponding API are available for you to test the portfolio margin for existing positions (even if you are using other margin modes), as well as any simulated portfolio.

You can simulate new positions in Position builder. The IMR and MMR are as shown below. You can also include the existing positions with the simulated positions, so you can also simulate the impact on the IMR and MMR.

When you hover over MMR as shown, the system will show the breakdown of the MMR based on the market risks.

What happens during liquidation?

When the margin level is lower than a certain threshold (e.g. 300%), the system will send you a liquidation alert.

The liquidation in portfolio margin mode is triggered when the margin level drops to 100%. When options liquidity is low, liquidation may lead to the opening of new perpetual or expiry futures positions. However, this is only to reduce the overall risk profile of the portfolio.

The liquidation process is executed in the sequential steps below. If the account is still at risk after a step, the next step will be executed. The process is complete when the account resumes a safe status (margin level > 110%) or all the positions in the account are liquidated. Each step of the process can’t be undone once it’s complete.

Step 1: dynamic hedging process for stablecoin risk (DDH1)

Dynamic hedging, or delta dynamic hedging (DDH), uses delta hedging principles to mitigate stablecoin depegging risk in portfolio margin mode by adjusting positions of perpetual or expiry futures. DDH1 applies to scenarios where MR9 is the dominant risk among all market risks (e.g. in a stablecoin depegging situation).

Step 2: dynamic hedging process (DDH2)

DDH principles are used to reduce the overall risk in portfolio margin mode by adjusting the positions of perpetual and expiry futures. DDH applies options positions when spot shock risk (MR1) is largest among all risks (e.g. BTCUSD index drops 15%).

Step 3: basis hedge process

The basis hedge process reduces basis risk by liquidating expiry futures of different expiry dates at the same time when basis risk (MR4) is the largest among all risks. Basis risk means the risk of different futures prices of the same underlying asset with different expiry dates. In this scenario, spot is treated as if it has its own expiry date.

Step 4: general position reducing process

The general position reducing process prioritizes positions that can help reduce the account’s maintenance margin. The number of positions to reduce is determined by both default system configurations (the liquidity of each instrument) and tradable positions. For example, the system will liquidate positions tier by tier until the account is back to a safe level.

Appendix: margin calculations

Note that all the parameters listed below are subject to change based on the market.

MR1: spot shock

A spot shock scenario includes market simulations of increasing or decreasing the price of the underlying asset, or keeping it constant, while increasing or decreasing implied volatility, or keeping it constant. MR1 is the maximum loss in these 21 market simulations (7 price movement simulations × 3 implied volatility change simulations. Implied volatility change could be in volatility points or a percentage. MR1 takes the maximum loss.

Price move:

Underlying asset | Maximum price move |

BTC, ETH | +/– 0%, 5%, 10%, 15% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | +/– 0%, 7%, 14%, 20% |

Others | +/– 0, 8%, 16%, 25% |

Implied volatility change (options only), in points or in a percentage:

Time to expiry | Maximum implied volatility, change in points | Maximum implied volatility, change in percentage |

0 days | 30 (e.g. IV = 50%, after shock IV = 80% or 20%) | 50 (e.g. IV = 50%, after shock IV = 75% or 25%) |

30 days | 25 | 35 |

60 days | 20 | 25 |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, and XRP.

MR2: time decay risk (options only)

Time decay risk measures the 24-hour decay in portfolio value, assuming no change in underlying asset price moves and implied volatility.

MR3: vega term structure risk (options only)

Vega term structure risk arises from differences in options value for the same underlying asset with different expiry dates under the same implied volatility shock. It measures the risk of change in implied volatility across different expiry dates that isn’t captured in MR1.

MR4: basis risk

MR4 considers not only the basis risk but also time to more accurately reflect changes in risk across different time horizons.

Basis risk: This refers to the risk when the spot price of an asset and its perpetual or expiry futures price don’t move in sync. This divergence can lead to ineffective hedging. For example, if you hold BTC and sell BTC futures to hedge against a price drop, the difference between the spot and perpetual or expiry prices (the basis) may widen or narrow, resulting in unexpected gains or losses.

Basis = Futures price – Spot price = 51,000 – 50,000 = 1,000

Time as a factor in basis risk: Time to expiry is a key factor in basis risk. As a futures contract approaches its expiration, the futures price typically converges with the spot price, reducing the basis. However, before expiry, factors like market sentiment, interest rates, or liquidity can cause basis fluctuations and increase risk. The further away from expiry, the greater the basis volatility, which can destabilize the effectiveness of hedging.

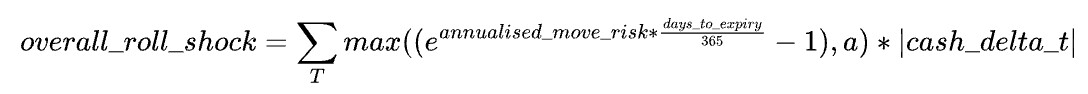

The formula is as follows for each crypto:

Parameters explained

a (underlying minimum basis charge)

Fallback logic: This is a safeguard mechanism to protect the exchange, where we account for an extreme minimum fluctuation value.

Different values for each crypto: The value of a varies for each crypto, as shown in the table below:

Underlying asset | a |

BTC, ETH | 0.20% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | 0.80% |

Others | 2% |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, and XRP.

2. Annualized move risk

This represents the estimated annualized volatility or movement of a derivative. It quantifies the potential change in value that the derivative might experience over a 1-year period as a percentage.

This metric is commonly used to project the risk or fluctuation in value of assets when calculating margin requirements or risk exposure, particularly over different time horizons.

Underlying asset | Annualized move risk |

BTC, ETH | 7.50% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | 22.50% |

Others | 45.00% |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, XRP.

3. Days to expiry

Instrument | Days to expiry |

Spot | 0 |

Perpetual futures | 0.33 |

Expiry futures and options | Time to expiry – Today’s date (expressed as a decimal) |

4. Cash delta t

This groups the cash delta that has the same expiry date, resulting in cash delta t. If the underlying asset has 4 different days to expiry, the overall roll shock percentage charge will be summed up and multiplied by the cash delta t.Each instrument’s cash delta calculations

USDT-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDT to USD price × Position size

USDC-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDC to USD price × Position size

Other crypto-based perpetual and expiry futures: Cash delta = [1 / (Mark price × (1 + 0.01%))] × Contract size × Multiplier × The crypto’s USD-equivalent price

Options: Cash delta = Cash delta contract × Contract size × Multiplier × Mark price

Spot: Cash delta = Spot hedging amount × The crypto’s USD-equivalent price + Spot order quantity × The crypto’s USD-equivalent price

For example, if you hold spot, perpetual futures, expiry futures, and options with 1 day to expiry, and expiry futures and options with 7 days to expiry, then you will have 4 groups of cash delta t:

Cash delta t (spot) = 5000

Cash delta t (perpetual futures) = -2000

Cash delta t (expiry futures or options with 1 day to expiry) = 3000

Cash delta t (expiry futures or options with 7 days to expiry) = 2000

MR5: interest rate risk (options only)

Interest rate risk measures the risk of change in yield curve by populating a principal component analysis (PCA) style rate movement table. Interest rate here refers to interest rate used in the option pricing model.

Basic factor loadings:PC1 explains the parallel shift in the yield curve.

PC2 explains the slope change of the yield curve.

Days | 1 | 7 | 14 | 30 | 90 | 180 | 360 | 720 |

PC1 | 3 | 2 | 1.75 | 1.5 | 1 | 0.9 | 0.8 | 0.7 |

PC2 | 4 | 3 | 2 | 1 | 0 | -0.5 | -0.75 | -0.9 |

The interest rate risk is comprised of 8 market simulations by moving the yield curve proportionally to PC1 and PC2. For instance, scenarios include moving the existing yield curve by +/– 5% × PC1, +/– 2.5% × PC1, +/– 3% × PC2, +/– 2% × PC1. MR5 is the maximum loss that occurs in these 8 market simulations.

MR6: extreme move

Extreme move is similar to spot shock but the maximum underlying price move doubles the largest spot shock in MR1 and implied volatility remains unchanged. Extreme move is designed to capture scenarios where options might be exercised when the underlying asset experiences extreme move. MR6 takes half of the maximum loss under 2 scenarios. For example, the MR6 of the BTC-USD risk unit is half of the maximum loss when BTC-USD moves + 30% or – 30%, whichever is larger. If the risk unit only contains perpetual and expiry futures, MR6 equals MR1.

Underlying asset | Maximum price move |

BTC, ETH | +/– 30% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | +/– 40% |

Others | +/– 50% |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, XRP.

MR7: minimum charge

Step 1: raw minimum charge

Raw minimum charge is designed to cover any slippage, and trading fee.

Raw minimum charge per contract = Slippage per contract + Trading fee per contract

Perpetual/expiry futures minimum charge

Trading fee per contract = Taker fee × Contract value × Contract multiplier

Slippage per contract depends on tier 1 futures MMR in unified account.

Options minimum charge

Trading fee per contract = Min (Taker fee × Contract value × Contract multiplier, 12.5% × Mark price × Contract value × Contract multiplier)

For long positions: slippage per contract = Min {Max (min per delta, min per delta abs(delta)), Mark price} Contract multiplier

For short positions, slippage per contact = Max (min per delta, Min per delta × Abs(delta)) × Contract multiplierTake BTC as an example, Min charge per delta (min per delta) = 0.02

Step 2: adjusted minimum charge

The adjusted minimum charge is derived from a scaling factor function based on perpetual futures, expiry futures, and options short raw minimum charges under each risk unit. Scaling factor is designed to reflect the slippage of liquidating portfolios of different sizes.

Adjusted minimum charge MR7 = (Perpetual futures + Expiry futures + Options short raw minimum charge) × Scaling factor + Options long raw minimum charge

Tier configuration on BTC, ETHRefer to the latest adjustment to the scaling factor logic.

Tier (i) | Range of the raw minimum charge (in USD) | Multiplier |

1 | [0 - 7,000] | 1 |

2 | (7,000 - 16,000] | 2 |

3 | (16,000 - 29,000] | 3 |

4 | (29,000 - 43,000] | 4 |

5 | (43,000 - 69,000] | 5 |

6 | (69,000 - 95,000] | 6 |

7 | (95,000 - 121,000] | 7 |

8 | (121,000 - 147,000] | 8 |

9 | (147,000 - +∞) | 9 |

Tier configuration on other underlying assets

Tier (i) | Range of the raw minimum charge (in USD) | Multiplier |

1 | [0 - 3,000] | 1 |

2 | (3,000 - 8,000] | 2 |

3 | (8,000 - 14,000] | 3 |

4 | (14,000 - 19,000] | 4 |

5 | (19,000 - 27,000] | 5 |

6 | (27,000 - 36,000] | 6 |

7 | (36,000 - 45,000] | 7 |

8 | (45,000 - 54,000] | 8 |

9 | (54,000 - 63,000] | 9 |

10 | (63,000 - 72,000] | 10 |

11 | (72,000 - 81,000] | 11 |

12 | (81,000 - 90,000] | 12 |

13 | (90,000 - +∞) | 13 |

MR8: borrowing margin

In auto-borrow mode, you could sell crypto unavailable in your account through spot or derivatives when the total USD-equivalent equity is sufficient. A potential borrowing amount will be generated in your account, and some of the adjusted equity will be used as the margin requirement. When the crypto’s equity is less than 0 due to overselling or the derivative loss is settled in the crypto, the real liability and the corresponding interest of this crypto will be generated automatically.

When not in auto-borrow mode, you can only use the available balance or available equity of the crypto to place orders for spot, perpetual futures, expiry futures, and options. There may be a scenario where the equity of a certain crypto can’t pay off the loss settled in this crypto. In this situation, if the account has surplus equity in other cryptocurrencies and the overall USD value of the account is sufficient, the positions in the account won’t be at risk of liquidation, and the real liability will be passively generated. If the liability is within the interest-free range of the crypto, no interest will be charged. When the liability of the crypto exceeds the interest-free limit, a forced repayment called the time-weighted average price (TWAP) will be triggered. The system will automatically use available equity of other crypto in the account to cover the liability and make it stay within the interest-free limit. TWAP will be executed by selling the positive assets into USDT and repaying the liability with USDT.

Potential borrowing = Actual borrowing + Virtual borrowing

Actual borrowing refers to margin borrowing, options buyer borrowing, and floating loss caused by opening positions. Actual borrowing occupies your margin tier limit, main account limit, and the platform’s total lending limit.Virtual borrowing refers to borrowing used for opening positions. Virtual borrowing occupies your margin tier limit, but doesn’t occupy your main account limit or the platform’s total lending limit.

The floating loss from opening positions in actual borrowing enjoys the interest-free limit. While the borrowing from margin borrowing, options buyer borrowing, and the realized profit and loss (RPL) of the contract doesn’t enjoy the interest-free limit.

For details on the interest-fee limit rules, refer to interest calculation.

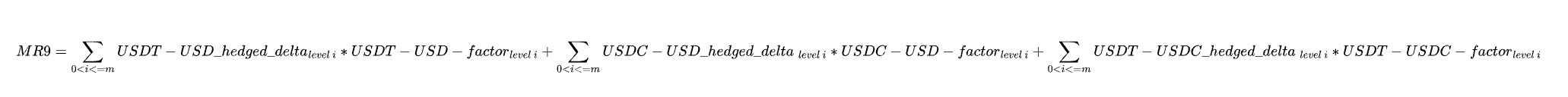

MR9: stablecoin depegging risk

In the upgraded portfolio margin mode, the risk units of different underlying assets are merged. For example, BTC-USDT, BTC-USDC, and BTC-USD derivatives are merged into a single risk unit. This enables cross-margining between derivatives and spot positions across different underlying assets. However, when a stablecoin depegs, this cross-margining could expose users to risk, which MR9 measures.

MR9 calculation logic:

Step 1: Calculate cash delta by underlying assets (USDT, USDC, USD), displayed in USD unit.

USDT-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDT to USD price × Position size

USDC-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDC to USD price × Position size

Other crypto-based perpetual and expiry futures: Cash delta = [1 / (Mark price × (1 + 0.01%))] × Contract size × Multiplier × The crypto’s USD-equivalent price

Options: Cash delta = Cash delta contract × Contract size × Multiplier × Mark price

Spot: Cash delta = Spot hedging amount × Crypto to USD price + Spot order amount × The crypto’s USD-equivalent price

Step 2: Calculate the total cross-currency hedging volume by group.

Using a fixed order, calculate hedging volumes as follows: USDT-USD, USDT-USDC, then USDC-USD. For example, to determine the USDT-USD hedging volume:

If USDT cash delta and USD cash delta are both positive or negative (or at least one equals to zero), then the USDT-USD hedging volume = 0.

Otherwise, USDT-USD hedging volume = Min {Abs (USDT cash delta), Abs (USD cash delta)}

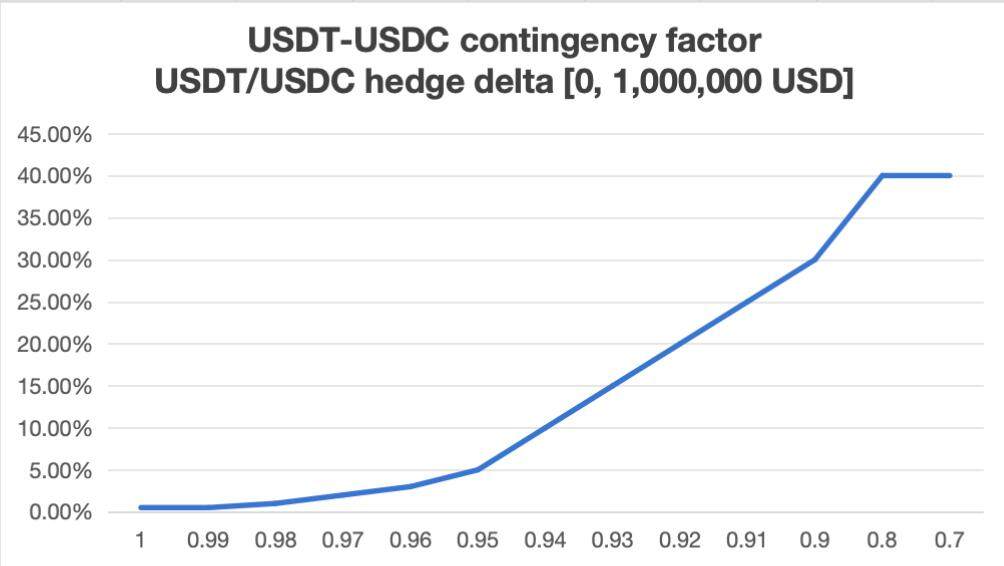

Step 3: Calculate MR9 based on tiers.

Calculate using the 3 cross-currency hedging volumes calculated in step 2: [USDT-USD hedging volume], [USDT-USDC hedging volume], [USDC-USD hedging volume], and index prices for [USDT/USD], [USDC/USD], and [USDT/USDC]. Then, refer to the different tiers in the tables below to determine the MR9 factor.

The factor value will be linearly interpolated if the current price is in between columns of the different hedge delta.

Example: If the USDT-USD hedging volume is 10,000,000 USD, and USDT/USD = 0.985 (falling under tier 3), then MR9 is calculated as follows:

Tier 1 factor value:

0.5% + (0.99 – 0.985) / 1% × (1% – 0.5%) = 0.75%

Tier 2 factor value:

1.5% + (0.99 – 0.985)/ 1% × (2% – 1.5%) = 1.75%

Tier 3 factor value:

2% + (0.99 – 0.985) / 1% × (3% – 2%) = 2.5%

MR9 = 1,000,000 (max amount considered in tier 1) × 0.75% + 4,000,000 (max amount considered in tier 2) × 1.75% + 5,000,000 × 2.5% = 202,500 USDNote: For each USDT-USD index price value, there’s a corresponding value associated with it (as shown in the example tier 1 graph above). A fixed factor won’t be applied.For any value above 0.99, only the min factor of all values will be considered. For example, for tier 1, the min charge won’t be less than 0.5%, tier 2 won’t be less than 1%, and so on.

Note: For each USDT-USD index price value, there’s a corresponding value associated with it, as shown in the example tier 1 graph above. A fixed factor won’t be applied.

For any value above 0.99, only the min factor of all values will be considered. For example, for tier 1, the min charge won’t be less than 0.5%, tier 2 won’t be less than 1%, and so on.

USDT-USD tiers

USDT-USD index = USDT dollar price Cross-currency hedging delta volume | Above 0.99 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000+ USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |

USDC-USD tiers

USDC-USD index = USDC dollar price Cross-currency hedging delta volume | Above 0.99 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000+ USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |

USDT-USDC tiers

USDT-USDC index = USDT dollar price/USDC dollar price Cross-currency hedging delta volume | Above 0.99 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000+ USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |