V. Tryb quick margin

Base or quote assets that are transferred into the isolated position will be displayed as collateral but not as an open position.

A position will be opened once the trader incurs liabilities from manual or auto borrowing.

Quick margin trading position

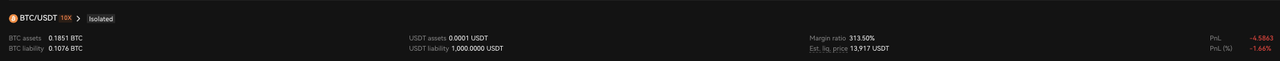

Quick margin trading positions will be displayed as follows:

Term | Definition |

Base assets | Amount of base crypto in position. Includes amount transferred in, borrowed, and bought. |

Quote assets | Amount of quote crypto in position. Includes amount transferred in, borrowed, and bought |

Base liability | Amount of base crypto borrowed and any accrued interest that hasn’t been repaid |

Quote liability | Amount of quote crypto borrowed and any accrued interest that hasn’t been repaid |

Margin level | Margin level = Net assets in isolated position / (Maintenance margin + Fees) Net assets in isolated position = (Quote assets - Quote liability) + (Base assets - Base liability) × Mark price Maintenance margin = (Quote liability × MMR) + (Base liability × Mark price × Maintenance margin requirement) Note: Margin level will only be displayed for open positions, i.e. when the trader has outstanding liabilities |

Est. liq. price | Estimated liquidation price = [Quote liability × (1 + Maintenance margin requirement) × (1 + Taker fee) - Quote asset] / [Base asset - Base liability × (1 + Maintenance margin requirement) × (1 + Taker fee)] |

PnL | PnL = (Quote assets - Quote liability) + Mark price × (Base assets - Base liability) - Value of crypto transferred in + Value of crypto transferred out Remarks: PnL is calculated in the quote crypto unit |

PnL% | PnL% = PnL / (Value of crypto transferred in - Value of crypto transferred out) |

Borrowing rules

Under quick margin trading, users can borrow crypto manually or via auto borrow orders. The maximum amount that users can borrow is calculated using the collateral transferred into the isolated position and the position tiers for isolated margin positions. Users can borrow both quote and base crypto.

Order validation

Under quick margin trading, users can place orders via 3 modes: Manual, Auto borrow, and Auto repay

Mode | Description | Order validation |

Manual | Similar to placing an order in spot trading. Users can buy and sell crypto with the amount borrowed beforehand. | Order amount ≤ Base/Quote assets of the position - Amount in use for open orders |

Auto borrow | Borrowing will only happen once the order is filled and not when it’s placed. Likewise, interest will only start accruing after funds are borrowed. However, potential borrowing in open orders will take up part of the borrowing limit. | Order amount ≤ Base/Quote assets of the position - Amount in use for open orders + Available to borrow |

Auto repay | When the order is filled, the system will calculate and try to repay the liability with the amount bought. Residual amount will be added to the position asset. | Order amount ≤ Base/Quote assets of the position - Amount in use for open orders |

Maintenance margin requirement

The maintenance margin requirement is based on the higher tier between your base and quote borrowings.

Order cancellation assessment

Cancellation of orders will occur once the risk of a user’s position has exceeded a certain threshold but has yet to reach the point of liquidation. It helps the position drop below the risk threshold and avoids the liquidation threshold being reached right after certain orders are filled.Rules for order cancellation under quick margin trading:When net assets are less than the sum of the position’s maintenance margin and the initial margin for open auto borrow orders, the system will cancel all auto borrow orders for that position.

Partial liquidation and full liquidation

When the margin level of the position is less than or equal to 300%, our system will notify the trader of potential liquidation risks. 300% is the default level, but OKX reserves the right to adjust this according to market conditions.A liquidation will be triggered if the margin level of the position is less than or equal to 100%. The system will cancel all the orders in the position before partially or fully transferring the isolated margin position to the liquidation engine. If the position is at tier 2 and above, the system will progressively reduce the amount of outstanding borrowings on a tier-by-tier basis until the margin level is greater than 100%.Example:A trader has a BTC/USDT margin position, borrowing USDT to long BTC:Assuming the max borrow amount of the next lower tier is 1,000,000 USDT.If a trader holds a large position at tier 2 or above and the amount of USDT borrowed is greater than or equal to 1,000,000, for example, 1,100,000. When the margin level of the position is less than or equal to 100%, the liquidation system won’t liquidate the entire position in one go. Partial liquidation will be carried out and the system will calculate the position size that needs to be liquidated to lower the position tier by 1 level.Position size that needs to be liquidated = Amount currently borrowed - Max borrow amount of the next lower tier = 1,100,000 - 1,000,000 = 100,000.Scenarios where the position will be liquidated fully

When a trader’s position is at tier 1 and the margin level is less than or equal to 100%

When a trader’s position is at tier 2 or above, but the margin level calculated using the maintenance margin requirement of the lowest tier is less than or equal to 100%.