How do I apply for a Flexible Loan?

Getting Started

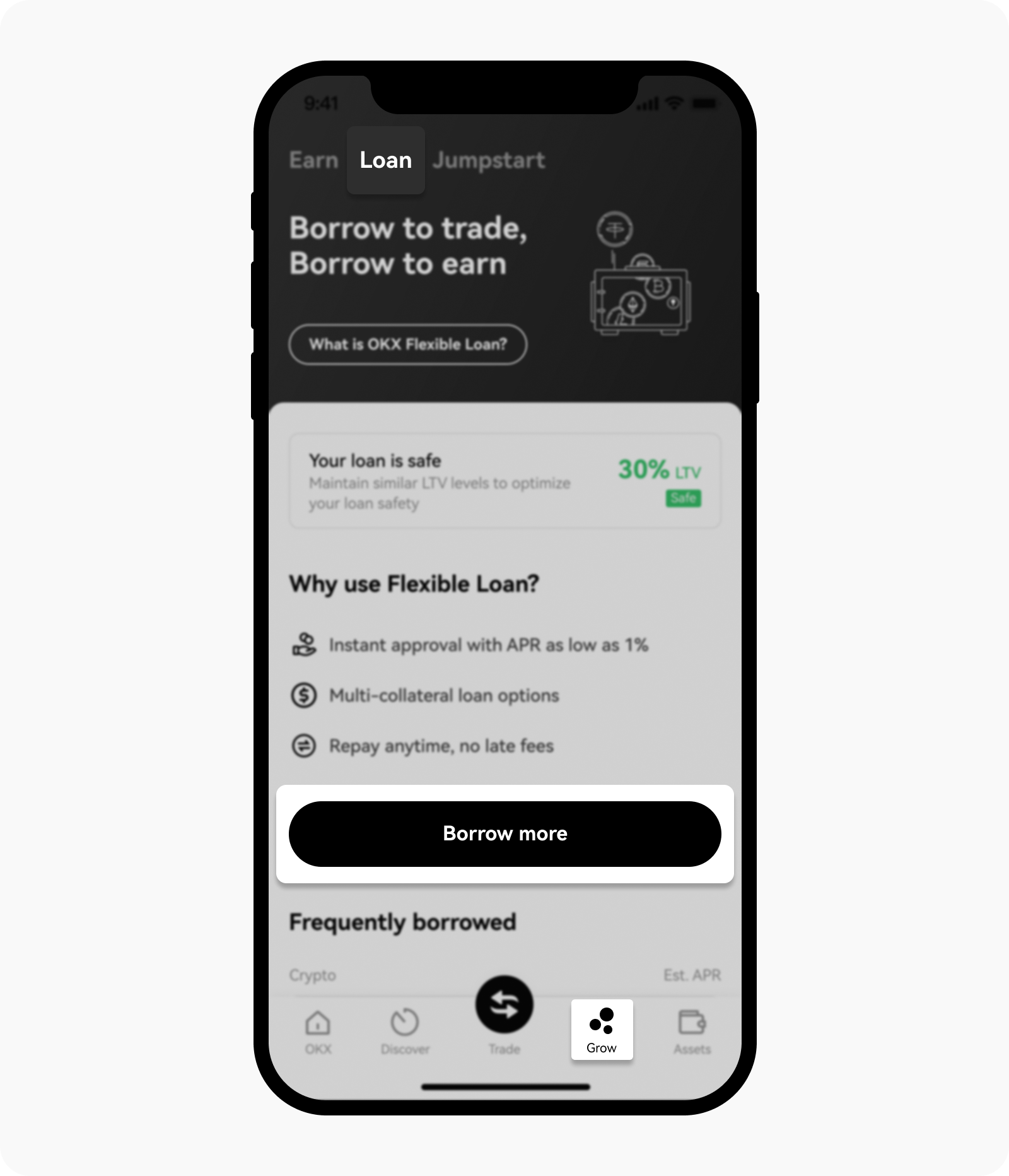

Go to the Loan page

Open your OKX app, go to Grow > Loan and select Borrow more

Opening Loan page

Log in to your account at okx.com and go to Grow > Loan

Select your preferred token and insert your preferred borrowed amount in the I want to borrow field (app) / Loan field (web)

Select your preferred single or multi-currencies as your collateral in the Collateral field

Read through the order summary and select the checkbox to agree with the user agreement

Select Complete (app) / Borrow Now (web) to complete the request

FAQ

1. Do I need to verify my account to use a flexible loan?

Yes, you're required to complete identity verification to apply for a flexible loan.

2. What is my borrowing limit?

Your borrowing limit depends on your trading leverage level and OKX trading position tier level (2.5x leverage), whichever is lower. Taking USDT as an example,

OKX uses 2.5x leverage and the corresponding loanable maximum USDT is 23,000,000 USDT;

If your account's trading tier is level 1 and the maximum borrowing limit is 3,500,000 USDT;

Hence, you can only borrow a maximum of 3,500,000 USDT.

3. Why is my liquidation LTV low?

It is because you have chosen a token that has a lower discount rate to apply for a flexible loan.

4. Can I apply for another loan after I've applied previously?

Yes, you can apply for another loan for any currency except for those you've applied as collateral. However, please note that if your current LTV is higher than your initial LTV when you're applying for a second loan, you're required to top up your pledge amount to complete the borrowing.

5. Why is my second borrowing amount lower than the value of the additional pledge amount?

If your current LTV is higher than the initial LTV when you're applying for the second loan, our system will prioritize the added pledge value as the original pledge rate, and calculate the remaining amount as the available borrowing amount.

6. Why is the APR different hourly?

Our APR is calculated hourly. You'll see the previous hour's APR when you're borrowing, while your borrowing APR will be calculated on the next hour after you've applied.

7. Why can't I select the same currency for my collateral as my borrowing in the flexible loan?

These currencies are included as collateral and the borrowed currency and the pledge currency are mutually exclusive, hence you can't select these currencies as your pledge token and borrowing token.

8. Why does the force repayment happen?

Force repayment occurs when our platform's borrowing limit for a specific crypto has been exceeded. In such cases, our system will automatically sell the token you've used as collateral to repay the loan in borrowed tokens.

For example, if our platform's borrowing limit for OKB is 1,000,000, but the total amount borrowed by loan users reaches 1,500,000 OKB, and you've used BTC as collateral to borrow OKB, we'll sell your BTC to buy more OKB and settle your loan.

9. What are the rules of force repayment?

We'll sell the token with a lower conversion rate first followed by the token with a higher conversion rate. If the token conversation rate is the same, we'll sell the token with a higher value.

10. How do collaterals and borrowing calculated?

We're calculating based on the spot mark price.

11. Why is my pledge amount not released even though I've repaid my loan?

It is because the discount rate of the remaining token is small. Hence, it is not able to transfer out. However, you're allowed to reduce collateral several times in the loan details.

12. Can BETH still get the benefits from ETH2.0 staking as collateral in Loan?

Yes, you will still receive ETH2.0 rewards if BETH is your collateral in Loan.