How do I automate grid trading strategies on futures grid trading bot?

Our futures trading bot is an automated trading strategy that designed to navigate cryptocurrency futures market volatility. By automatically buying low and selling high, users can make money from the difference in prices in rapidly moving markets.

The trading bot’s futures grid mode creates a grid of price levels at which to trade. You can either set these yourself or use our backtested AI strategy. When the price moves up, the bot executes orders based on your chosen strategy. If you've selected a long position, the bot will aim to buy and profit from further price increases. If you’ve chosen a short position, it will sell to profit from anticipated price drops. For a neutral stance, the bot will manage orders to take advantage of price fluctuations within a specified range, regardless of the direction. This flexibility ensures that the bot operates in alignment with your specific trading goals and market outlook.

To learn more about our other trading bots, visit here.

What's the futures grid trading bot, and what are its advantages?

Our futures grid trading bot is an automated futures contract trading strategy. The bot sets an order grid at predetermined price levels above and below the initial entry price. In its simplest terms, the bot sells futures contracts when the price is above entry and buys when below. By automatically buying low and selling higher, the traders may potentially benefit from price volatility without managing their positions actively.

The futures grid trading bot has three modes: long, short and neutral. With long selected, the bot will only open and close long positions. With short selected, it only opens and closes short positions. With neutral selected, the bot will open or close shorts above the market price and open or close longs below the market price.

A critical difference between the spot grid automated strategy and the futures trading bot is the ability to trade with leverage. In futures grid mode, you can amplify position size with leverage, enabling you to trade greater volume than otherwise possible.

Be warned, though. Leverage is an advanced tool that carries much greater risk than simple spot trading. This tool doesn't provide financial or investment advice and past performance isn't indicative of future results. If you choose to trade leveraged positions with the futures grid trading bot, make sure you fully understand the associated risks beforehand. You can learn more about leverage and margin requirements here.

How do I automate buys and sells with OKX’s futures trading bot?

The futures grid trading bot is currently available for both perpetual contracts and futures contracts. Not all products are available in all regions.

To access the futures grid trading bot, navigate to the home page and select Trade

In the app’s Trade section, select the trading pair at the top of the screen

Kickstart your futures trading bot automation journey by selecting Trade

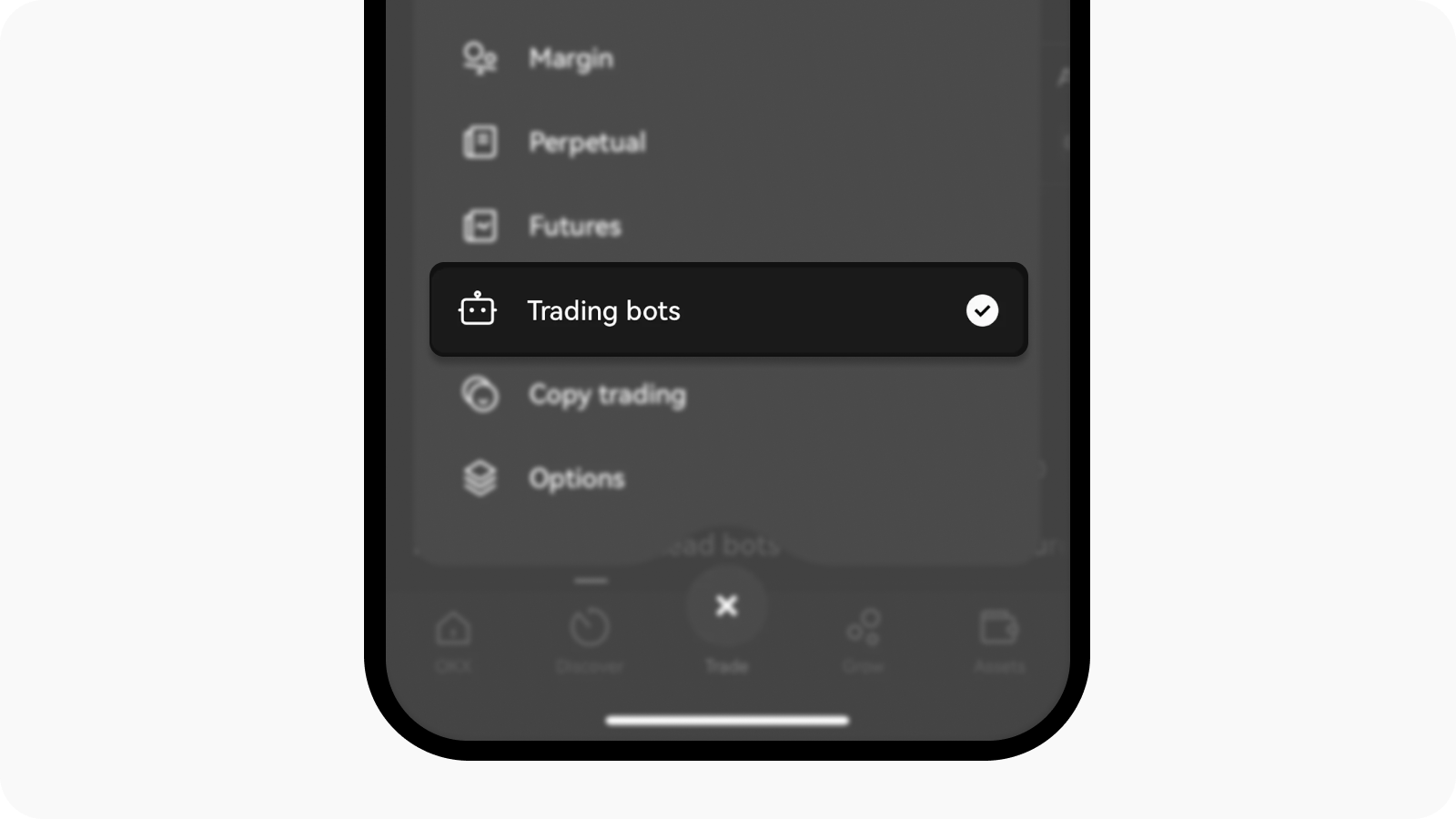

From the options available, select Trading bots to access the list of bots available

Select Trading bots

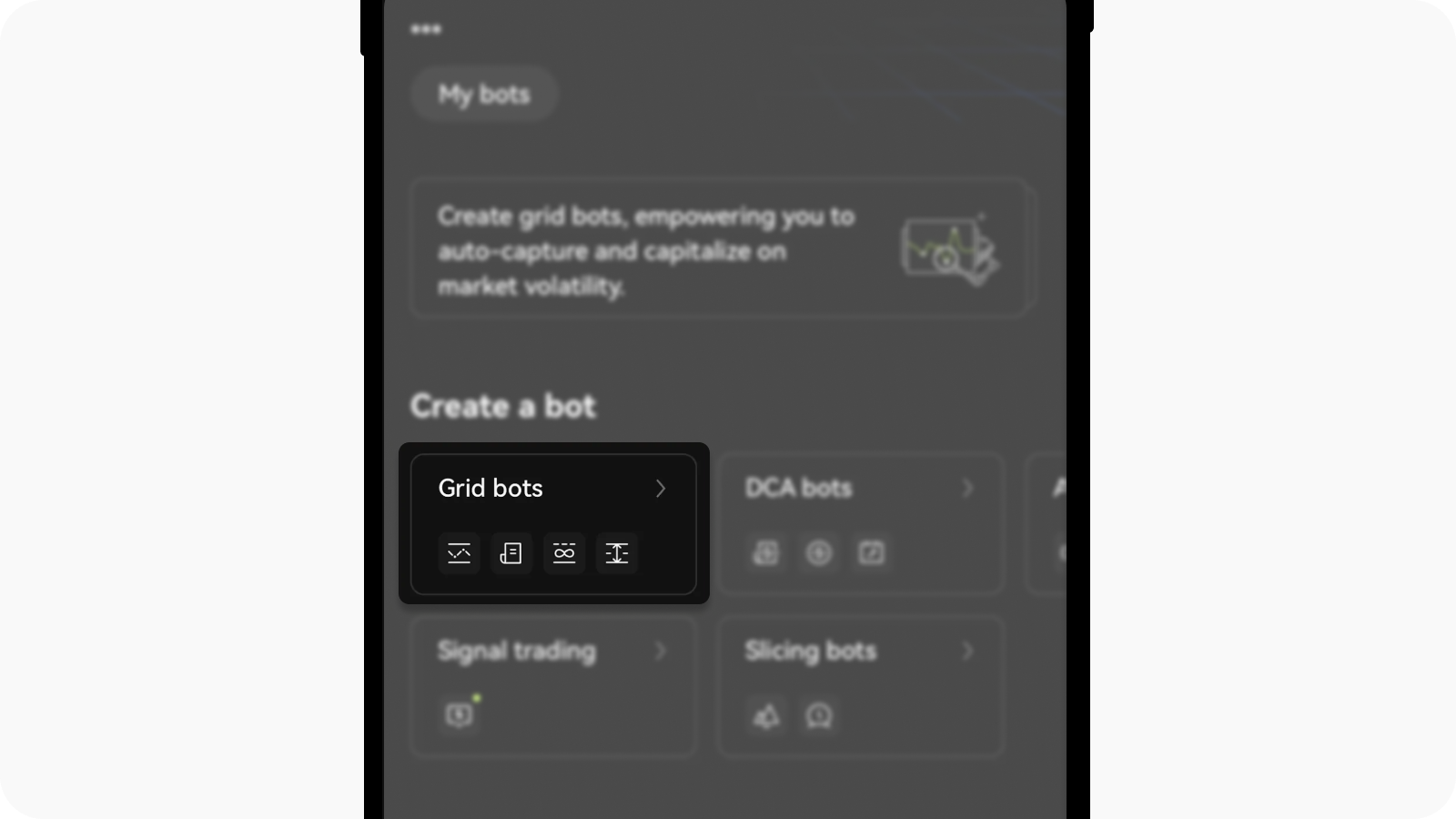

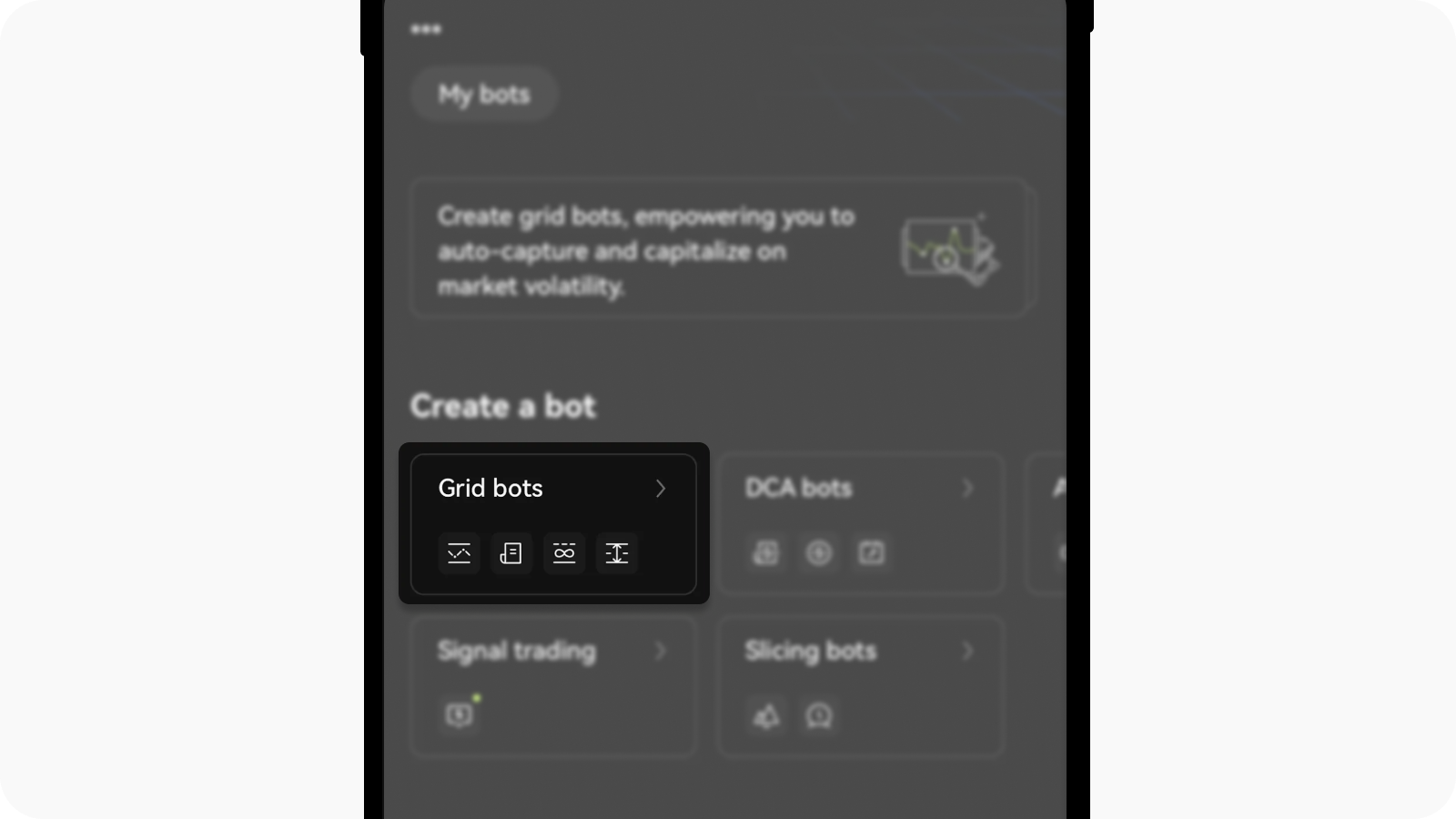

Next, select Grid bots

Find Spot Grid option at Trading bots > Grid bots

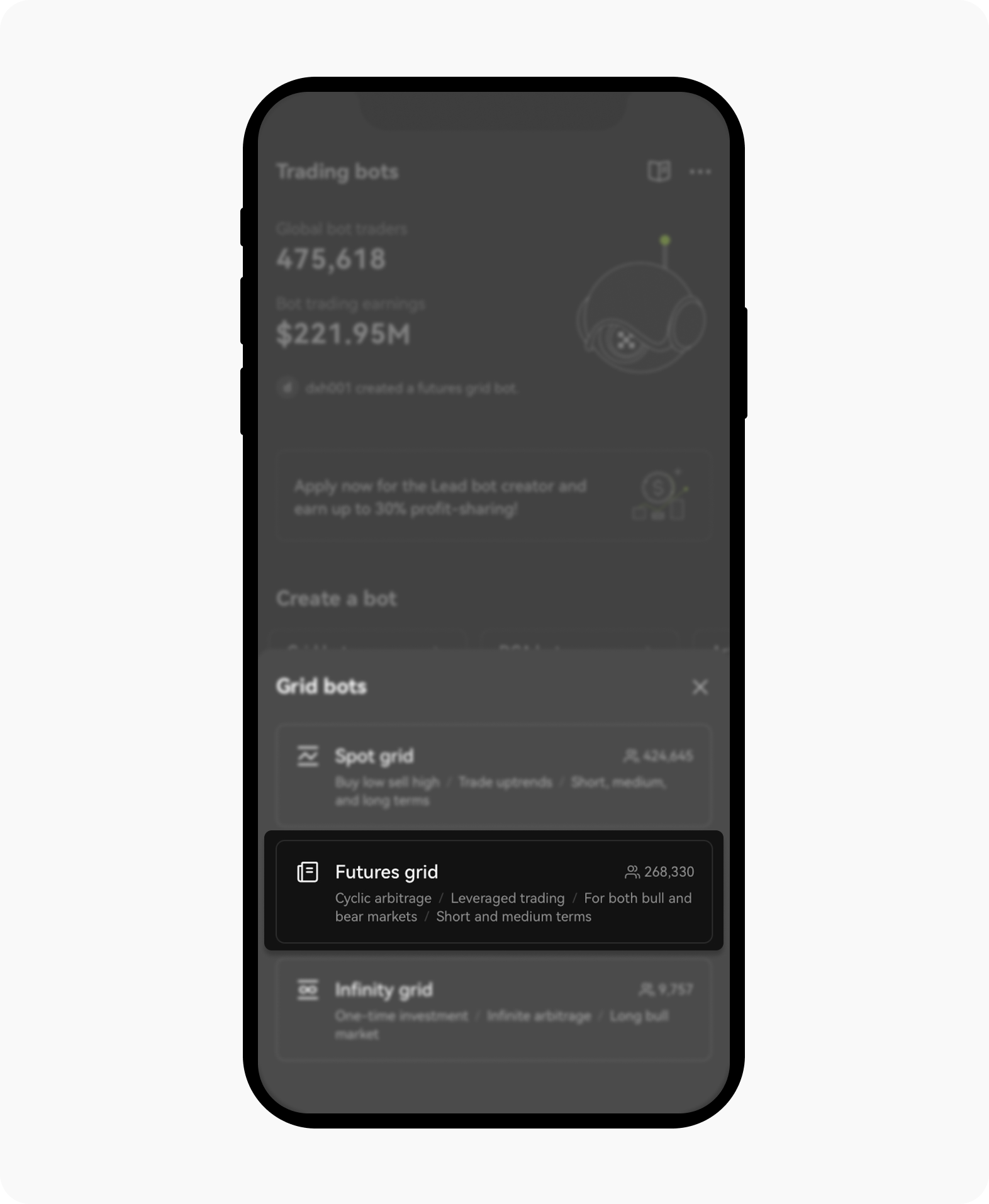

Then, select Futures grid

Futures grid is available as one of Grid bots' options

Select the trading pair at the top area and select a futures contract you want to trade

Start trading by selecting your trading pair and futures contract

How do I use the spot grid’s AI feature?

Like spot grid, the easiest way to use the futures grid trading bot is with the back-tested AI strategy. It's as below:

Select your trading pair before selecting Copy AI strategy

Select the Copy AI strategies option to launch the list of strategies

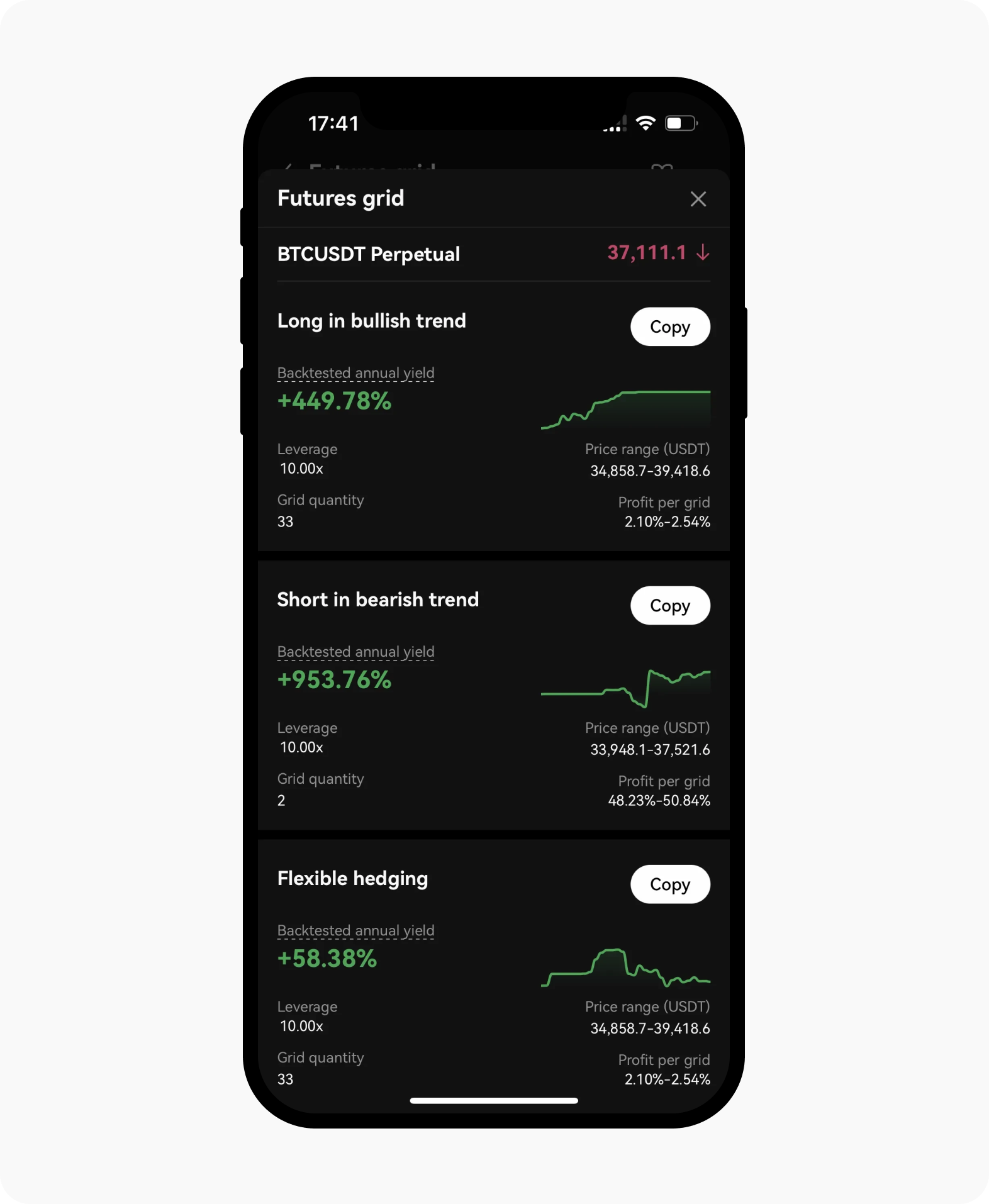

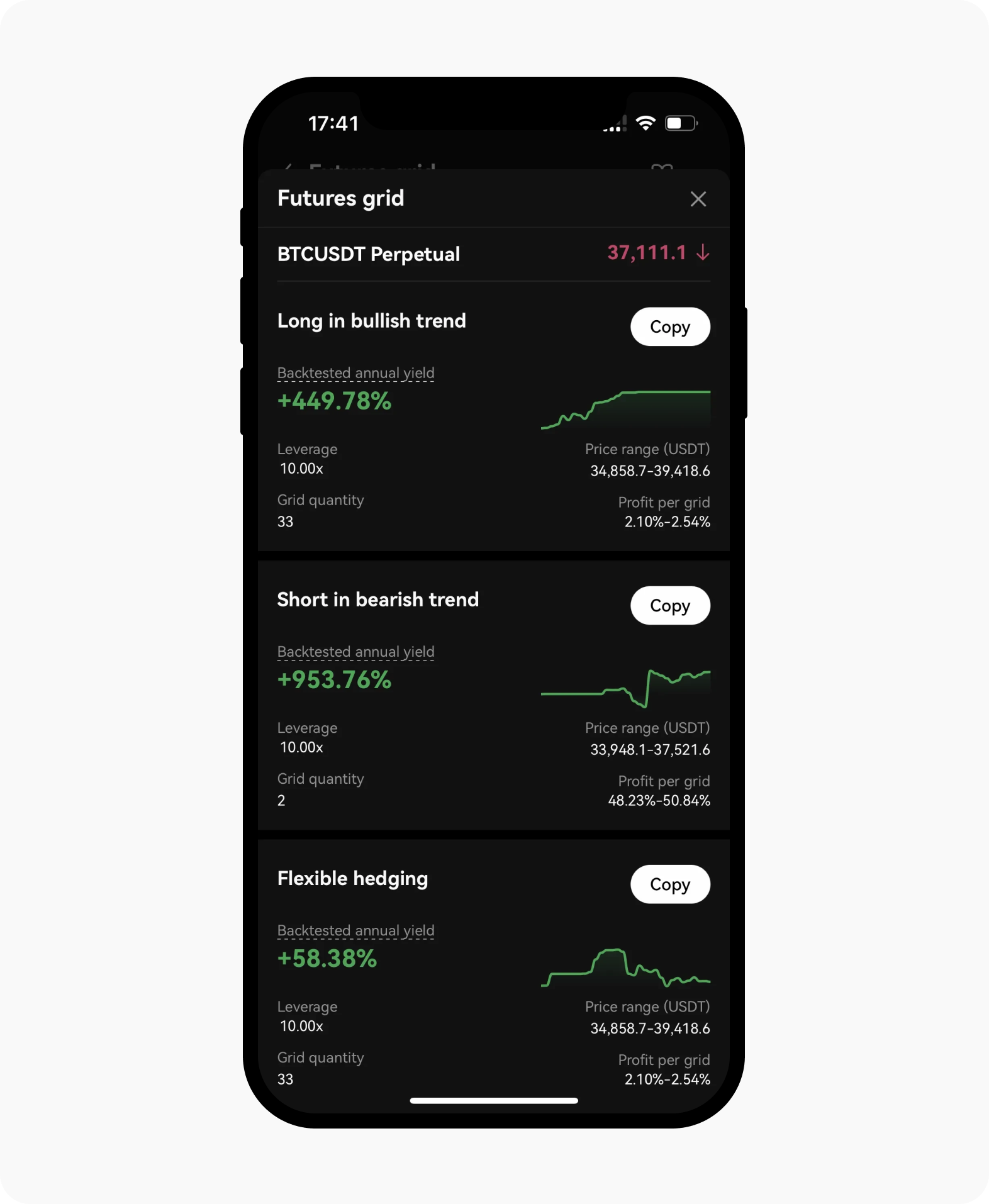

Select the strategy you want to use. Then, select Copy

Copy your preferred AI strategy after selecting your trading pair

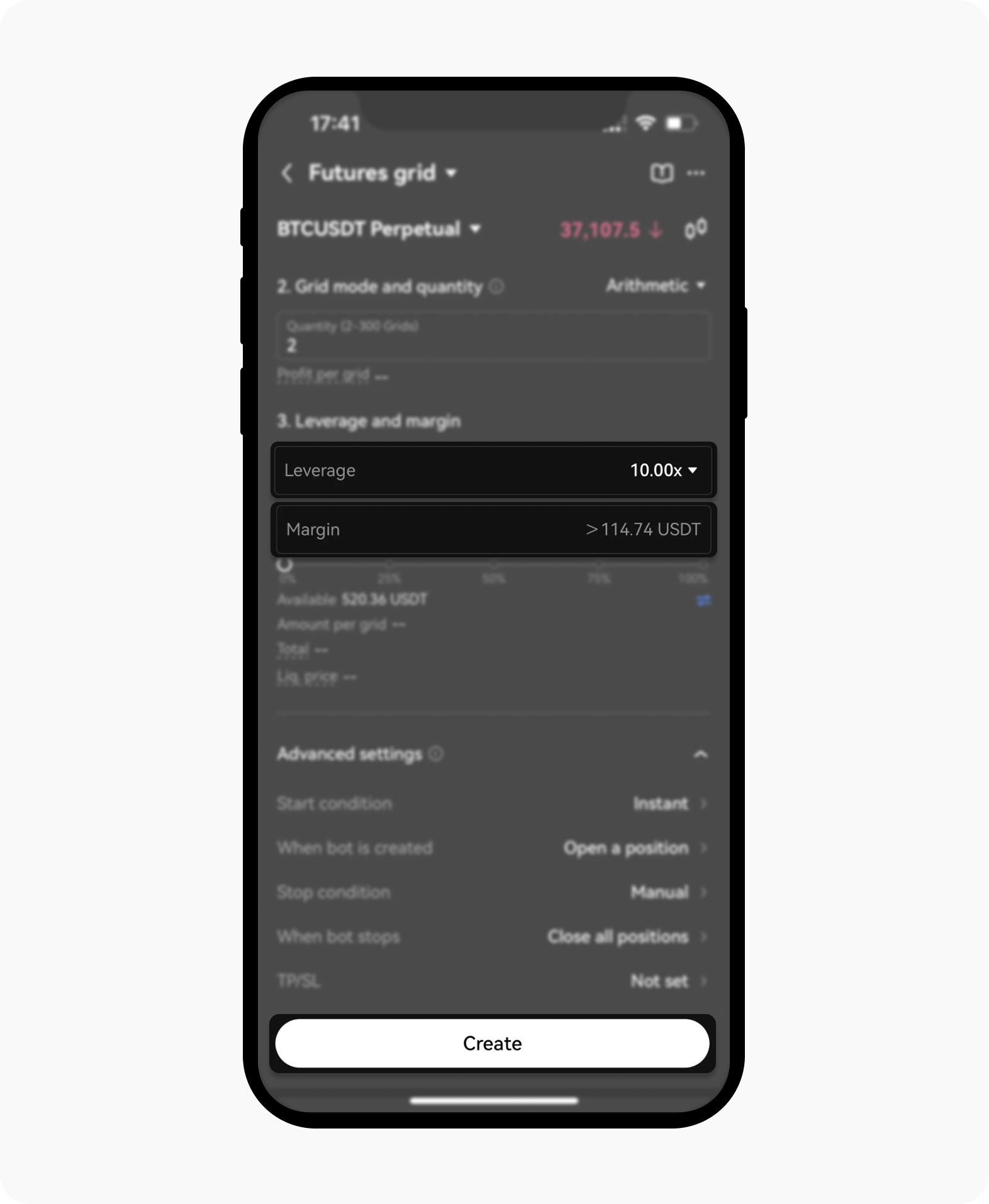

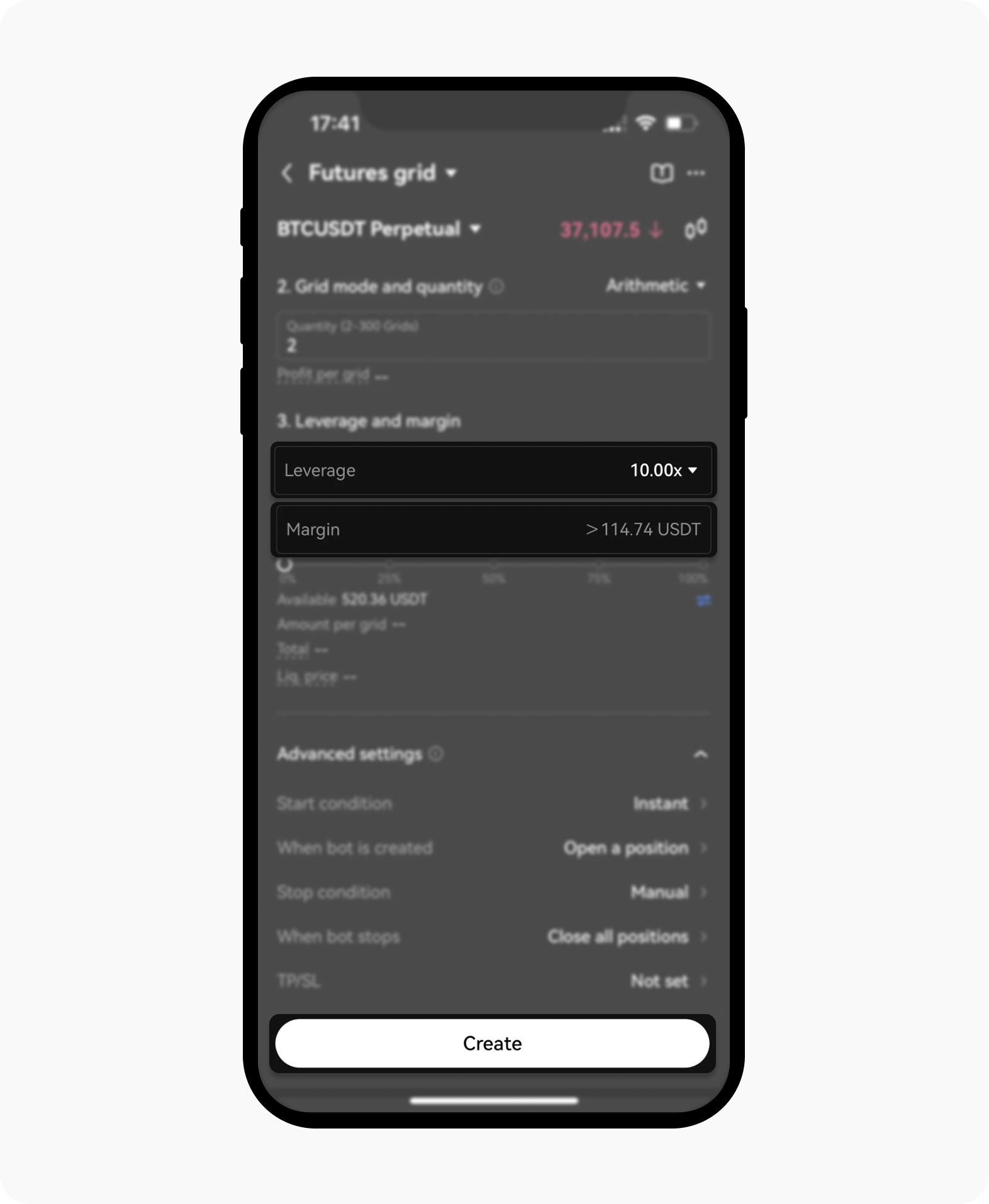

Next, you can customize the parameters such as leverage and margin and add an optional take profit or stop-loss order. Then, select Create

Set your preferred details before creating your bot

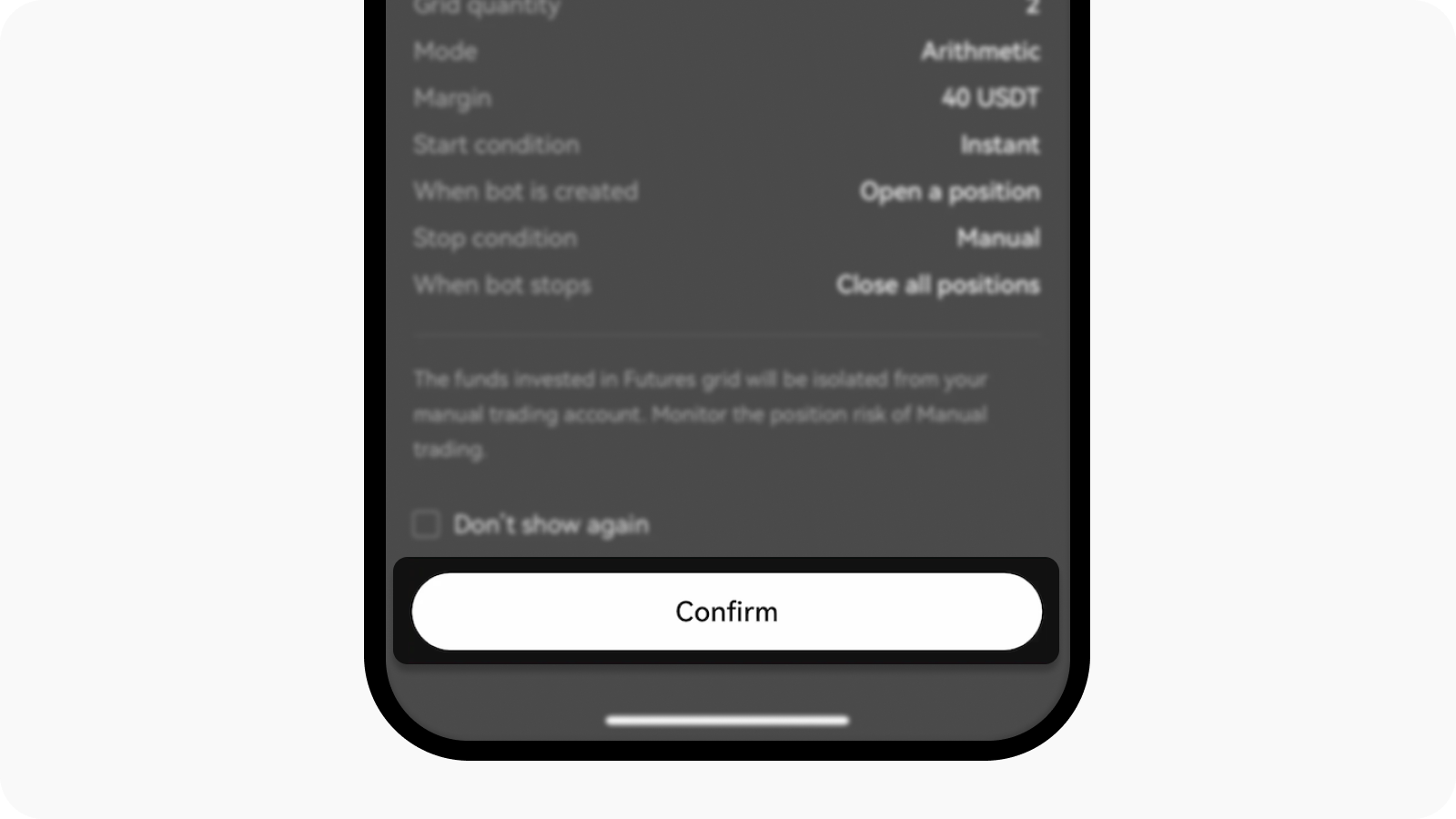

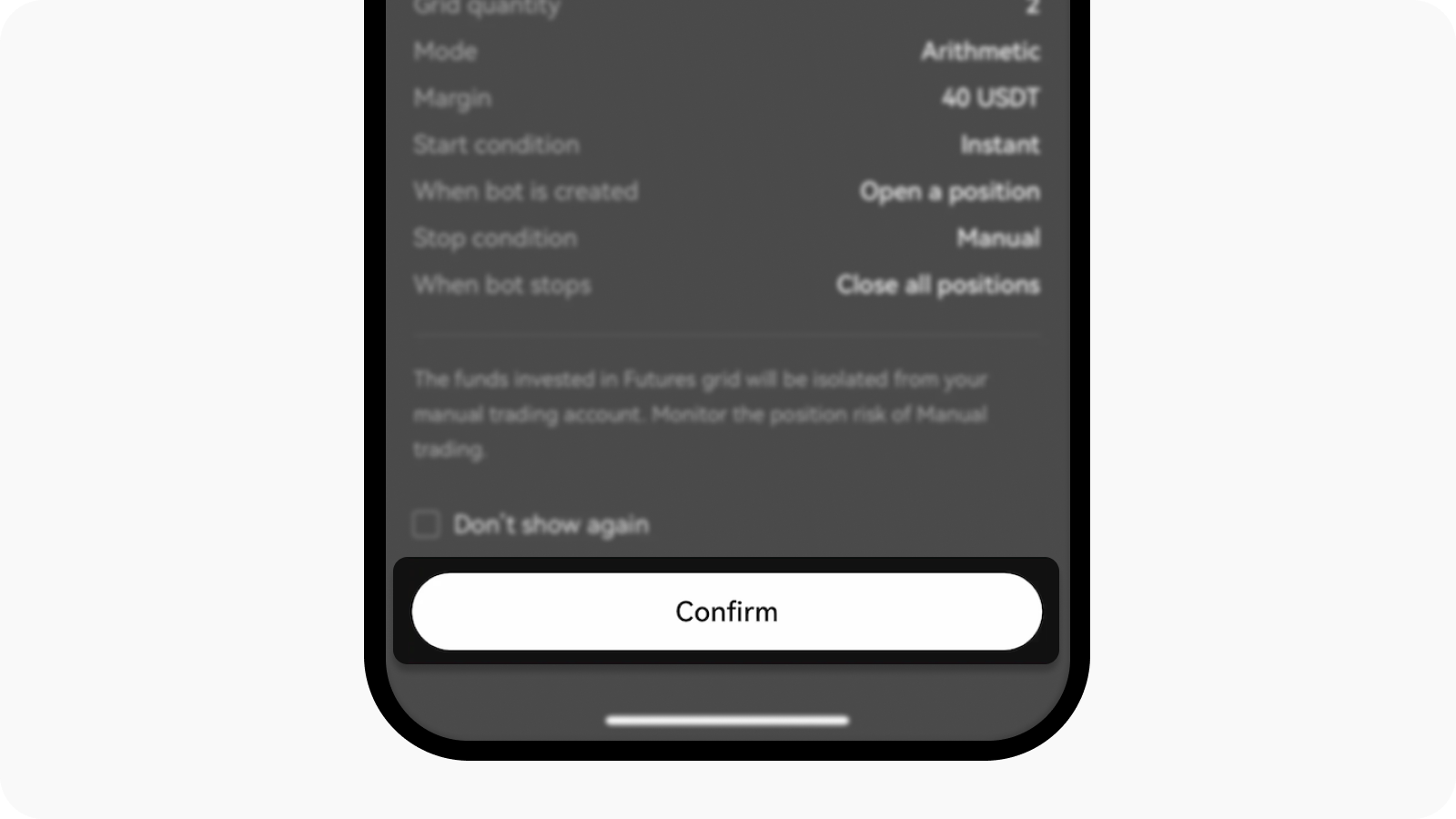

Examine your order details and select Confirm

Proceed to confirm once all the details are finalized