What's a futures trading bot and how do you automate trades with it?

Automated trading is an increasingly popular method of profiting from price volatility in the cryptocurrency markets. OKX provides a range of powerful, cutting-edge trading bot strategies that perform various functions without requiring active management. Among them is futures grid mode — a futures trading bot that automatically buys and sells futures contracts at predetermined price levels.

Although this tutorial focuses exclusively on our futures trading bot, it’s just one of several automated trading solutions we offer. The other bot modes are spot grid, recurring buy, arbitrage order, iceberg order and TWAPs. You can learn more about each in this dedicated guide to OKX trading bots.

What's a trading bot?

A trading bot is a software program designed to automatically execute trades on your behalf in the crypto market. Using advanced algorithms and real-time market data, trading bots can analyze market conditions, identify opportunities, and execute trades quickly and precisely.

The bot operates 24/7, monitoring the markets and identifying profitable opportunities even when you're not actively watching. This eliminates the need for constant manual monitoring and allows you to take advantage of market movements and opportunities as they arise, maximizing your potential for success.

Trading bots also offer benefits such as eliminating emotional biases and human errors. Unlike human traders, bots operate based on predefined rules and strategies, removing the influence of emotions such as fear and greed. This can result in more objective decision-making and help you avoid impulsive trading moves that could lead to losses.

OKX offers a range of preset bots, user-friendly interfaces, dedicated support, and a comprehensive trading experience for traders of all levels.

Whether you're a beginner exploring algorithmic trading or an experienced trader looking for new trading opportunities, OKX provides a secure and transparent environment to optimize your trading strategies and diversify your portfolio.

By choosing trading bots on OKX, you can leverage their advanced algorithms and real-time market data to enhance your trading experience, improve efficiency, and potentially achieve better trading results.

What's the futures grid trading bot, and what are its advantages?

OKX’s futures grid trading bot is an automated futures contract trading strategy. The bot sets an order grid at predetermined price levels above and below the initial entry price. In its simplest terms, the bot sells futures contracts when the price is above entry and buys when below. By automatically buying low and selling higher, the trader profits from price volatility without managing their positions actively.

The futures grid trading bot has three modes: long, short and neutral. With long direction, the bot will only open and close long positions. With short being selected, it only opens and closes short positions. With neutral selection, the bot will open or close shorts above the market price and open or close longs below the market price.

A critical difference between the spot grid automated strategy and the futures trading bot is the ability to trade with leverage. In futures grid mode, you can amplify position size with leverage, enabling you to trade greater volume than otherwise possible. Be warned, though. Leverage is a more advanced tool that carries much greater risk than simple spot trading.

If you’re going to trade leveraged positions with the futures grid trading bot, make sure you fully understand the risks first. You can learn more about leverage and margin requirements in this dedicated guide.

How do you automate buys and sells with OKX’s futures trading bot?

The futures grid trading bot is currently available for both perpetual contracts and futures contracts. Follow the steps below:

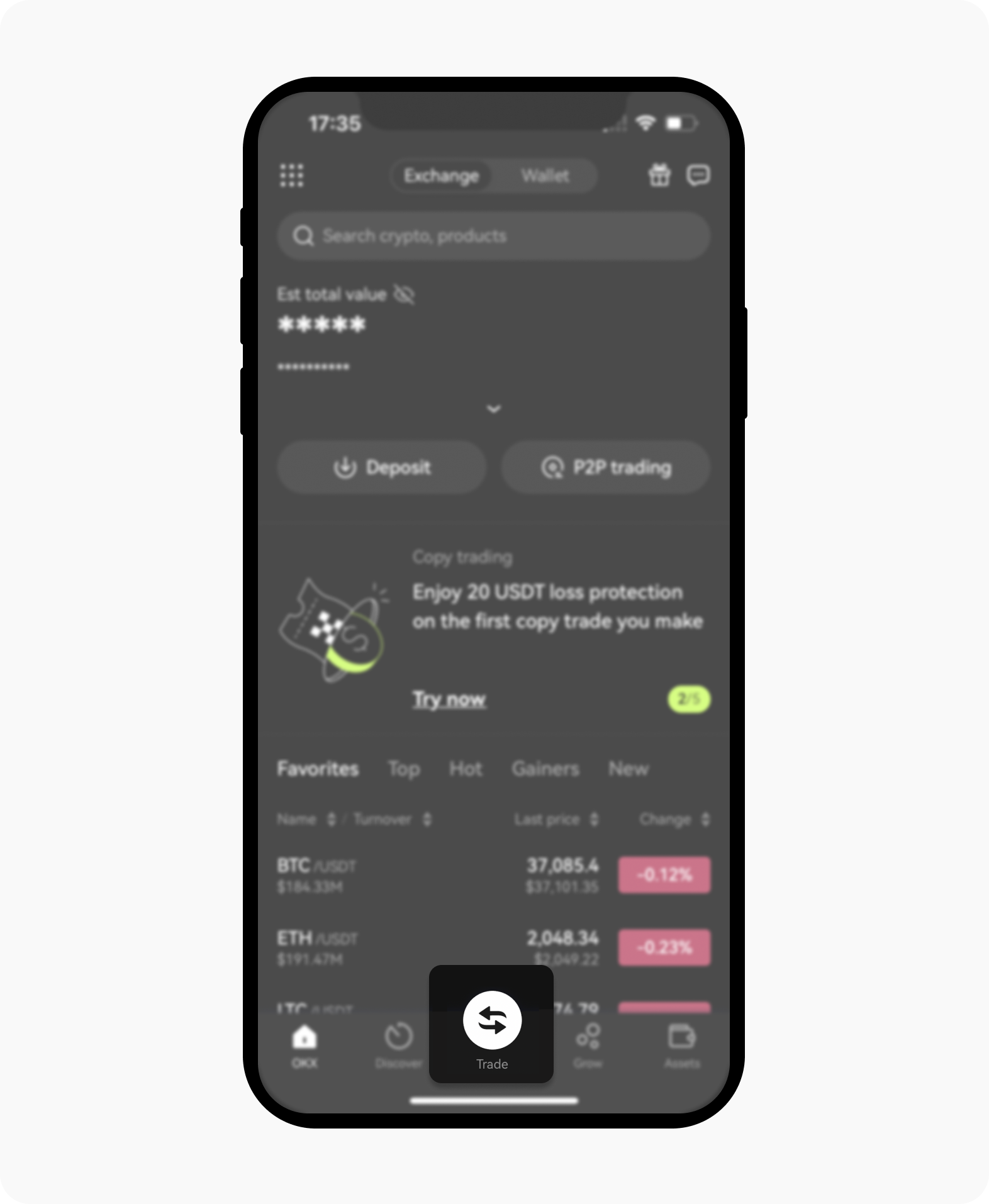

To access the futures grid trading bot, navigate to the home page and select Trade

Select Trade to kickstart your access to trading bot

In the app’s Trade section, select the trading pair at the top of the screen

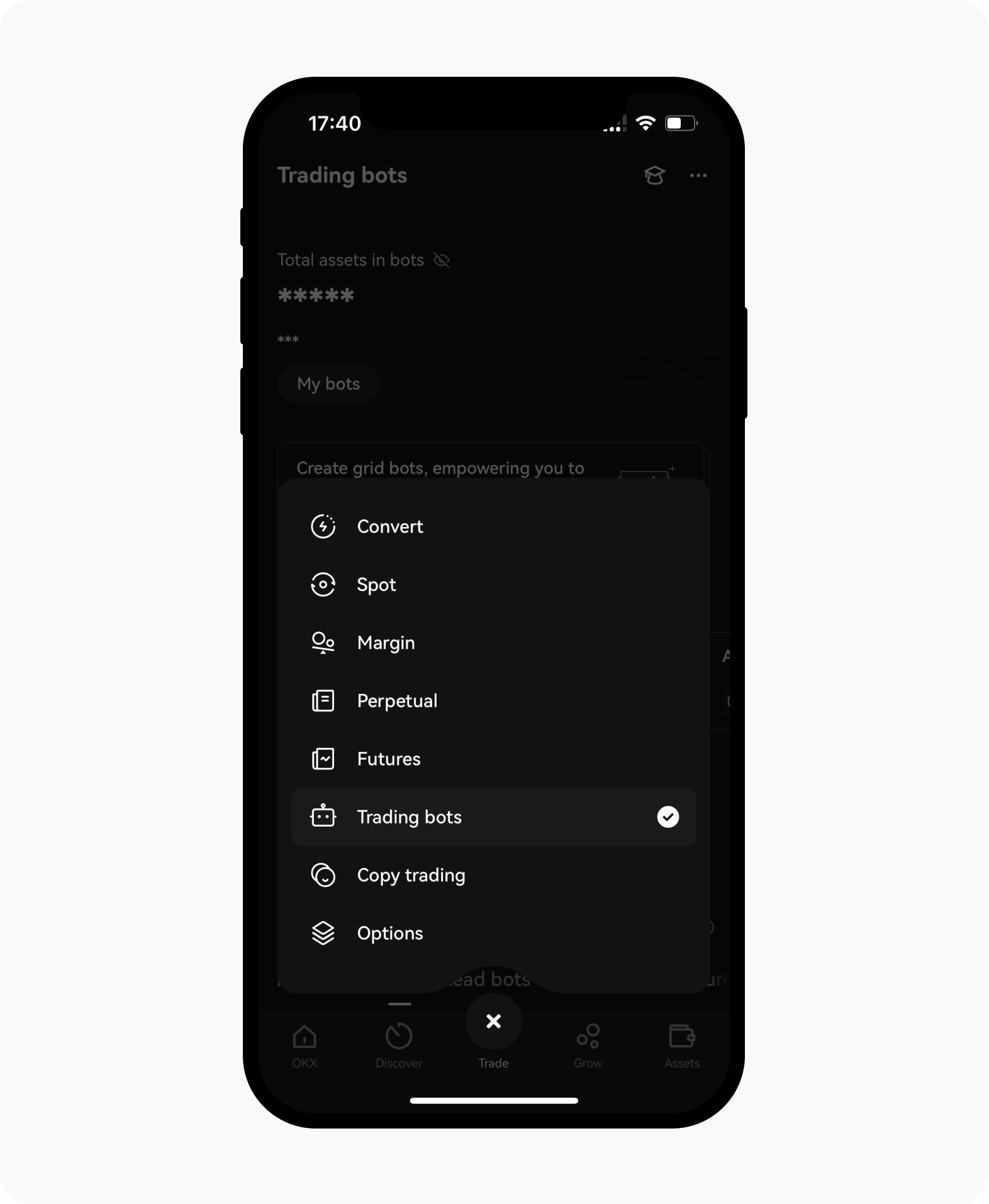

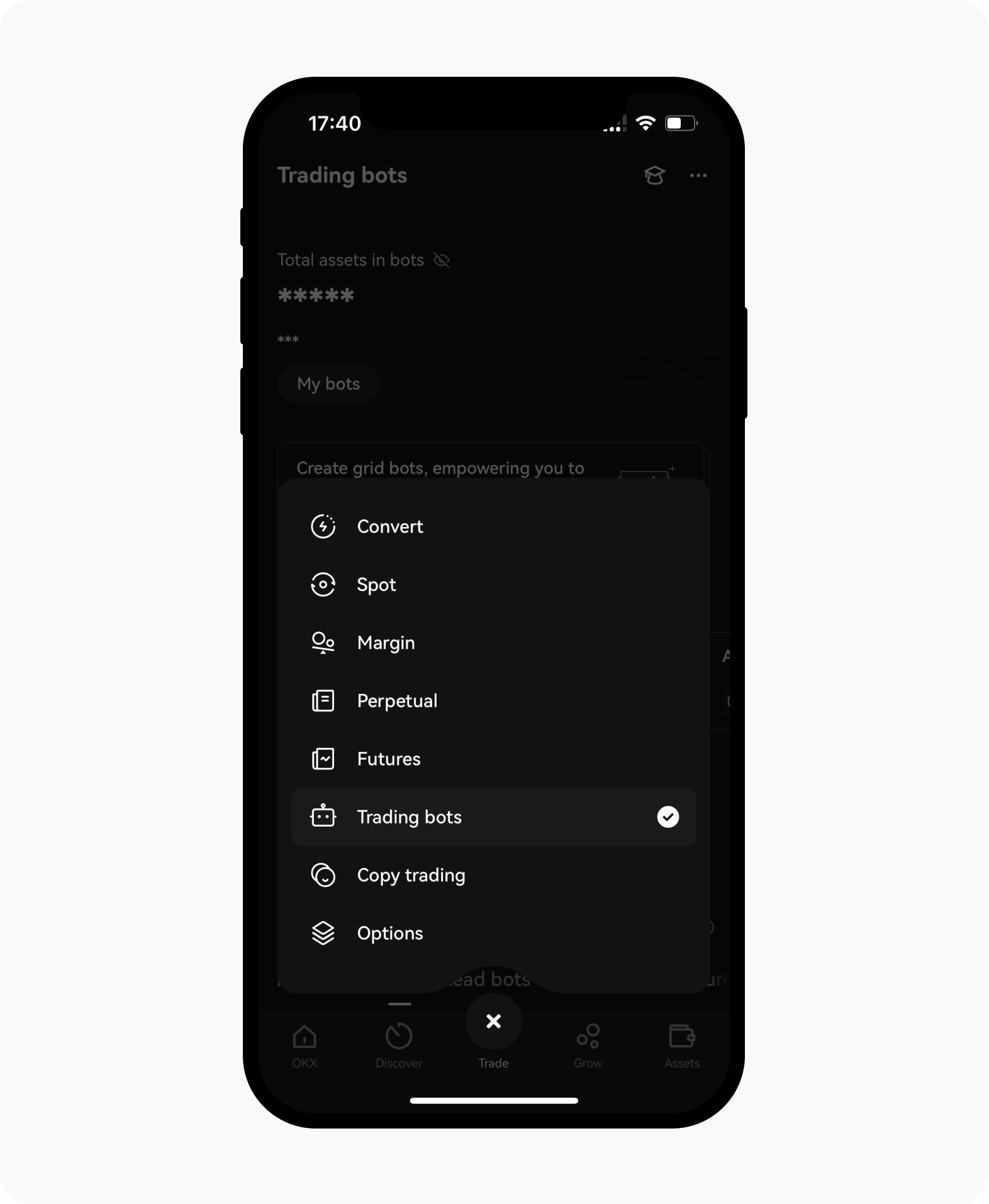

From the options available, choose Trading bots to access the bot marketplace

Trading bots is available as one of the options for bot marketplace

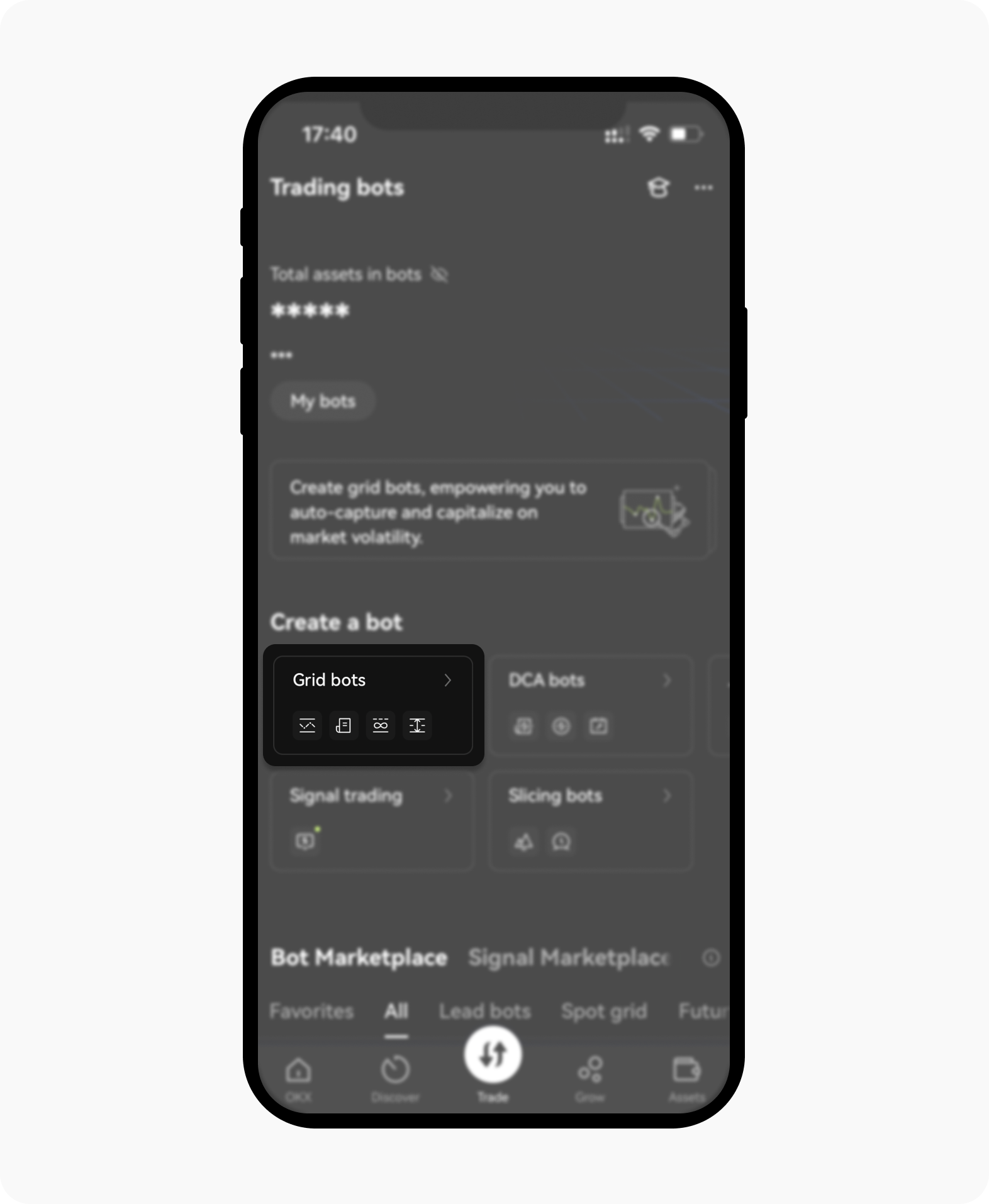

Next, select Grid bots

Create your bot by selecting grid bots

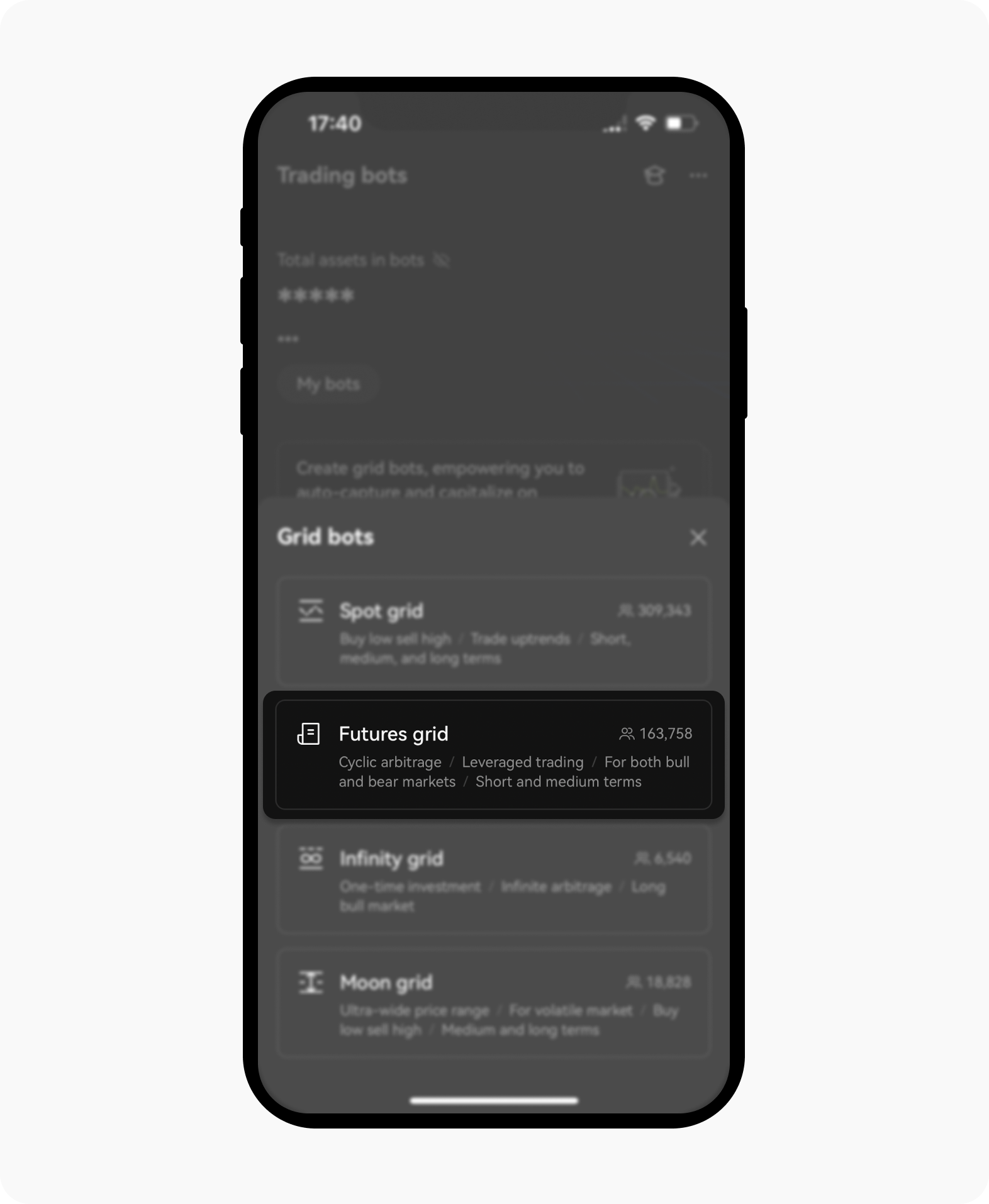

Then, select Futures grid

Futures grid is available to be selected

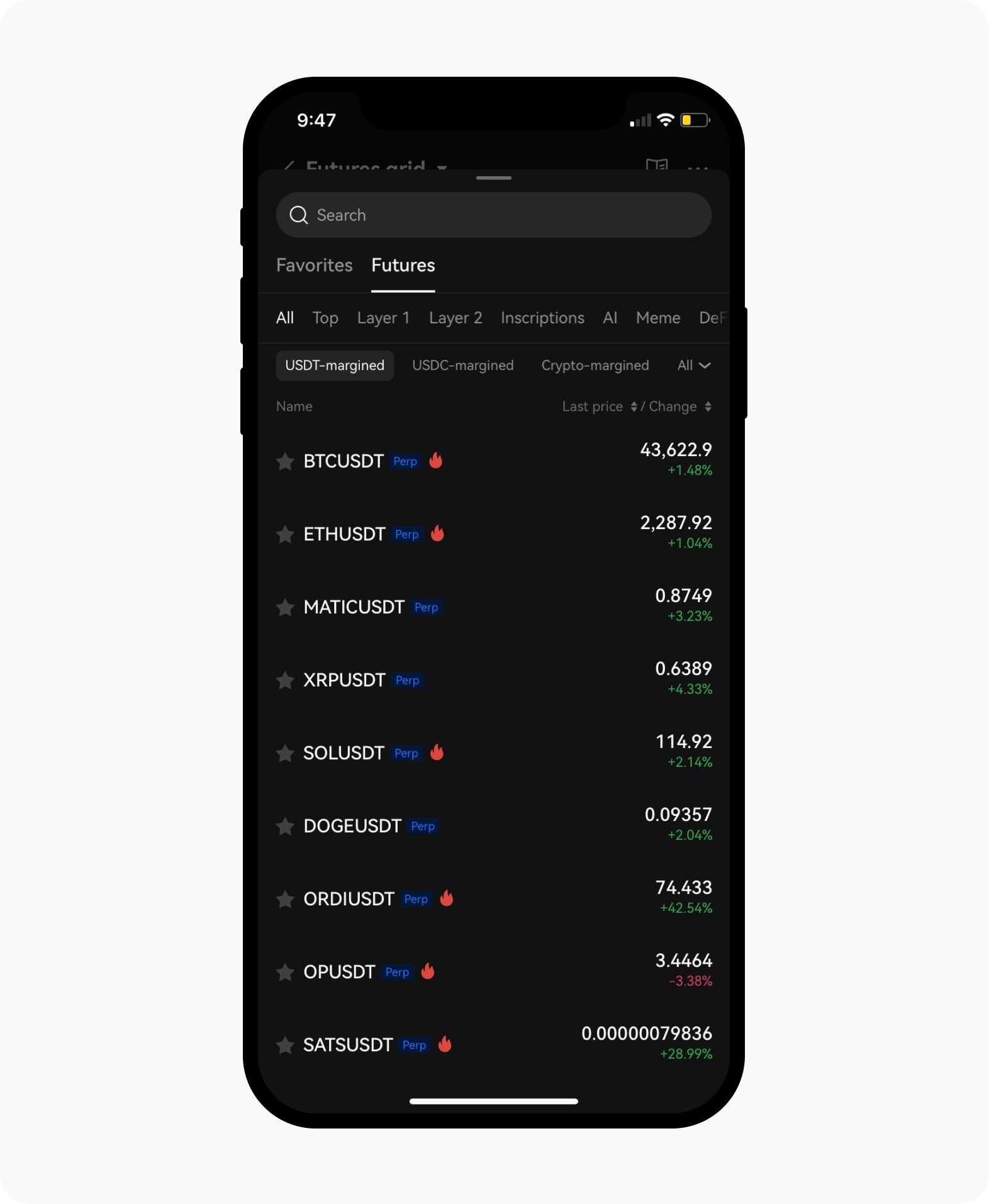

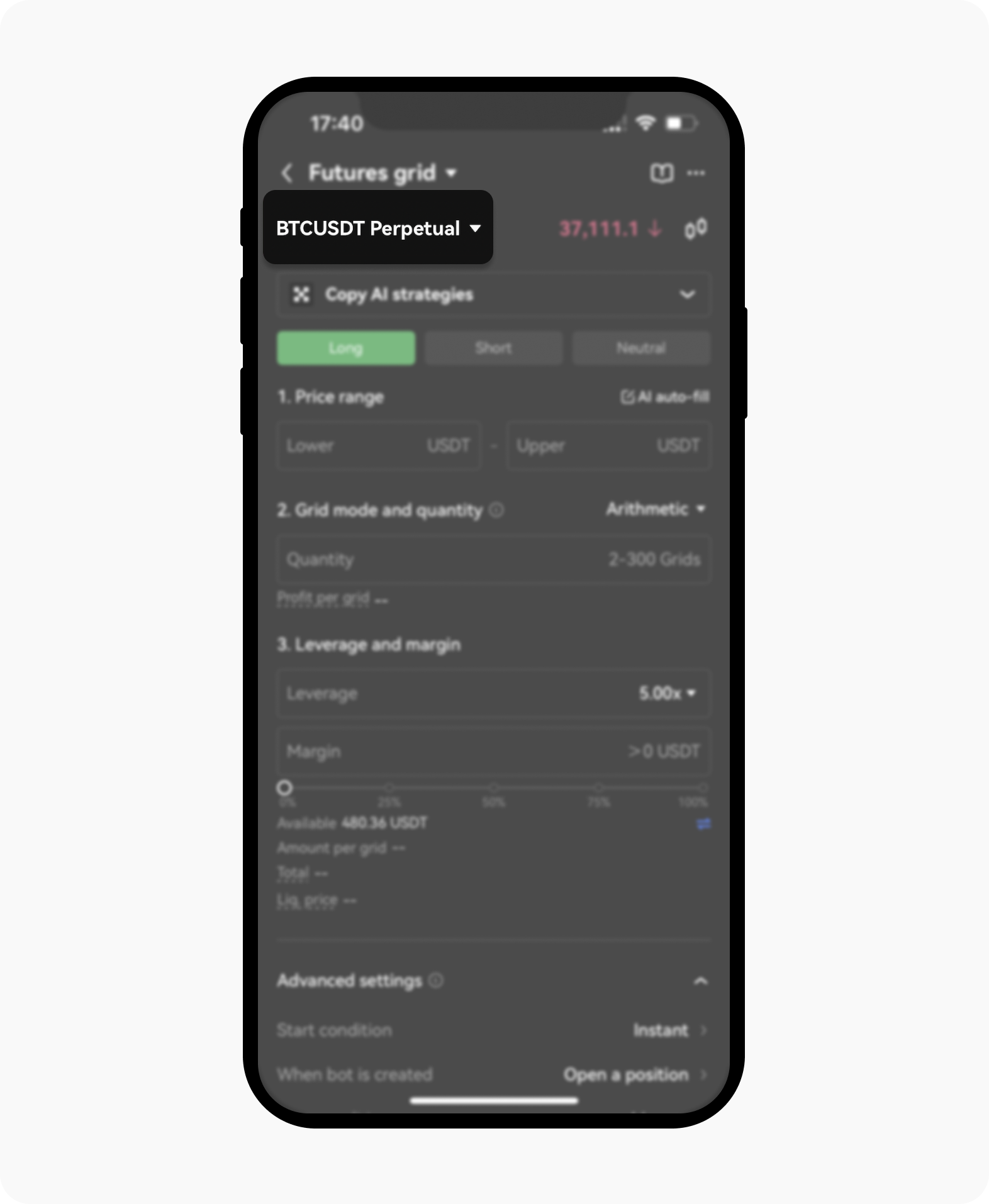

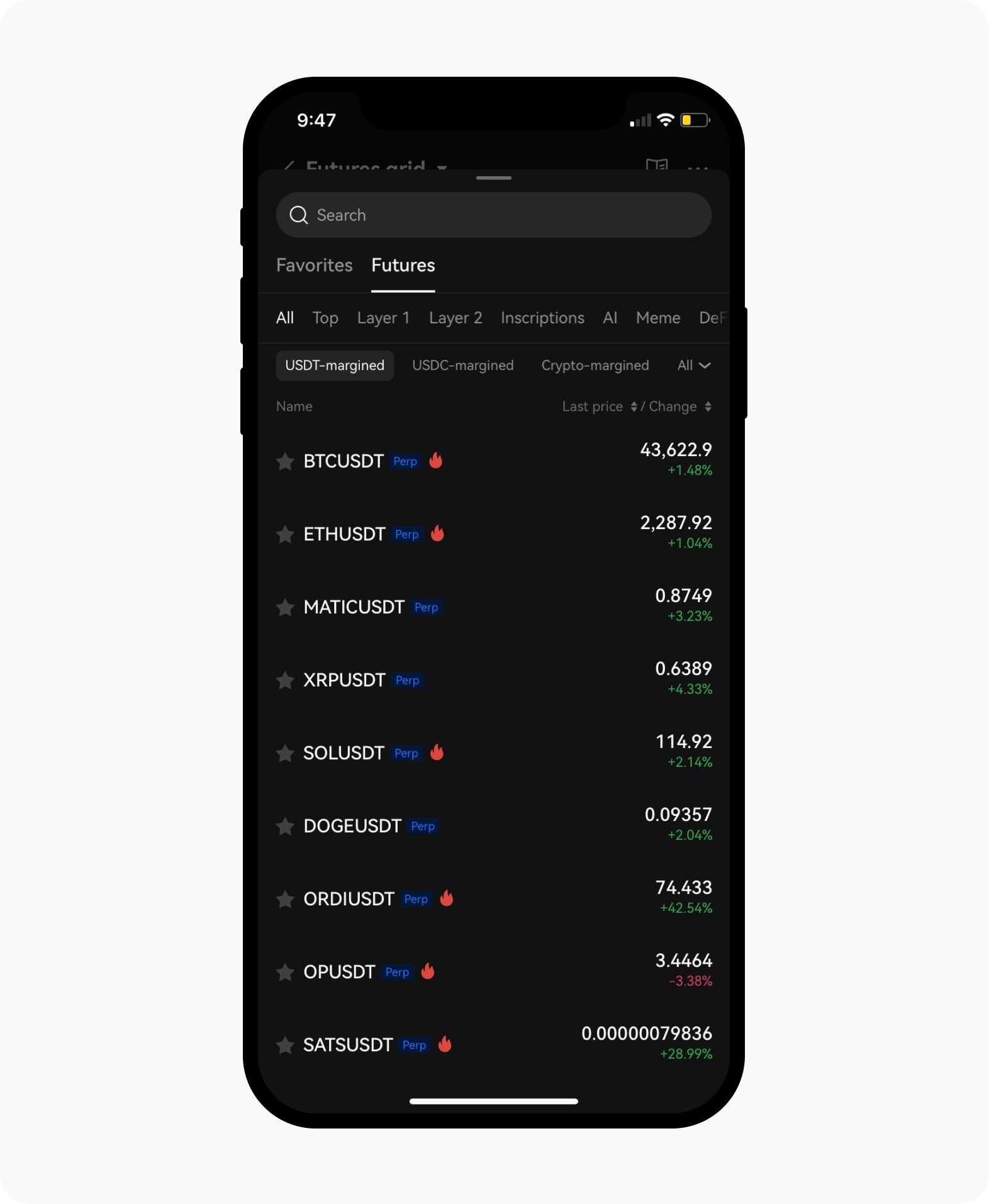

Select the trading pair at the top left of the screen and choose a futures contract you want to trade

Several futures contracts are available for you to explore

Take a good look at the list and select your token

How do I strategize futures grid AI strategy?

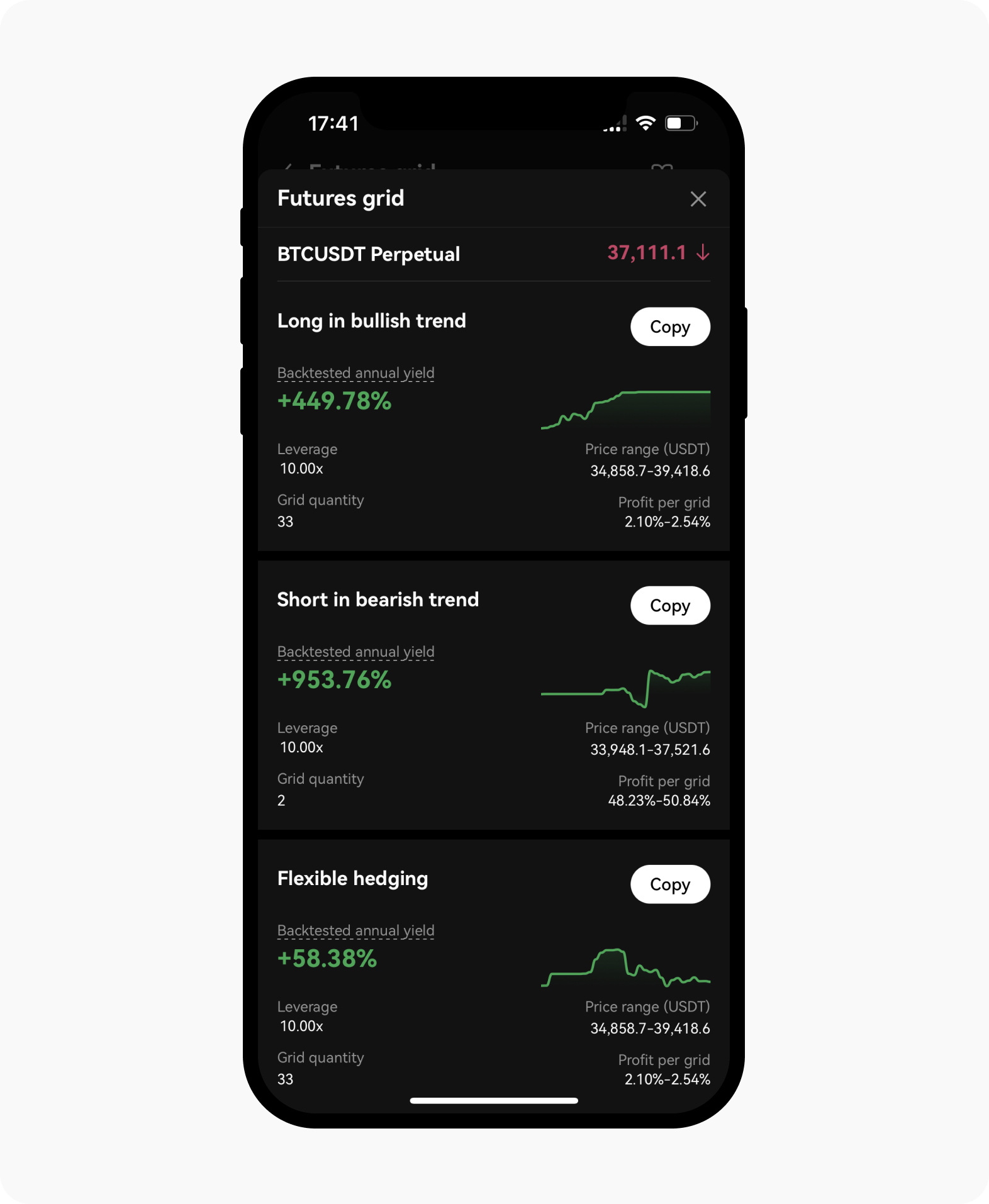

Like spot grid, the easiest way to use the futures grid trading bot is with the backtested AI strategy.

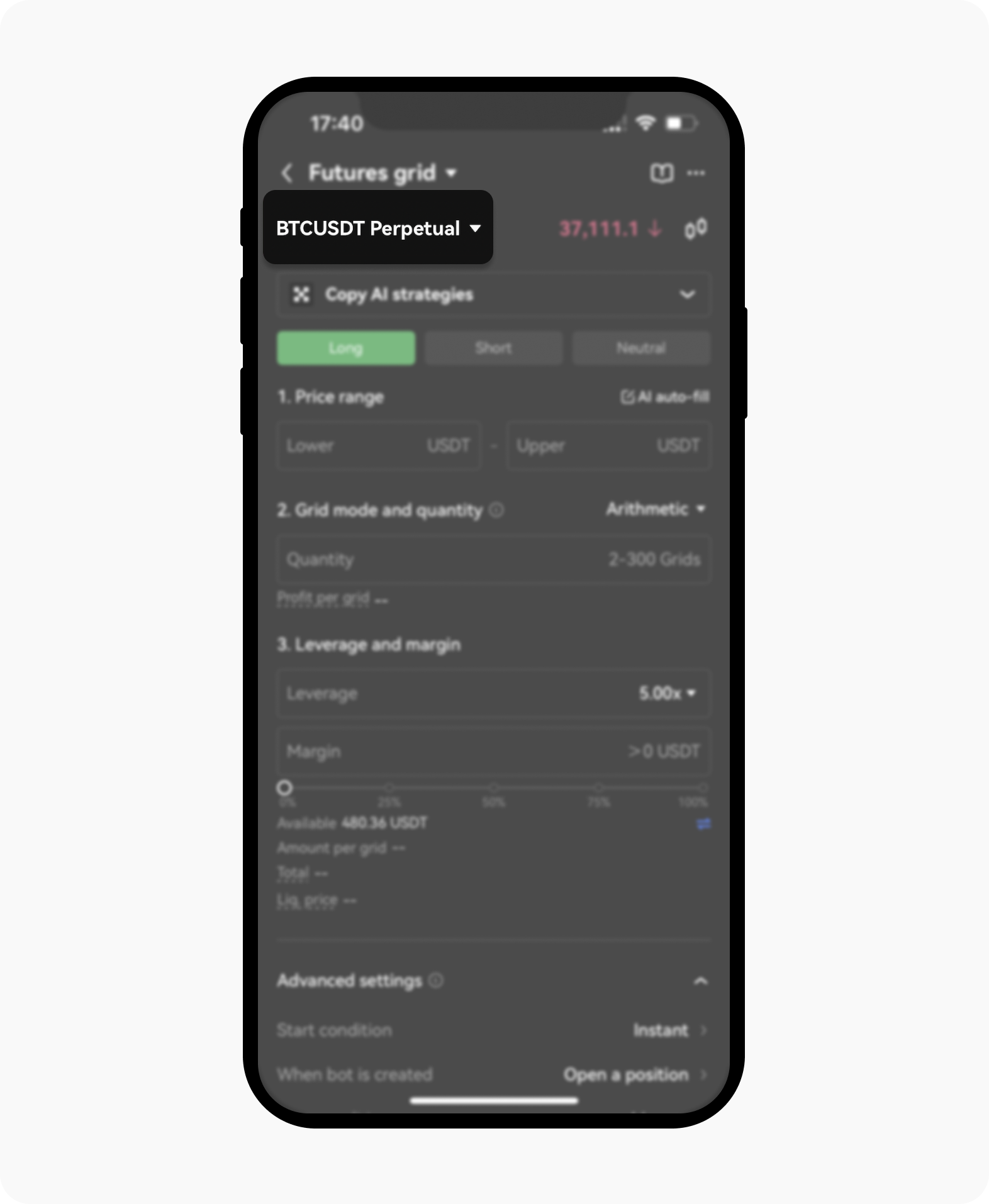

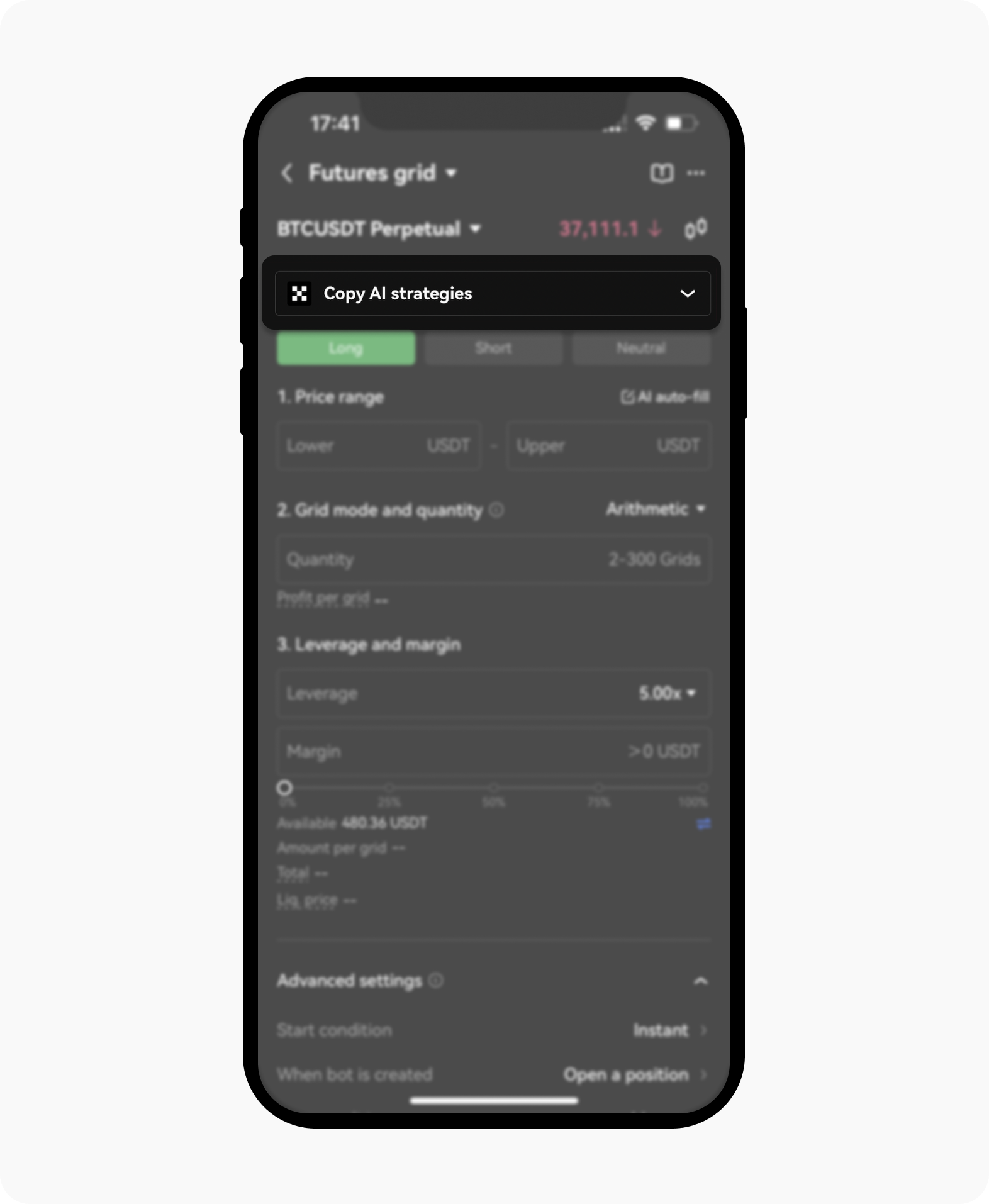

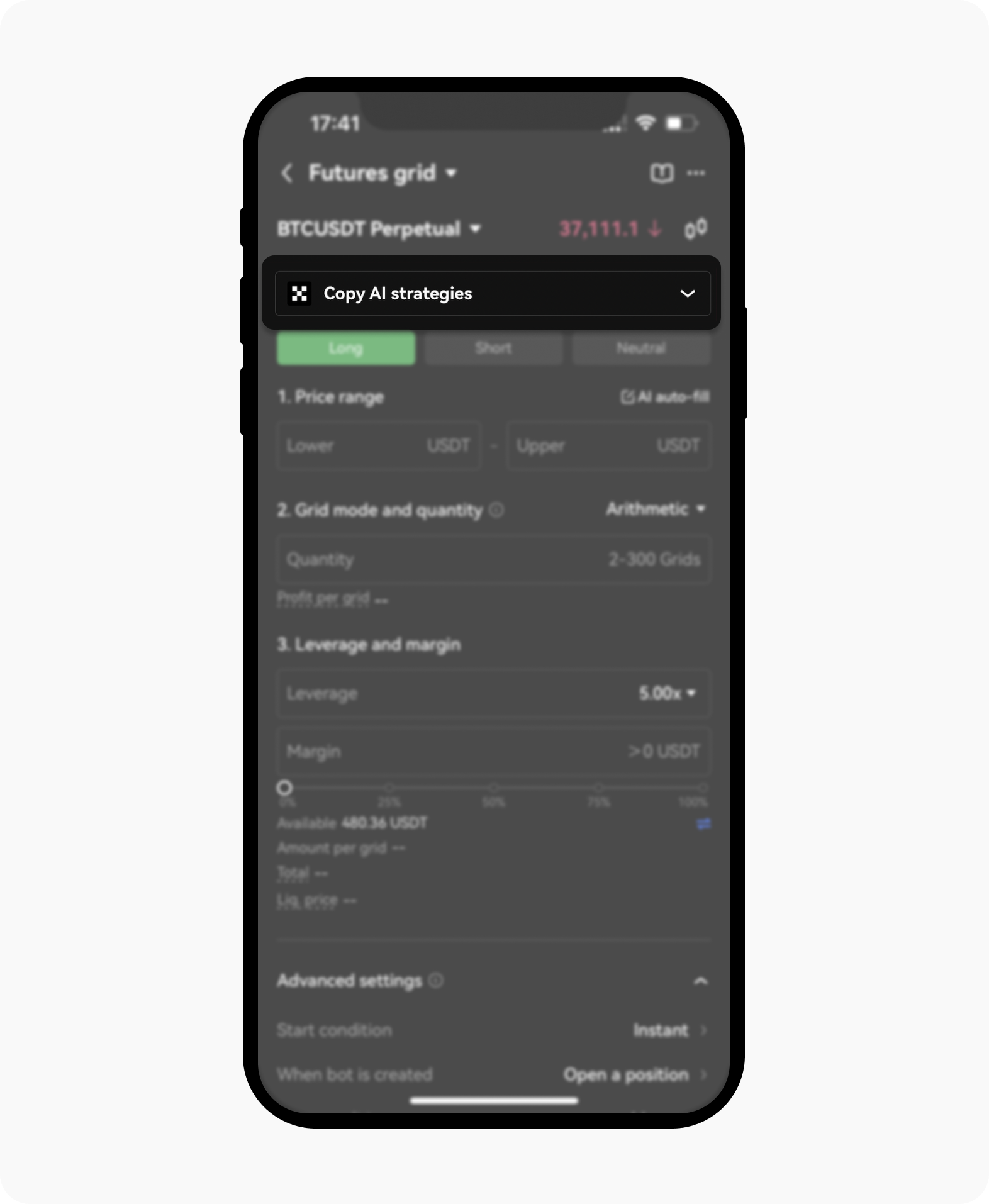

After selecting your trading pair, select Copy AI strategies

Copy AI strategies effortlessly after selecting the trading pair

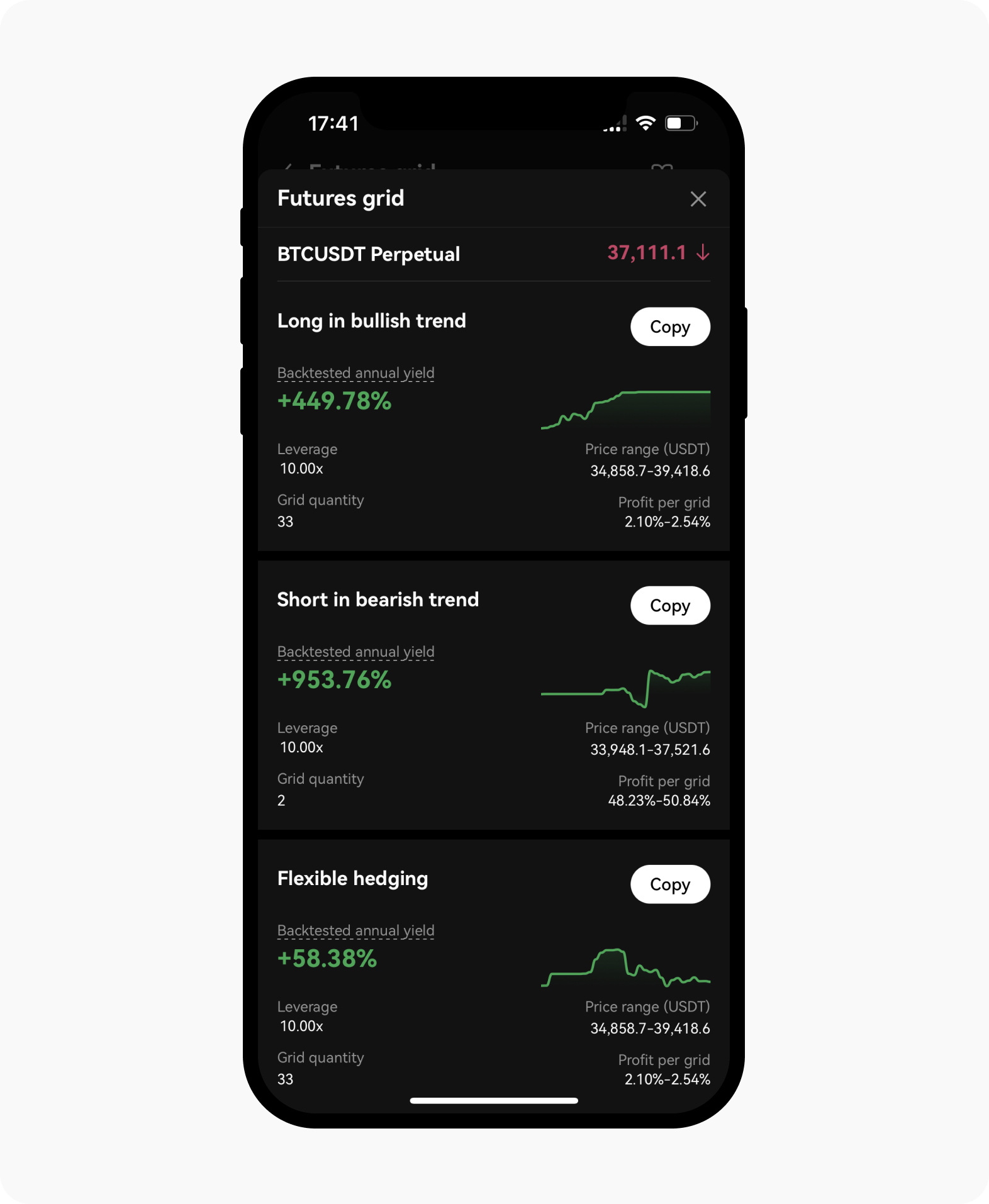

Select the strategy you want to use. Then select Copy

Several strategies are available to be copied

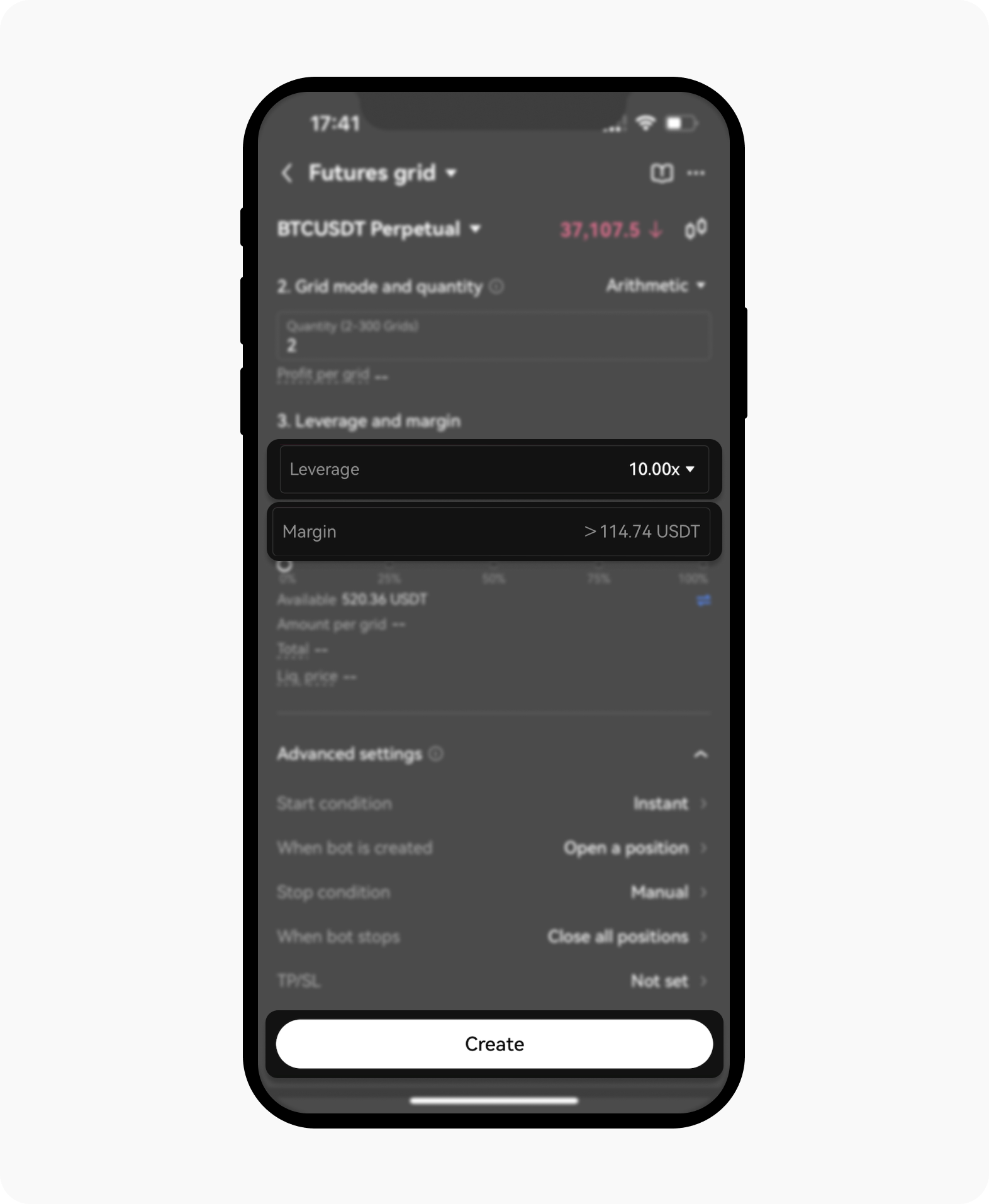

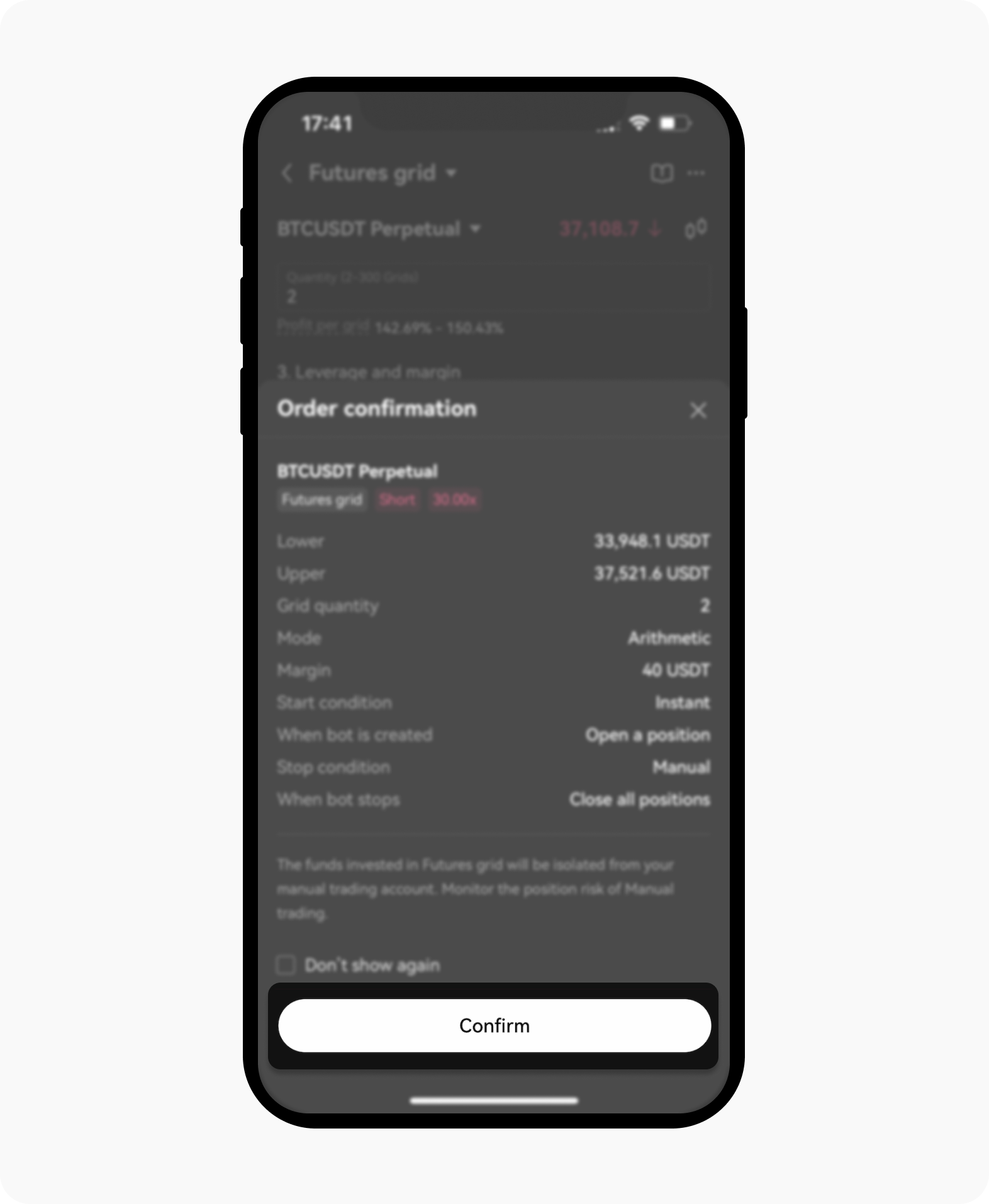

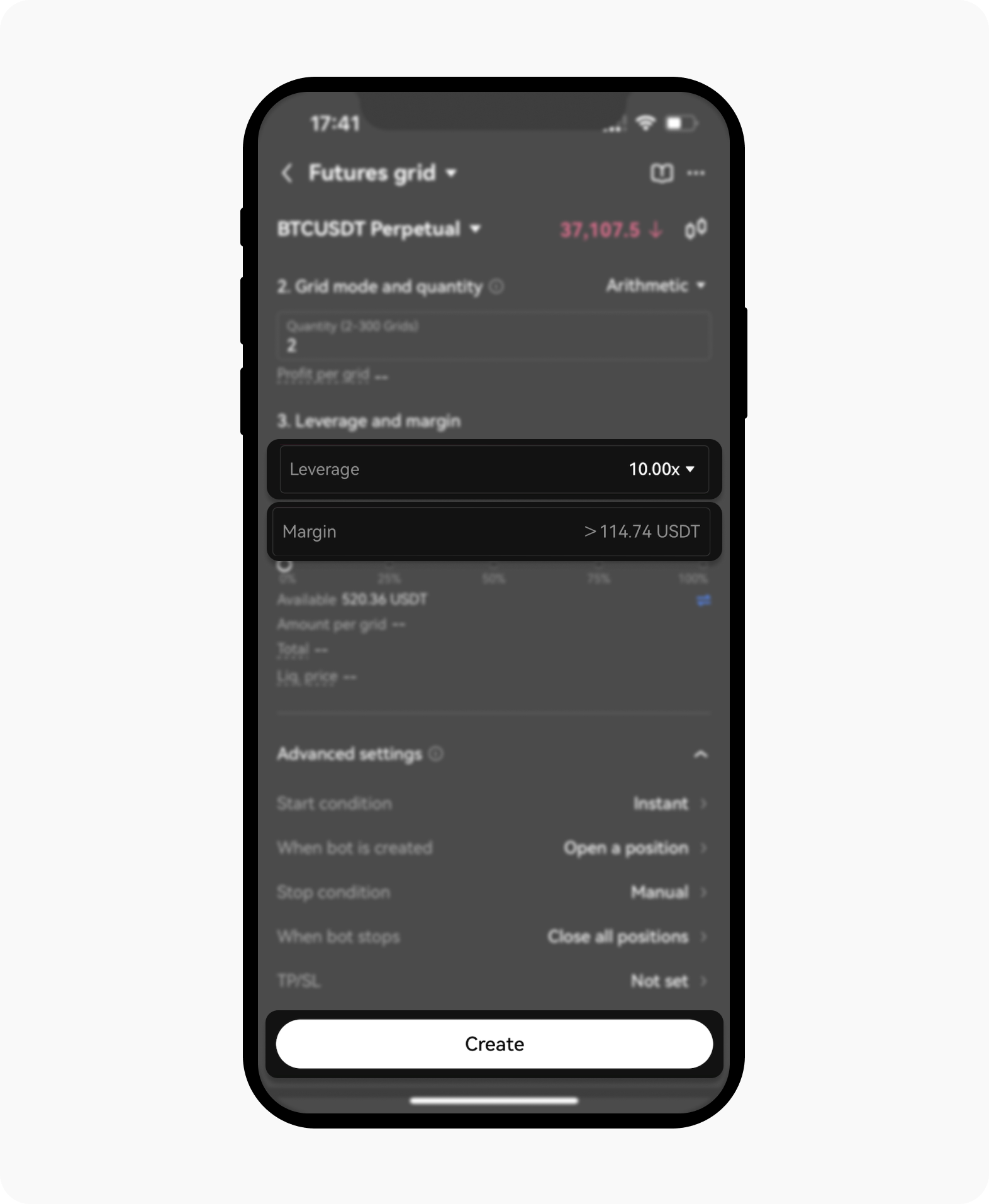

Next, you can customise the parameters such as leverage and margin and add an optional take profit or stop-loss order. Then, select Create

Set the preferred leverage and margin before creating your order details

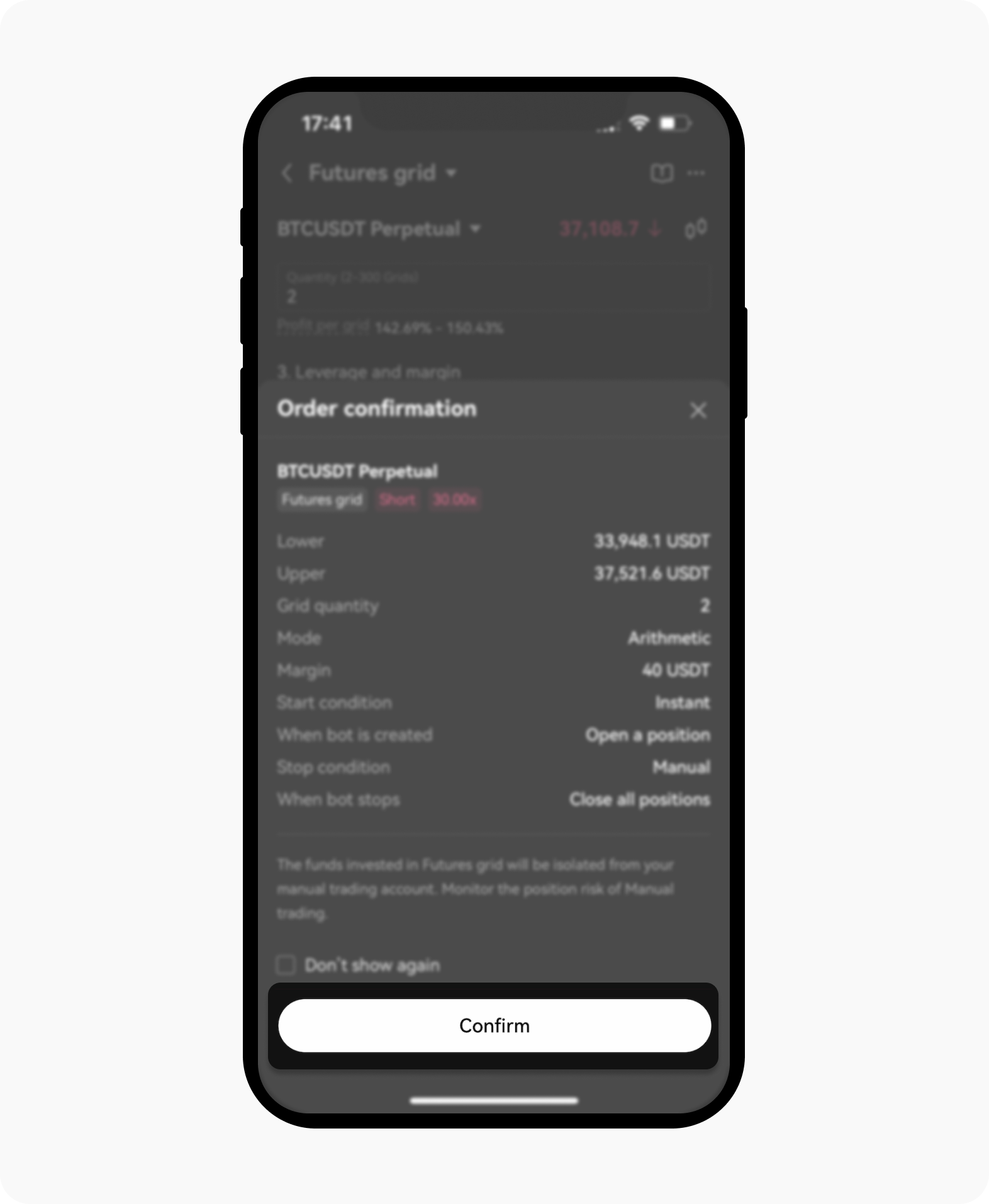

Check your order details and select Confirm

Confirm on the order details to proceed

How do I manually set the futures grid parameters?

To enter your own futures grid parameters, simply select Long, Short or Neutral. Next, enter the grid’s upper and lower price bound, and the total number of grids. Then, select Arithmetic or Geometric to determine exactly how the grid lines are spaced.

Select and enter the necessary details to determine the grid lines space

Arithmetic mode divides the price range from Lower Price to Upper Price into the number of grids by equal price difference, as each grid has an equal price difference (for example 1, 2, 3, 4..). For example, if you’re trading BTC with an upper price of 35,000 USDT and a lower price of 25,000 USDT, and 10 grids, each grid line will be 1,000 USDT apart.

In Geometric mode, each grid has an equal price difference ratio. The price range of each cell of the geometric grid is proportional (for example 1, 2, 4, 8..). This results in widening grids further out from the starting price.

You can also add leverage to your trades to increase your position size relative to the margin used.

When you’ve entered the futures grid bot parameters, select Create. On the next screen, check the order details and add a price at which to stop loss or take profit. Select Confirm to place your order.

Proceed to place your order once you're confirmed with the order details

How do I profit from futures volatility with the futures grid trading bot?

OKX’s futures trading bot is a powerful automated trading strategy that seeks to profit from cryptocurrency futures market volatility. By automatically buying low and selling high, users make money from the difference in prices in rapidly moving markets.

The trading bot’s futures grid mode creates a grid of price levels at which to trade. You can either set these yourself or use our backtested AI strategy. When the price moves up, the bot executes orders according to the strategy — long, short or neutral — you're following.

Futures grid is just one of the powerful trading bots OKX offers. Try it yourself today to automate trades and lock in profits from futures contract price volatility. Game on!